To the annoyance of some shareholders, Yunkang Group Limited (HKG:2325) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

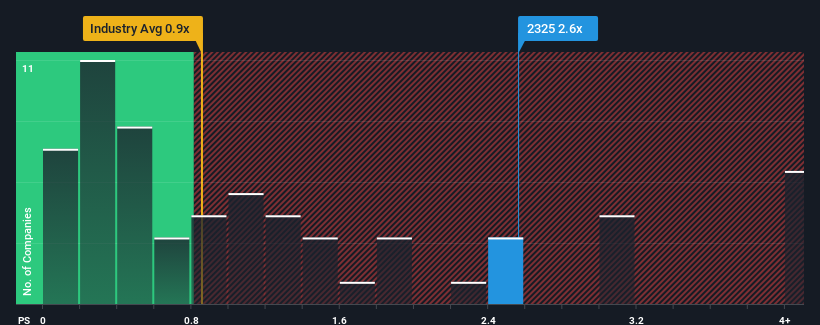

Even after such a large drop in price, you could still be forgiven for thinking Yunkang Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.6x, considering almost half the companies in Hong Kong's Healthcare industry have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Yunkang Group

How Yunkang Group Has Been Performing

Yunkang Group has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Yunkang Group's future stacks up against the industry? In that case, our free report is a great place to start .How Is Yunkang Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Yunkang Group's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. As a result, revenue from three years ago have also fallen 58% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 29% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 8.1%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Yunkang Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Yunkang Group's P/S

Yunkang Group's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Yunkang Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Yunkang Group that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.