As global trade tensions show signs of easing, Asian markets are experiencing a cautious optimism, with key indices like Japan's Nikkei 225 and China's CSI 300 posting gains amid expectations for economic stimulus. In this environment, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential in less-explored sectors. Identifying promising stocks often involves looking for companies with solid fundamentals and innovative strategies that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 10.11% | 36.75% | 56.34% | ★★★★★★ |

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Thai Steel Cable | NA | 3.33% | 18.04% | ★★★★★★ |

| Suzhou Highfine Biotech | NA | 8.24% | 9.72% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| OpenWork | NA | 24.40% | 27.84% | ★★★★★★ |

| Eclatorq Technology | 20.08% | 12.22% | 22.98% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 20.62% | 19.35% | -6.10% | ★★★★★☆ |

| Renxin New MaterialLtd | 8.55% | 17.79% | -34.07% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Johnson Electric Holdings (SEHK:179)

Simply Wall St Value Rating: ★★★★★★

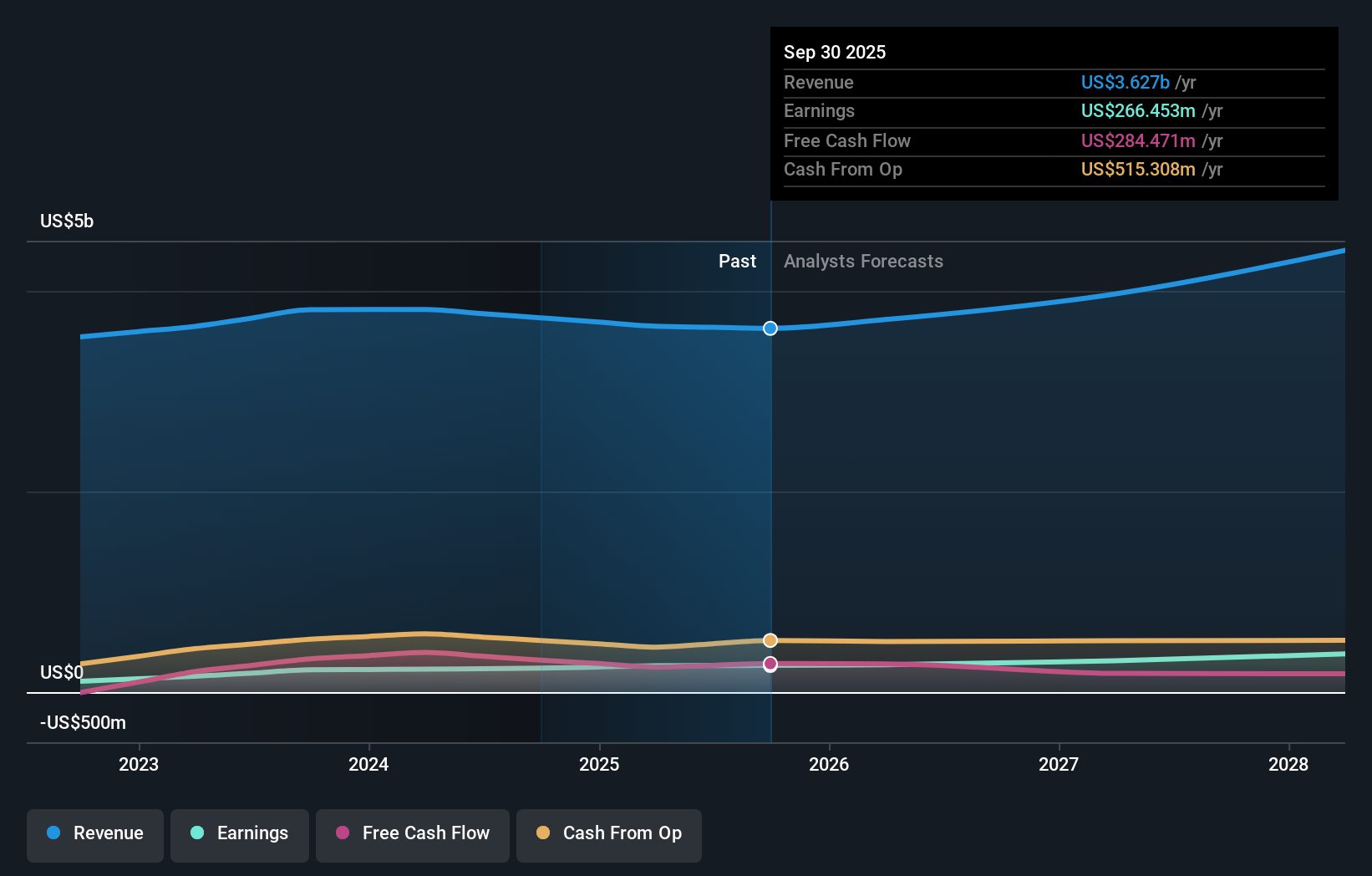

Overview: Johnson Electric Holdings Limited is an investment holding company that manufactures and sells motion systems globally, with a market capitalization of HK$12.67 billion.

Operations: Johnson Electric Holdings generates revenue primarily from its Auto Parts & Accessories segment, amounting to $3.73 billion.

Johnson Electric, a notable player in the auto components sector, is trading at a significant 66.4% below its estimated fair value. Over the past five years, it has successfully reduced its debt-to-equity ratio from 19.4% to 13.3%, indicating prudent financial management. The company boasts high-quality earnings and its interest payments are well covered by EBIT at a robust 52.6 times coverage, showcasing financial stability. Despite experiencing share price volatility recently, Johnson Electric's earnings grew by 7.5% last year, outpacing the industry average of just 0.2%. However, future earnings are expected to decline by an average of 2.5% annually over the next three years.

Chengdu Wintrue Holding (SZSE:002539)

Simply Wall St Value Rating: ★★★★☆☆

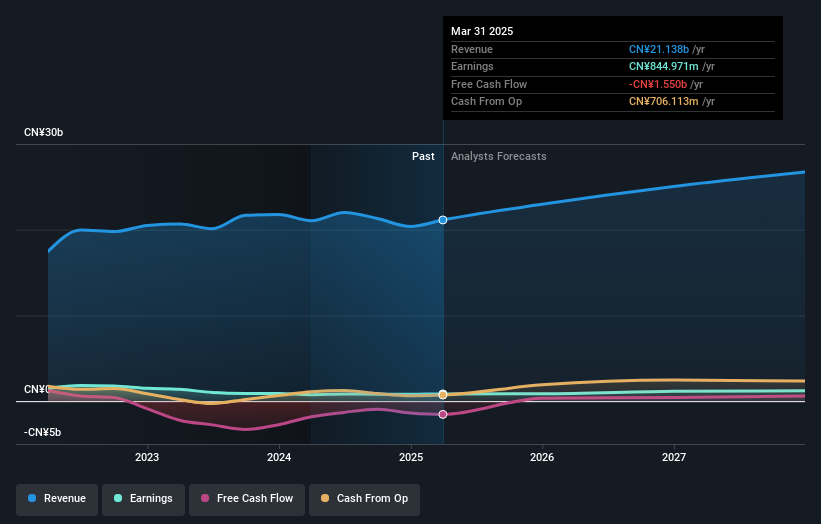

Overview: Chengdu Wintrue Holding Co., Ltd. is engaged in the production and sale of compound fertilizers, with a market capitalization of CN¥10.04 billion.

Operations: Chengdu Wintrue Holding generates revenue primarily through the production and sale of compound fertilizers. The company's market capitalization stands at CN¥10.04 billion.

Chengdu Wintrue Holding, a notable player in the chemicals sector, has demonstrated robust performance with earnings growth of 12.5% over the past year, outpacing its industry average of 2.1%. The company's net debt to equity ratio stands at a high 80.6%, though interest payments are well covered by EBIT at 6.3 times coverage. Trading below fair value by approximately 14%, it offers potential value for investors. Recent financials show an increase in first-quarter sales to CNY 5.71 billion from CNY 4.95 billion last year, while net income rose to CNY 253 million from CNY 213 million previously, indicating strong operational momentum despite challenges in free cash flow generation and dividend adjustments.

Sumitomo Riko (TSE:5191)

Simply Wall St Value Rating: ★★★★★★

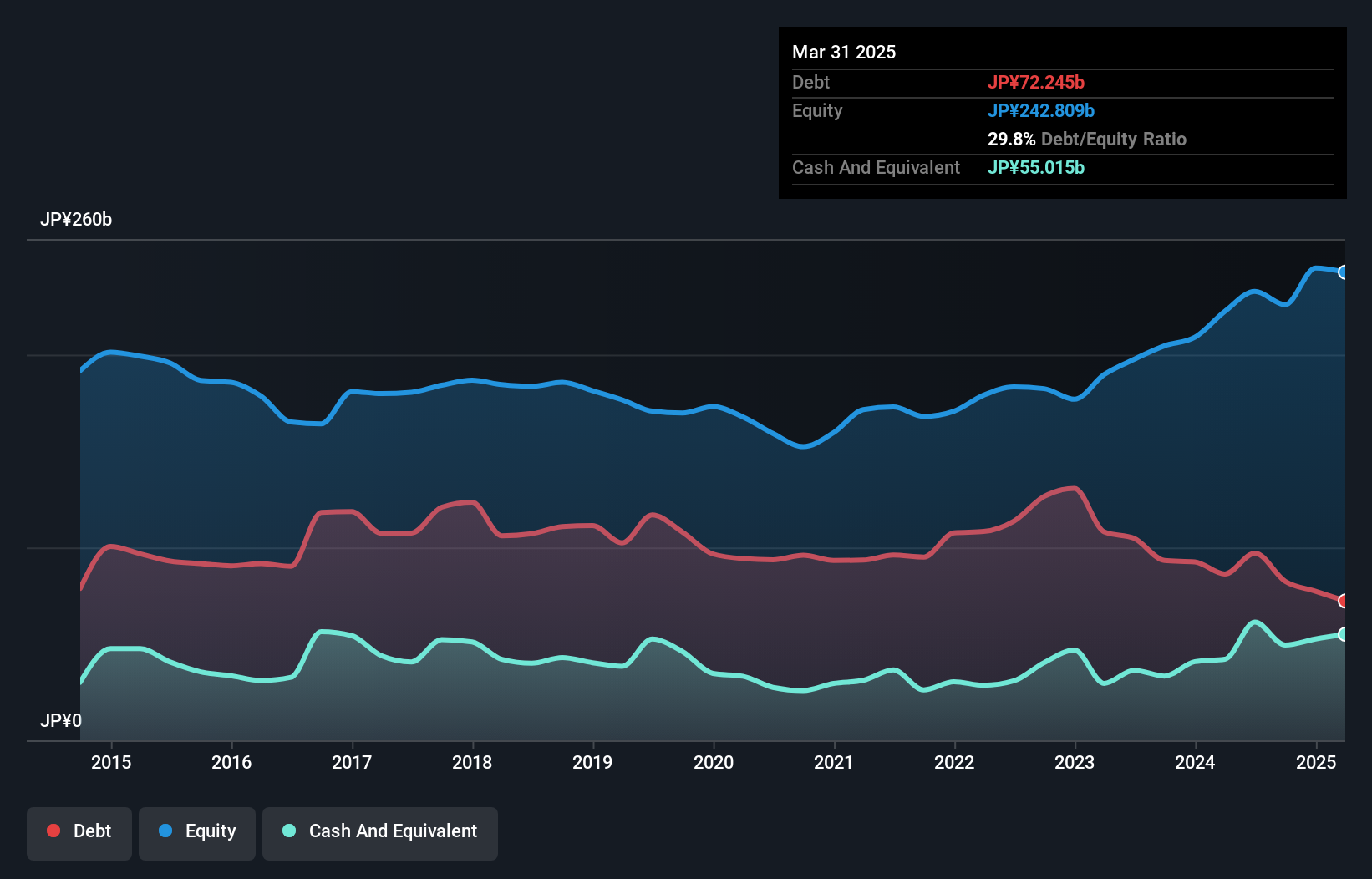

Overview: Sumitomo Riko Company Limited specializes in the manufacture and sale of automotive parts, with a market capitalization of ¥168.92 billion.

Operations: Sumitomo Riko generates revenue primarily from automobile supplies, amounting to ¥572.90 billion, and general industrial supplies, contributing ¥76.63 billion.

Sumitomo Riko, a notable player in the auto components sector, has demonstrated robust growth with earnings surging by 21% over the past year, outpacing its industry. This performance is underpinned by high-quality earnings and a satisfactory net debt to equity ratio of 10%. The company’s interest payments are well covered by EBIT at 40 times coverage. Despite recent share price volatility, Sumitomo Riko trades at an attractive price-to-earnings ratio of 6.2x compared to the JP market's average of 12.8x, suggesting potential value for investors seeking opportunities in this space.

Where To Now?

- Delve into our full catalog of 2661 Asian Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com