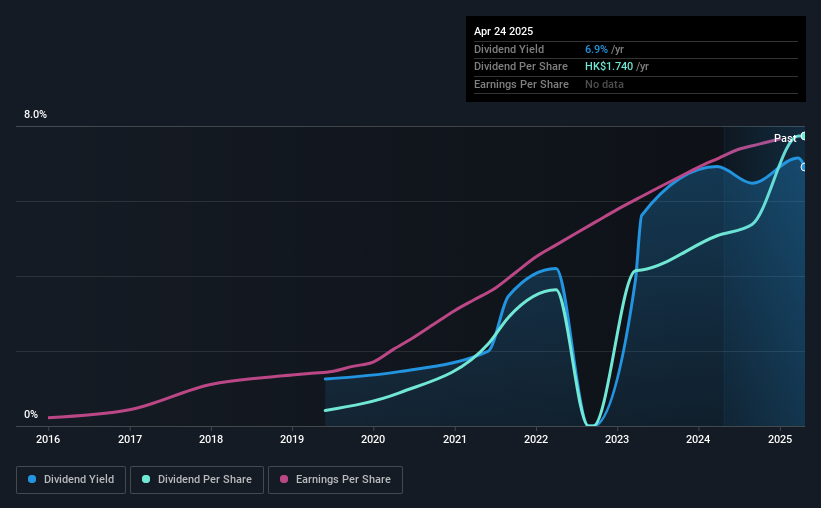

The board of Binjiang Service Group Co. Ltd. (HKG:3316) has announced that it will pay a dividend of CN¥0.876 per share on the 7th of August. The dividend yield will be in the average range for the industry at 6.9%.

We've discovered 1 warning sign about Binjiang Service Group. View them for free.Binjiang Service Group's Future Dividend Projections Appear Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before this announcement, Binjiang Service Group was paying out 72% of earnings, but a comparatively small of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Earnings per share is forecast to rise by 13.7% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 92% which is a bit high but can definitely be sustainable.

Check out our latest analysis for Binjiang Service Group

Binjiang Service Group's Dividend Has Lacked Consistency

Binjiang Service Group has been paying dividends for a while, but the track record isn't stellar. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2019, the annual payment back then was CN¥0.0877, compared to the most recent full-year payment of CN¥1.63. This implies that the company grew its distributions at a yearly rate of about 63% over that duration. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Binjiang Service Group has seen EPS rising for the last five years, at 35% per annum. EPS is growing rapidly, although the company is also paying out a large portion of its profits as dividends. If earnings keep growing, the dividend may be sustainable, but generally we'd prefer to see a fast growing company reinvest in further growth.

We Really Like Binjiang Service Group's Dividend

It is generally not great to see the dividend being cut, but we don't think this should happen much if at all in the future given that Binjiang Service Group has the makings of a solid income stock moving forward. By reducing the dividend, pressure will be taken off the balance sheet, which could help the dividend to be consistent in the future. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Binjiang Service Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.