Amid escalating trade tensions and policy uncertainties, Asian markets have shown resilience with gains in major indices, as seen in China's CSI 300 and Japan's Nikkei 225. In such a fluctuating environment, identifying stocks that may be priced below their intrinsic value can be a prudent strategy for investors seeking opportunities that offer potential for growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥73.48 | CN¥146.19 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.88 | CN¥41.46 | 49.6% |

| Rise Consulting Group (TSE:9168) | ¥927.00 | ¥1818.23 | 49% |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥6.70 | CN¥13.24 | 49.4% |

| World Fitness Services (TWSE:2762) | NT$79.70 | NT$156.16 | 49% |

| Zhejiang Haikong Nanke Huatie Digital Intelligence and Technology (SHSE:603300) | CN¥10.76 | CN¥21.27 | 49.4% |

| Swire Properties (SEHK:1972) | HK$16.34 | HK$32.21 | 49.3% |

| Everest Medicines (SEHK:1952) | HK$49.70 | HK$97.92 | 49.2% |

| Visional (TSE:4194) | ¥8432.00 | ¥16585.40 | 49.2% |

| Sunstone Development (SHSE:603612) | CN¥16.82 | CN¥32.98 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

Precision Tsugami (China) (SEHK:1651)

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that manufactures and sells computer numerical control machine tools in Mainland China and internationally, with a market cap of HK$8.38 billion.

Operations: The company generates revenue of CN¥3.60 billion from the manufacture and sale of CNC high precision machine tools.

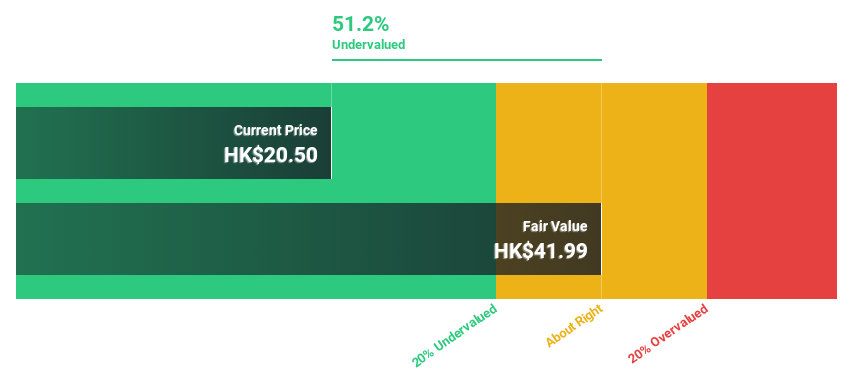

Estimated Discount To Fair Value: 48.5%

Precision Tsugami (China) is trading at HK$22.25, significantly below its estimated fair value of HK$43.22, indicating potential undervaluation based on cash flows. The company has initiated a share buyback program to enhance net asset value and earnings per share. Despite a volatile share price, earnings are forecast to grow 25.9% annually, outpacing the Hong Kong market's growth rate. However, dividends are not well covered by free cash flows despite high expected revenue growth of 22% annually.

- Upon reviewing our latest growth report, Precision Tsugami (China)'s projected financial performance appears quite optimistic.

- Take a closer look at Precision Tsugami (China)'s balance sheet health here in our report.

Autel Intelligent Technology (SHSE:688208)

Overview: Autel Intelligent Technology Corp., Ltd. specializes in the research, development, production, sale, and servicing of automotive intelligent diagnostics equipment and electronic components, with a market cap of CN¥16.56 billion.

Operations: Autel Intelligent Technology Corp., Ltd. generates revenue through its automotive intelligent diagnostics equipment, detection and analysis systems, and automotive electronic components.

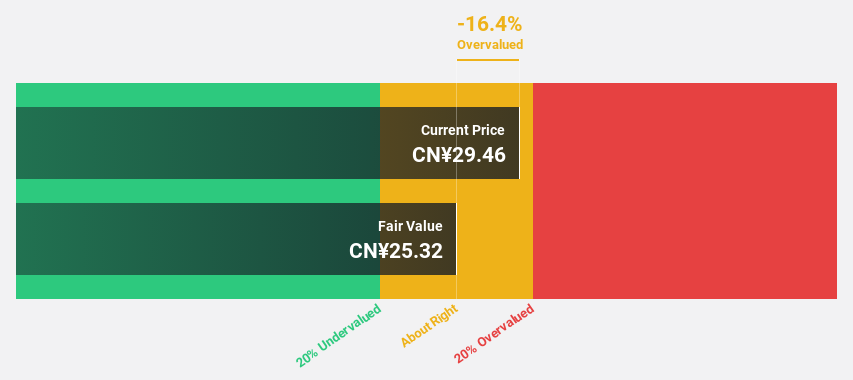

Estimated Discount To Fair Value: 29.6%

Autel Intelligent Technology is trading at CNY 37.56, below its estimated fair value of CNY 53.35, suggesting undervaluation based on cash flows. The company announced a share repurchase program worth up to CNY 200 million to support shareholder value. Despite recent volatility, earnings grew significantly last year and are forecasted to grow annually by 21.2%. However, the dividend track record remains unstable amidst these positive financial metrics.

- Insights from our recent growth report point to a promising forecast for Autel Intelligent Technology's business outlook.

- Get an in-depth perspective on Autel Intelligent Technology's balance sheet by reading our health report here.

Sumco (TSE:3436)

Overview: Sumco Corporation manufactures and sells silicon wafers for the semiconductor industry across Japan, the United States, China, Taiwan, Korea, and internationally with a market cap of ¥329.01 billion.

Operations: Sumco Corporation's revenue primarily comes from the manufacturing and sale of silicon wafers for the semiconductor industry across various international markets, including Japan, the United States, China, Taiwan, and Korea.

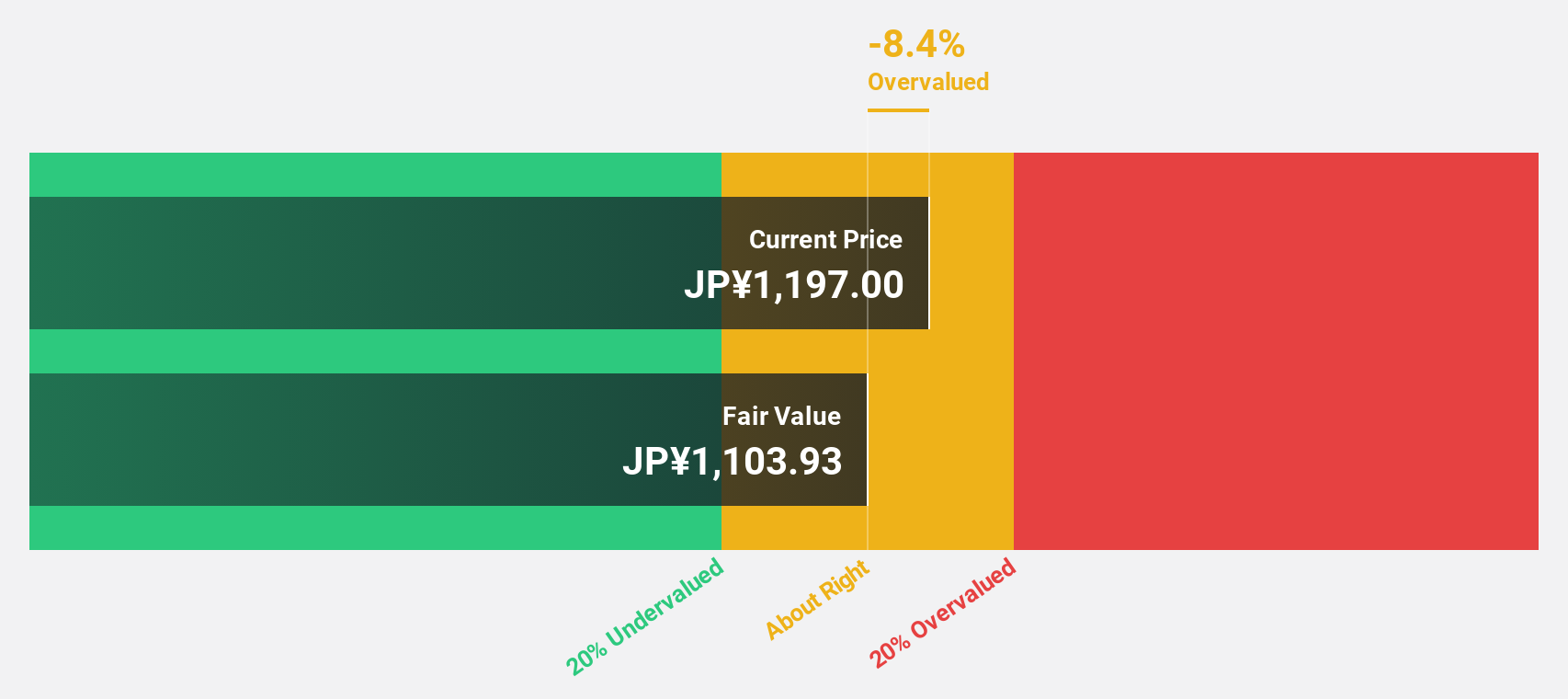

Estimated Discount To Fair Value: 26.2%

Sumco Corporation, trading at ¥940.8, is undervalued compared to its estimated fair value of ¥1,274.07. Despite a volatile share price and reduced profit margins from 15% to 5%, earnings are expected to grow significantly at 29% annually, outpacing the Japanese market average. However, the dividend yield of 2.23% is not well-covered by free cash flows, and recent dividend cuts highlight sustainability concerns amidst these growth prospects.

- According our earnings growth report, there's an indication that Sumco might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Sumco.

Summing It All Up

- Get an in-depth perspective on all 266 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com