Amidst a backdrop of mixed performances in global markets, Asian stocks have been drawing attention, with smaller-cap indexes showing resilience. Penny stocks, although an older term, remain relevant as they often represent smaller or newer companies that can offer significant value. By focusing on those with strong financial foundations and potential for growth, investors may uncover opportunities within these under-the-radar gems.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.70 | THB2.91B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.66 | THB1.68B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.41 | SGD166.17M | ✅ 3 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.198 | SGD39.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.08 | HK$681.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.88B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.95 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.11 | CN¥3.52B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,139 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, is engaged in the research, design, development, production, and sale of automotive steering systems and accessories in China with a market cap of HK$8.50 billion.

Operations: The company generates revenue of CN¥2.61 billion from its manufacture of automobile parts and accessories segment.

Market Cap: HK$8.5B

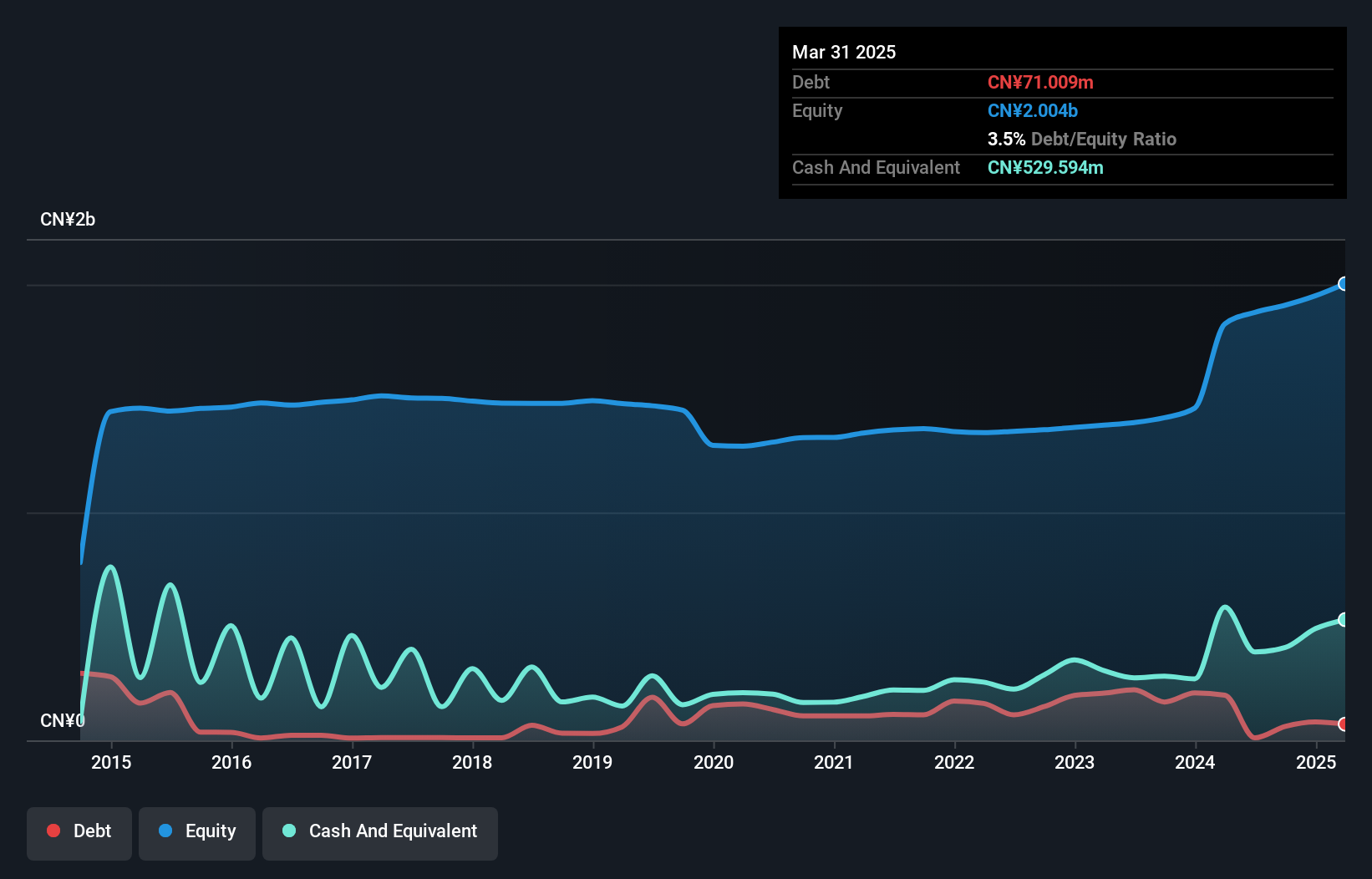

Zhejiang Shibao has demonstrated robust financial performance with a significant earnings growth of 93.2% over the past year, surpassing industry averages. The company's recent Q1 2025 results reflect this trend, with sales reaching CN¥717.81 million and net income rising to CN¥48.73 million from CN¥21.78 million a year ago. Its strong balance sheet is evident as short-term assets exceed both short and long-term liabilities, while the debt-to-equity ratio has improved significantly over five years. However, its return on equity remains low at 8.7%, and operating cash flow does not fully cover its debt obligations yet.

- Click here to discover the nuances of Zhejiang Shibao with our detailed analytical financial health report.

- Explore historical data to track Zhejiang Shibao's performance over time in our past results report.

Xtep International Holdings (SEHK:1368)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xtep International Holdings Limited designs, develops, manufactures, markets, and sells sports footwear, apparel, and accessories for adults and children in Mainland China with a market cap of HK$13.21 billion.

Operations: The company's revenue is derived from two main segments: Mass Market, contributing CN¥12.33 billion, and Professional Sports, generating CN¥1.25 billion.

Market Cap: HK$13.21B

Xtep International Holdings has shown consistent revenue growth, with sales reaching CN¥13.58 billion in 2024, up from CN¥12.74 billion the previous year. The company maintains a robust financial position, with short-term assets of CN¥11.2 billion surpassing both short and long-term liabilities, and its debt is well-covered by operating cash flow at 41.5%. Despite a stable earnings trajectory over five years at 16.7% annually, recent profit growth slowed to 4.1%. The management team is relatively new with an average tenure of less than a year; however, the board remains experienced with an average tenure of 13.7 years.

- Dive into the specifics of Xtep International Holdings here with our thorough balance sheet health report.

- Evaluate Xtep International Holdings' prospects by accessing our earnings growth report.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Food Empire Holdings Limited is a food and beverage manufacturing and distribution company operating in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally with a market cap of SGD774.58 million.

Operations: The company's revenue is primarily derived from South Asia ($264.76 million), Russia ($147.23 million), Ukraine, Kazakhstan and CIS ($124.68 million), and South-East Asia ($83.01 million).

Market Cap: SGD774.58M

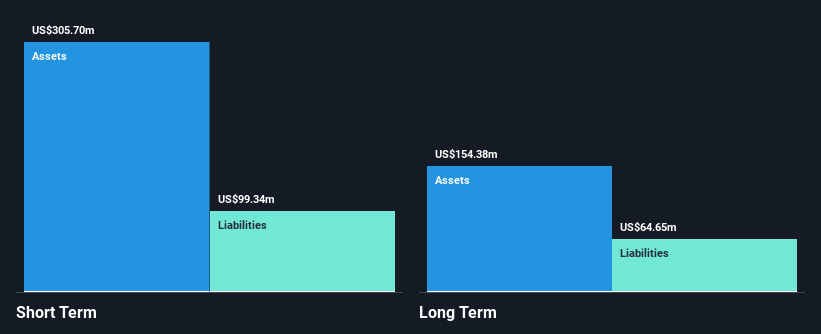

Food Empire Holdings has demonstrated financial stability, with short-term assets of $305.7M exceeding both short and long-term liabilities. The company recently secured a US$10 million loan from the EBRD to construct a new facility in Kazakhstan, signaling growth potential. Despite negative earnings growth over the past year and lower profit margins (11% compared to 13.3% last year), its debt is well-covered by operating cash flow (64.7%). The seasoned management team averages 9.3 years of tenure, while shareholders have not faced significant dilution recently. However, dividends are not fully covered by free cash flows.

- Unlock comprehensive insights into our analysis of Food Empire Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Food Empire Holdings' future.

Summing It All Up

- Click this link to deep-dive into the 1,139 companies within our Asian Penny Stocks screener.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com