Despite an already strong run, Boer Power Holdings Limited (HKG:1685) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

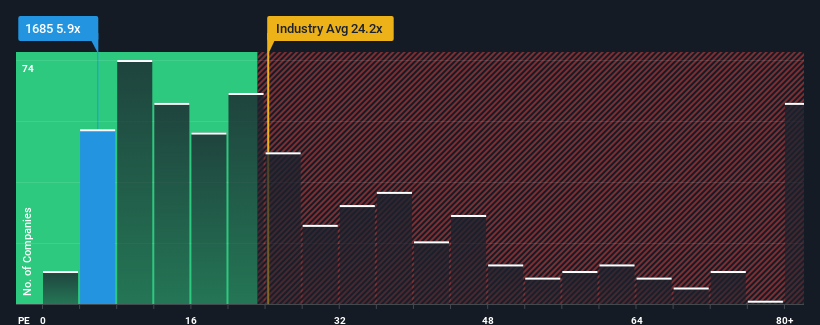

Even after such a large jump in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider Boer Power Holdings as an attractive investment with its 5.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen at a steady rate over the last year for Boer Power Holdings, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Boer Power Holdings

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Boer Power Holdings' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.5% last year. This was backed up an excellent period prior to see EPS up by 150% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 18% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Boer Power Holdings is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Boer Power Holdings' P/E

The latest share price surge wasn't enough to lift Boer Power Holdings' P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Boer Power Holdings revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Boer Power Holdings (at least 1 which is concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.