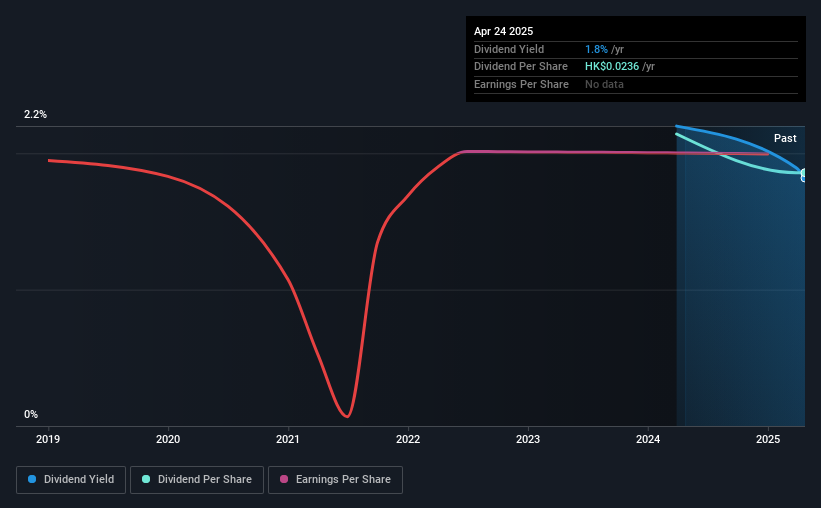

Kindstar Globalgene Technology, Inc.'s (HKG:9960) dividend is being reduced from last year's payment covering the same period to CN¥0.0238 on the 27th of August. This payment takes the dividend yield to 1.8%, which only provides a modest boost to overall returns.

Kindstar Globalgene Technology's Distributions May Be Difficult To Sustain

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. While Kindstar Globalgene Technology is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Looking forward, earnings per share could rise by 76.2% over the next year if the trend from the last few years continues. This is the right direction to be moving, but it is probably not enough to achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

View our latest analysis for Kindstar Globalgene Technology

Kindstar Globalgene Technology Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Kindstar Globalgene Technology has seen EPS rising for the last five years, at 76% per annum. While the company is not yet turning a profit, it is growing at a good rate. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

Our Thoughts On Kindstar Globalgene Technology's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Kindstar Globalgene Technology stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.