Varonis Systems announced a strategic partnership with Pure Storage (NYSE:PSTG) on April 21, aimed at enhancing data security and cyber resilience, possibly adding weight to Pure Storage's 13% price gain over the past week. This price move mirrors the broader market’s trend, which also experienced an upward movement. Despite gains, the tech sector overall faced challenges, as seen in declines of major players like Nvidia and Tesla. However, Pure Storage's recognition as a leader in primary storage platforms and its alliance with Varonis could have boosted investor confidence, lending support against the tech sector's broader malaise.

Buy, Hold or Sell Pure Storage? View our complete analysis and fair value estimate and you decide.

The recent collaboration between Pure Storage and Varonis Systems holds potential to drive significant changes in Pure Storage's business outlook, especially regarding its market positioning and revenue potential. Known for its robust data storage solutions, Pure Storage's strategic move to team up with Varonis underscores its intent to bolster its cybersecurity capabilities, potentially enhancing investor confidence. Over the last five years, Pure Storage has delivered a substantial total return of 255.09%, reflecting its ability to adapt and scale in a competitive tech landscape.

Despite a strong five-year performance, the company's share price underperformed the broader US Tech industry in the past year. This alliance could address this issue by strengthening Pure Storage's offerings, particularly as it aligns with emerging trends in AI and data security. The anticipated increase in market penetration and expanded deployments following a design win with a top hyperscaler may support revenue growth and operational scale, further positioning the company to capitalize on AI-driven opportunities.

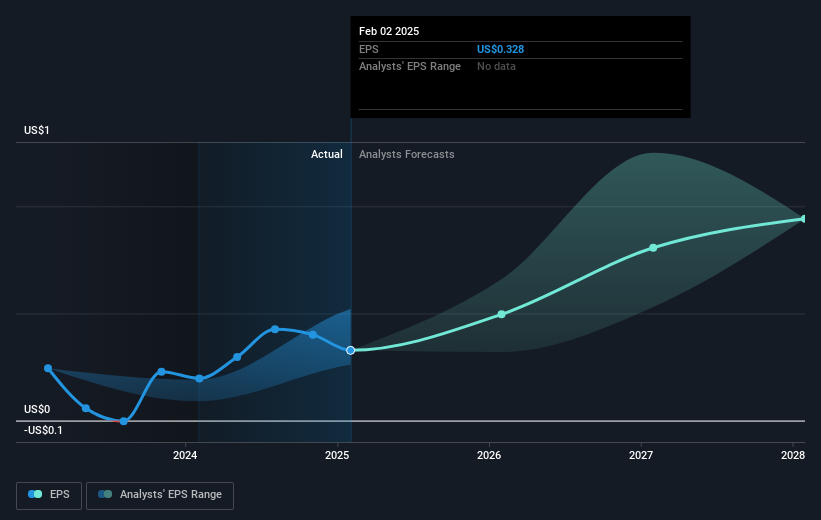

In terms of financial forecasts, analysts project an 11.8% annual revenue growth over the next three years along with improved profit margins, which could be favorably impacted by this partnership. However, the current share price of US$40.36 remains below the analysts' consensus price target of US$67.81, suggesting considerable room for appreciation if Pure Storage can meet its growth objectives. As Pure Storage navigates its expansion plans and external challenges, including potential geopolitical risks and pricing pressures, the Varonis partnership could be a critical factor in achieving the desired scale and efficiency gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com