ACCO Brands (NYSE:ACCO) First Quarter 2025 Results

Key Financial Results

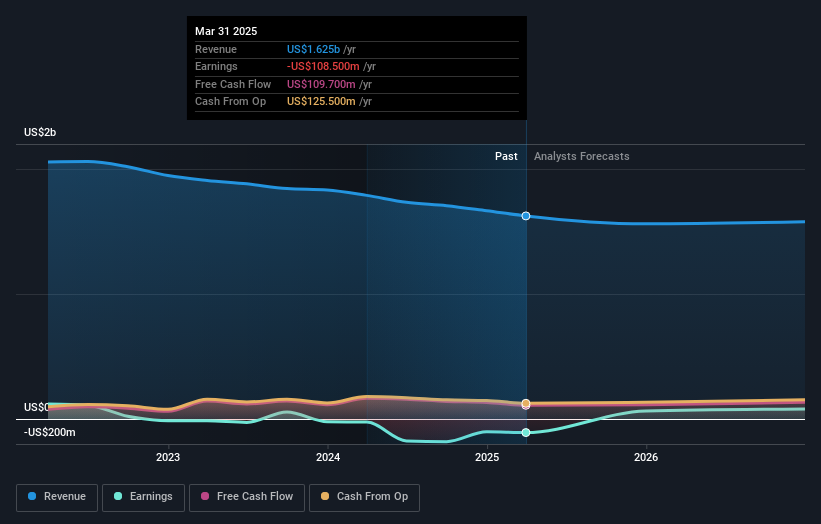

- Revenue: US$317.4m (down 12% from 1Q 2024).

- Net loss: US$13.2m (loss widened by 110% from 1Q 2024).

- US$0.14 loss per share (further deteriorated from US$0.066 loss in 1Q 2024).

All figures shown in the chart above are for the trailing 12 month (TTM) period

ACCO Brands EPS Misses Expectations

Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 3.7%.

Looking ahead, revenue is expected to decline by 1.5% p.a. on average during the next 2 years, while revenues in the Commercial Services industry in the US are expected to grow by 6.7%.

Performance of the American Commercial Services industry.

The company's shares are down 5.9% from a week ago.

Risk Analysis

We should say that we've discovered 2 warning signs for ACCO Brands (1 can't be ignored!) that you should be aware of before investing here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.