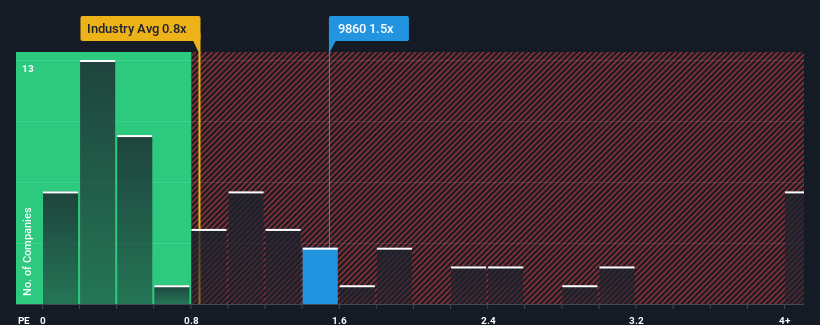

Adicon Holdings Limited's (HKG:9860) price-to-sales (or "P/S") ratio of 1.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Healthcare industry in Hong Kong have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

We've discovered 2 warning signs about Adicon Holdings. View them for free.Check out our latest analysis for Adicon Holdings

How Has Adicon Holdings Performed Recently?

Recent times haven't been great for Adicon Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Adicon Holdings.Is There Enough Revenue Growth Forecasted For Adicon Holdings?

In order to justify its P/S ratio, Adicon Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.9% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Adicon Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Adicon Holdings' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Adicon Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Adicon Holdings has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.