As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a positive shift, with indices in Japan and China posting gains amid hopes for economic stability. In this context, identifying stocks that may be trading below their intrinsic value can offer investors opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alexander Marine (TWSE:8478) | NT$145.50 | NT$281.65 | 48.3% |

| Newborn Town (SEHK:9911) | HK$8.05 | HK$16.05 | 49.8% |

| Members (TSE:2130) | ¥1137.00 | ¥2210.40 | 48.6% |

| Rakus (TSE:3923) | ¥2194.50 | ¥4291.28 | 48.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.32 | CN¥41.17 | 48.2% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.54 | CN¥20.79 | 49.3% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.50 | CN¥77.51 | 49% |

| Everest Medicines (SEHK:1952) | HK$48.95 | HK$97.21 | 49.6% |

| Swire Properties (SEHK:1972) | HK$16.86 | HK$32.76 | 48.5% |

| Holtek Semiconductor (TWSE:6202) | NT$41.70 | NT$81.89 | 49.1% |

Let's uncover some gems from our specialized screener.

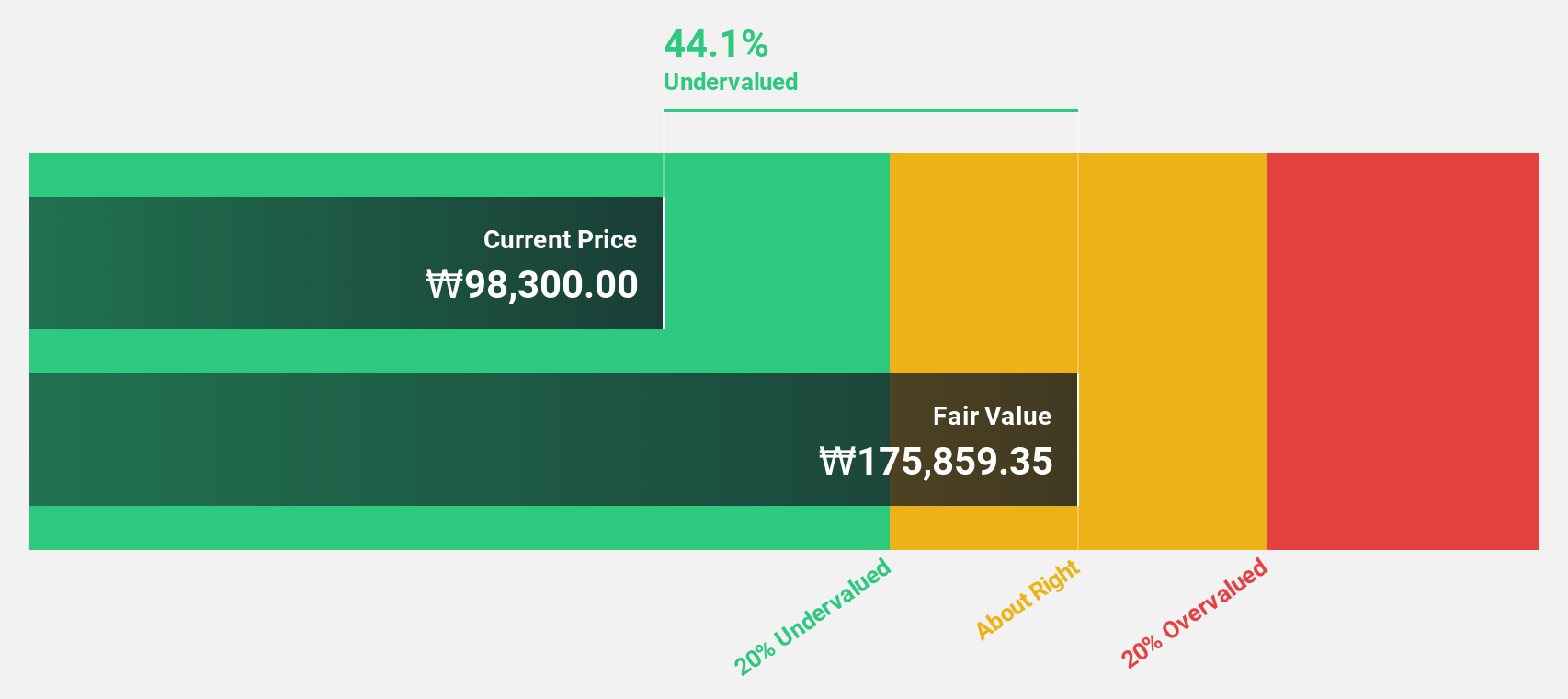

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on researching and developing drugs for central nervous system disorders, with a market cap of ₩8.33 trillion.

Operations: The company's revenue primarily stems from its new drug development segment, generating approximately ₩547.60 million.

Estimated Discount To Fair Value: 36.6%

SK Biopharmaceuticals is trading at ₩106,400, significantly below its estimated fair value of ₩167,884.79. Despite a forecasted annual earnings growth of 7.6%, which lags behind the broader Korean market's 21.5%, the company's revenue is expected to grow robustly at 21.6% per year, outpacing market averages. Additionally, SK Biopharmaceuticals has recently turned profitable and maintains a high forecasted return on equity of 28.6% in three years, suggesting potential for value appreciation based on cash flows.

- Our growth report here indicates SK Biopharmaceuticals may be poised for an improving outlook.

- Click here to discover the nuances of SK Biopharmaceuticals with our detailed financial health report.

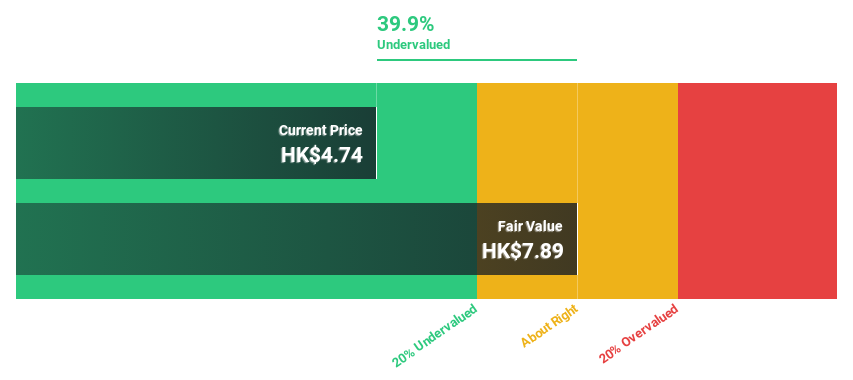

Newborn Town (SEHK:9911)

Overview: Newborn Town Inc. is an investment holding company that operates in the social networking business globally, with a market cap of HK$10.79 billion.

Operations: The company generates revenue from its Social Networking Business segment, which accounts for CN¥4.63 billion, and its Innovative Business segment, contributing CN¥459.64 million.

Estimated Discount To Fair Value: 49.8%

Newborn Town is trading at HK$8.05, significantly below its fair value estimate of HK$16.05, reflecting a potential undervaluation based on cash flows. Despite recent volatility in share price, the company's earnings are forecasted to grow significantly at 28.2% annually, outpacing the Hong Kong market's average growth rate of 10.5%. With revenue expected to increase by 17.6% per year and net profit margins improving from last year's figures when adjusted for one-off events, Newborn Town shows promise for investors focusing on cash flow valuation metrics.

- The growth report we've compiled suggests that Newborn Town's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Newborn Town's balance sheet health report.

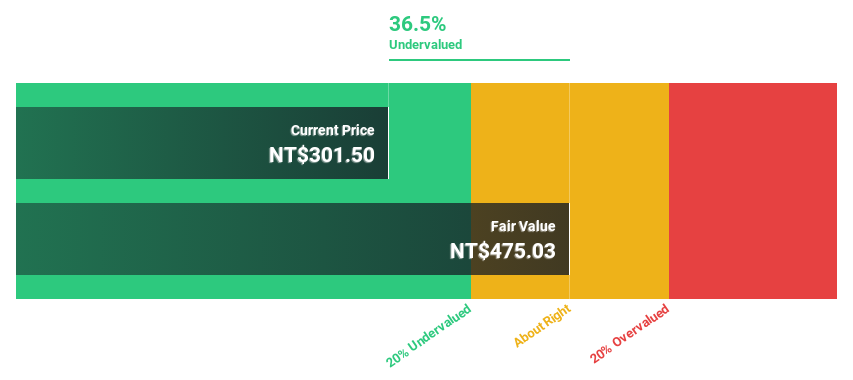

Chenbro Micom (TWSE:8210)

Overview: Chenbro Micom Co., Ltd. focuses on the research, development, design, manufacture, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$30.31 billion.

Operations: The company generates revenue primarily from its computer peripherals segment, amounting to NT$14.52 billion.

Estimated Discount To Fair Value: 42.9%

Chenbro Micom is trading at NT$250.5, well below its fair value estimate of NT$438.92, highlighting potential undervaluation based on cash flows. The company's earnings grew by a substantial 78.1% last year and are forecast to grow at 18.7% annually, outpacing the Taiwan market's growth rate of 14.2%. Despite recent share price volatility and an unstable dividend track record, Chenbro Micom's revenue growth prospects remain robust at over 20% per year.

- The analysis detailed in our Chenbro Micom growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Chenbro Micom.

Seize The Opportunity

- Get an in-depth perspective on all 268 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com