Check Point Software Technologies (NasdaqGS:CHKP) recently received EAL4+ certification for its Quantum Firewall Software R82, enhancing its position in critical security sectors. This announcement coincides with the company's share price moving up 2.5% over the past week. The market also saw an overall 1.8% increase driven by positive economic indicators, including a strong jobs report and progress in U.S.-China trade discussions. Check Point's gains aligned with broader market trends, implying that while the certification added credibility, the company's stock movement was consistent with general market conditions.

The recent EAL4+ certification for Check Point Software Technologies' Quantum Firewall Software R82 is a positive development, reinforcing its reputation in critical security sectors and potentially bolstering future revenue and earnings. While short-term gains were aligned with the market, this certification enhances the firm's portfolio, possibly supporting long-term revenue growth through increased customer trust and adoption.

Over the past five years, Check Point's total return, including share price and dividends, increased by 99.64%, indicating robust long-term performance. In contrast, recent one-year returns show a performance above the US Software industry which gained 15%, suggesting Check Point's resilience and investor confidence despite industry challenges. Given these figures, investors may consider its long-term growth trajectory as supportive of the company's strategic initiatives.

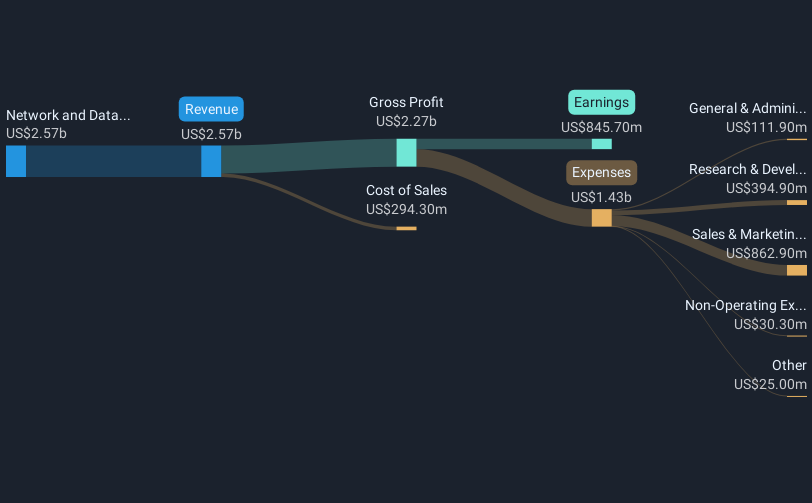

The news adds a layer of credibility that could influence revenue and earnings forecasts positively. Analysts estimate a 6.3% annual revenue growth over the next three years, and this certification may catalyze further demand, potentially affecting these projections. Moreover, while the current share price stands at US$215.30, close to the analyst consensus price target of US$234.01, the limited gap suggests a relatively balanced view on valuation. As analysts' expectations align closely with the current valuation, investors might see the certification as an enhancer of future growth prospects, potentially justifying the price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com