Amidst the backdrop of global trade tensions and economic policy shifts, Asian markets have shown resilience with mainland Chinese stock markets advancing due to anticipated stimulus measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the company best, potentially providing a buffer against broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 67.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Oscotec (KOSDAQ:A039200) | 21.3% | 85.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

We're going to check out a few of the best picks from our screener tool.

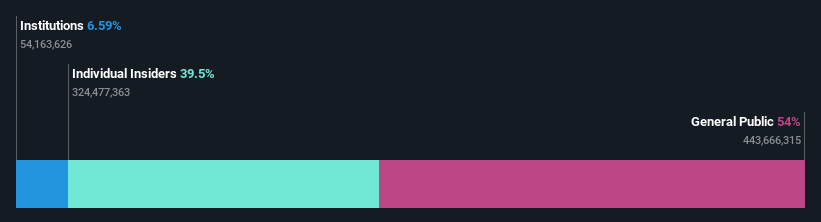

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lunit Inc. is a South Korean company that offers AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩1.55 trillion.

Operations: The company generates revenue from its AI-driven healthcare software segment, amounting to ₩54.18 billion.

Insider Ownership: 19.7%

Revenue Growth Forecast: 40.9% p.a.

Lunit, a growth-focused company in Asia, is poised for substantial revenue growth at 40.9% annually and earnings set to expand by 139.5% per year, though it faces challenges with a low forecasted Return on Equity of 6.3%. Recent strategic collaborations with the U.S. National Cancer Institute and Abu Dhabi's SEHA highlight its commitment to advancing AI applications in cancer research and diagnostics, despite concerns about financial runway stability.

- Take a closer look at Lunit's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Lunit's share price might be too optimistic.

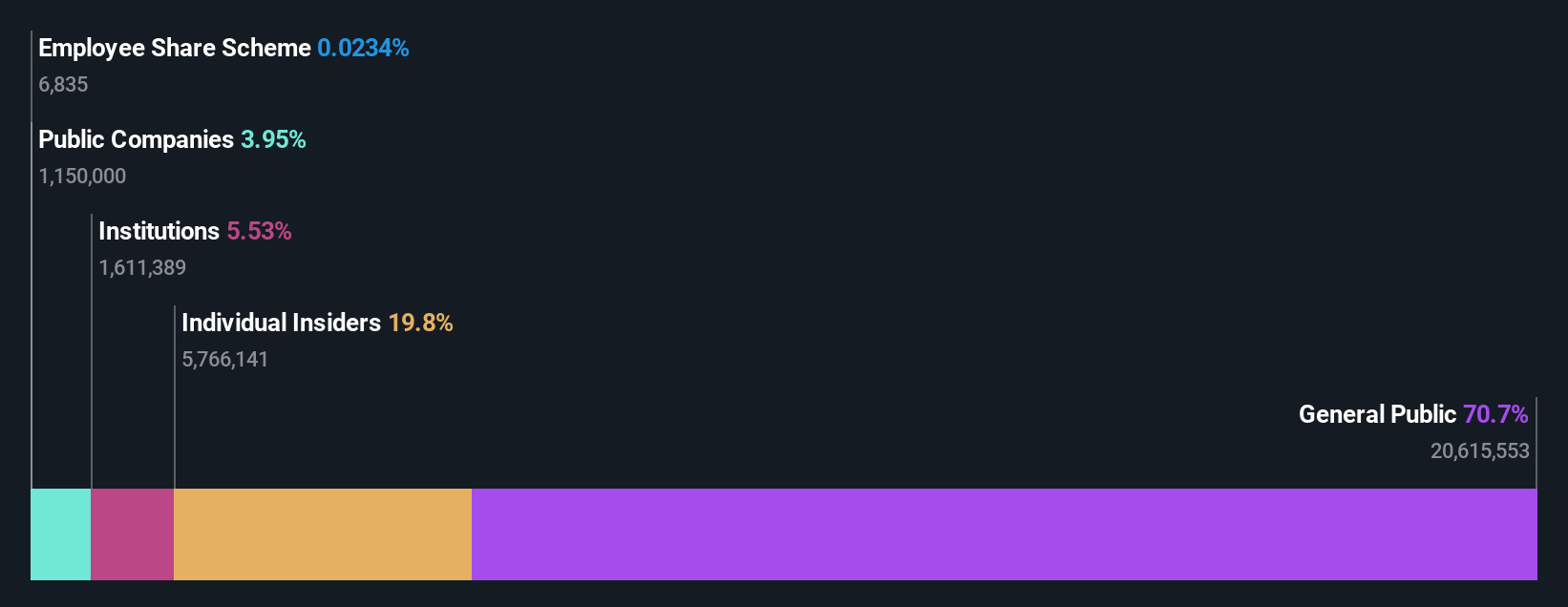

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc., with a market cap of HK$9.12 billion, operates in the social networking business globally as an investment holding company.

Operations: Newborn Town Inc. generates revenue through its Social Networking Business, which accounts for CN¥4.63 billion, and its Innovative Business segment, contributing CN¥459.64 million.

Insider Ownership: 22.6%

Revenue Growth Forecast: 17.6% p.a.

Newborn Town demonstrates growth potential with earnings expected to rise 28.15% annually, outpacing the Hong Kong market's 10.3%. Despite a volatile share price and lower profit margins than last year, it trades at a significant discount to its estimated fair value. Revenue is projected to grow at 17.6% per year, driven by the social networking sector's expansion through AI technology and strategic acquisitions like BlueCity, although insider trading activity remains unreported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Newborn Town.

- The analysis detailed in our Newborn Town valuation report hints at an deflated share price compared to its estimated value.

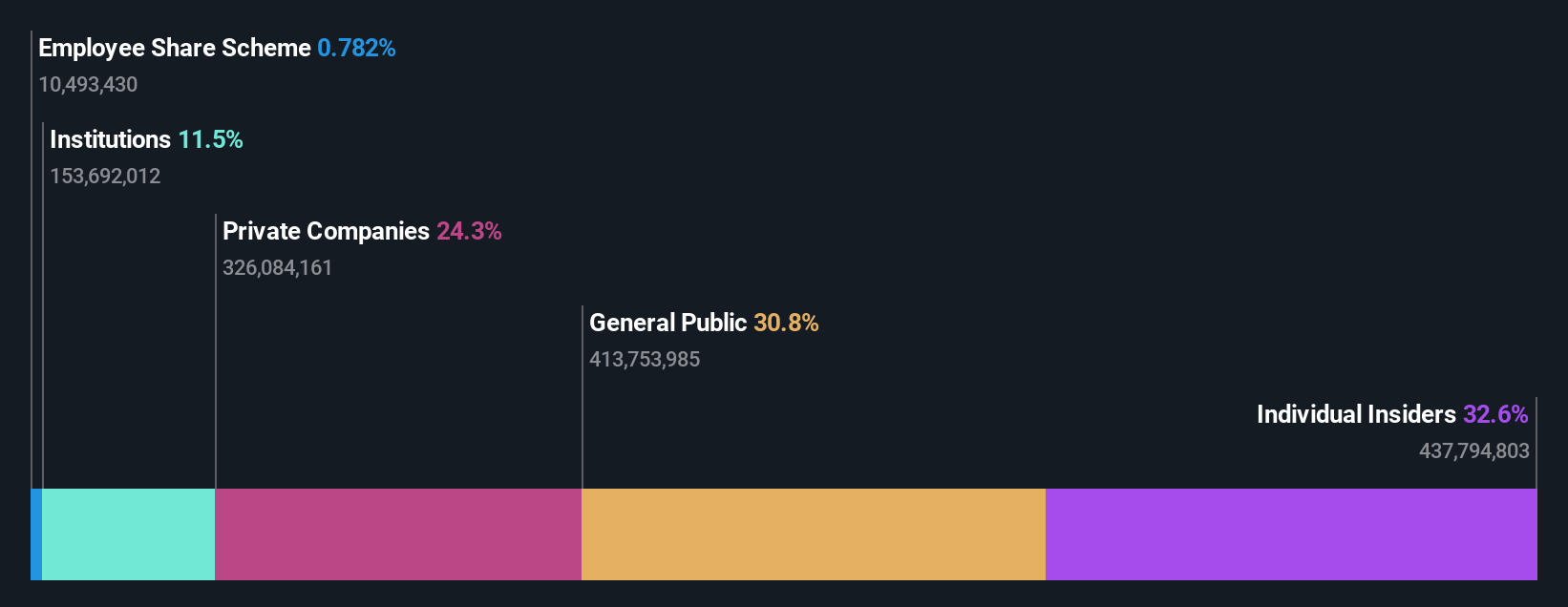

Allwinner TechnologyLtd (SZSE:300458)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allwinner Technology Co., Ltd. is involved in the research, development, design, manufacturing, and sale of intelligent application SoC, analog components, and wireless interconnect chips in China with a market cap of CN¥30.61 billion.

Operations: The company's revenue primarily comes from its Integrated Circuit Design segment, which generated CN¥2.29 billion.

Insider Ownership: 39.5%

Revenue Growth Forecast: 17.3% p.a.

Allwinner Technology Ltd. shows strong growth potential, with earnings expected to rise significantly at 39.6% annually, surpassing China's market average of 23.7%. Despite a highly volatile share price and low forecasted return on equity (10.9%), the company reported substantial profit growth of over 600% last year, driven by sales reaching CNY 2.29 billion in 2024. Recent dividend increases reflect confidence in future performance, although insider trading activity remains unreported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Allwinner TechnologyLtd.

- In light of our recent valuation report, it seems possible that Allwinner TechnologyLtd is trading beyond its estimated value.

Summing It All Up

- Delve into our full catalog of 645 Fast Growing Asian Companies With High Insider Ownership here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com