Amid heightened global trade tensions and significant market volatility, Asian markets are navigating a complex landscape shaped by recent tariff announcements and economic uncertainties. Despite these challenges, investors continue to seek opportunities that offer potential growth without excessive risk. Penny stocks, though an outdated term, still represent a compelling investment area for those interested in smaller or newer companies with strong financial health. By focusing on solid fundamentals and robust balance sheets, these stocks can provide promising opportunities for growth at lower price points.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

| Interlink Telecom (SET:ITEL) | THB1.16 | THB1.61B | ✅ 4 ⚠️ 5 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.33 | SGD133.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.168 | SGD33.47M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.87 | SGD7.38B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$2.68 | HK$1.1B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.24B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.05 | HK$662.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.00 | HK$1.67B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥2.85 | CN¥3.3B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,187 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pacific Online Systems (PSE:LOTO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pacific Online Systems Corporation, with a market cap of ₱2.97 billion, designs, develops, and manages online computer systems, terminals, and software for the gaming industry in the Philippines.

Operations: The company's revenue is primarily derived from leasing activities, amounting to ₱520.19 million.

Market Cap: ₱2.97B

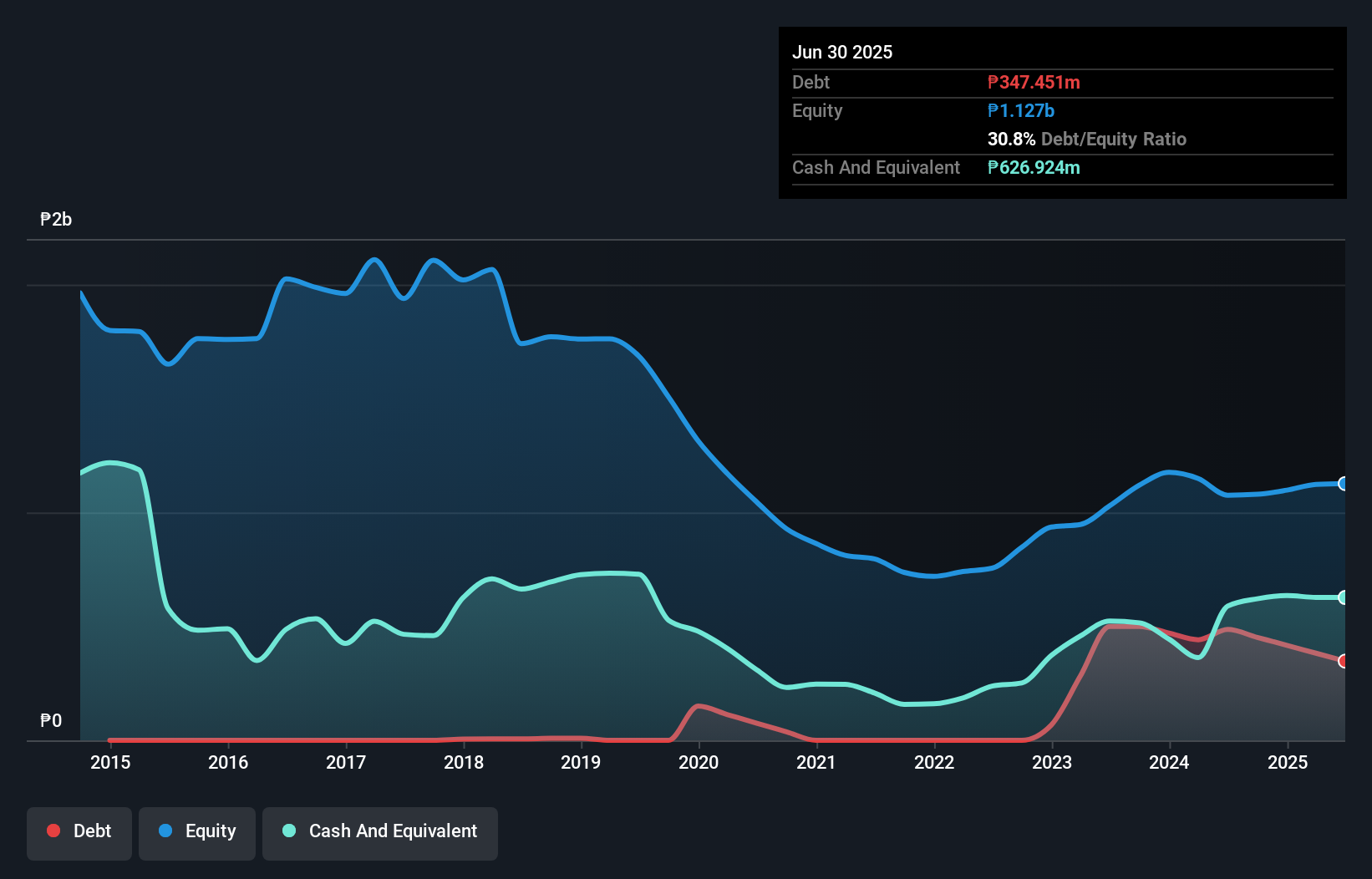

Pacific Online Systems Corporation, with a market cap of ₱2.97 billion, has seen its short-term assets surpass both short and long-term liabilities, indicating a strong liquidity position. However, the company faces challenges with declining profit margins and negative earnings growth over the past year. Despite becoming profitable in recent years, its dividend sustainability is questionable due to insufficient coverage by earnings or cash flows. The company's debt level has increased but remains well-covered by operating cash flow. Recent board changes include the election of Atty. Antonio Victoriano F. Gregorio III as a non-executive director following Mr. Raul B. De Mesa's passing.

- Click here to discover the nuances of Pacific Online Systems with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Pacific Online Systems' track record.

Huanxi Media Group (SEHK:1003)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Huanxi Media Group Limited is an investment holding company involved in media and entertainment operations in the People's Republic of China and Hong Kong, with a market cap of HK$1.61 billion.

Operations: The company's revenue is primarily derived from its investment in film and TV programmes rights, totaling HK$34.18 million.

Market Cap: HK$1.61B

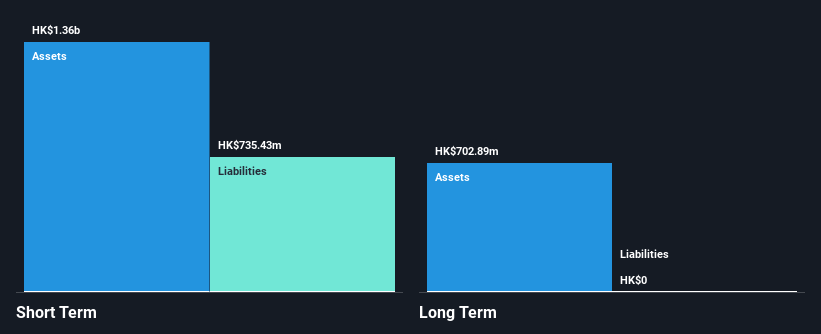

Huanxi Media Group, with a market cap of HK$1.61 billion, is currently unprofitable and reported a significant drop in revenue to HK$34.18 million for 2024 from the previous year's HK$1.33 billion. The company has ample short-term assets (HK$1.2 billion) exceeding both short and long-term liabilities, reflecting strong liquidity despite its losses. Recent setbacks include delayed film releases impacting earnings; however, past successes like "Full River Red" contributed positively to its performance last year. While management experience data is lacking, the board's average tenure suggests stability amidst ongoing challenges in the entertainment sector.

- Navigate through the intricacies of Huanxi Media Group with our comprehensive balance sheet health report here.

- Examine Huanxi Media Group's past performance report to understand how it has performed in prior years.

China Regenerative Medicine International (SEHK:8158)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Regenerative Medicine International Limited is an investment holding company that provides healthcare products and services in Hong Kong and the People's Republic of China, with a market cap of HK$135.39 million.

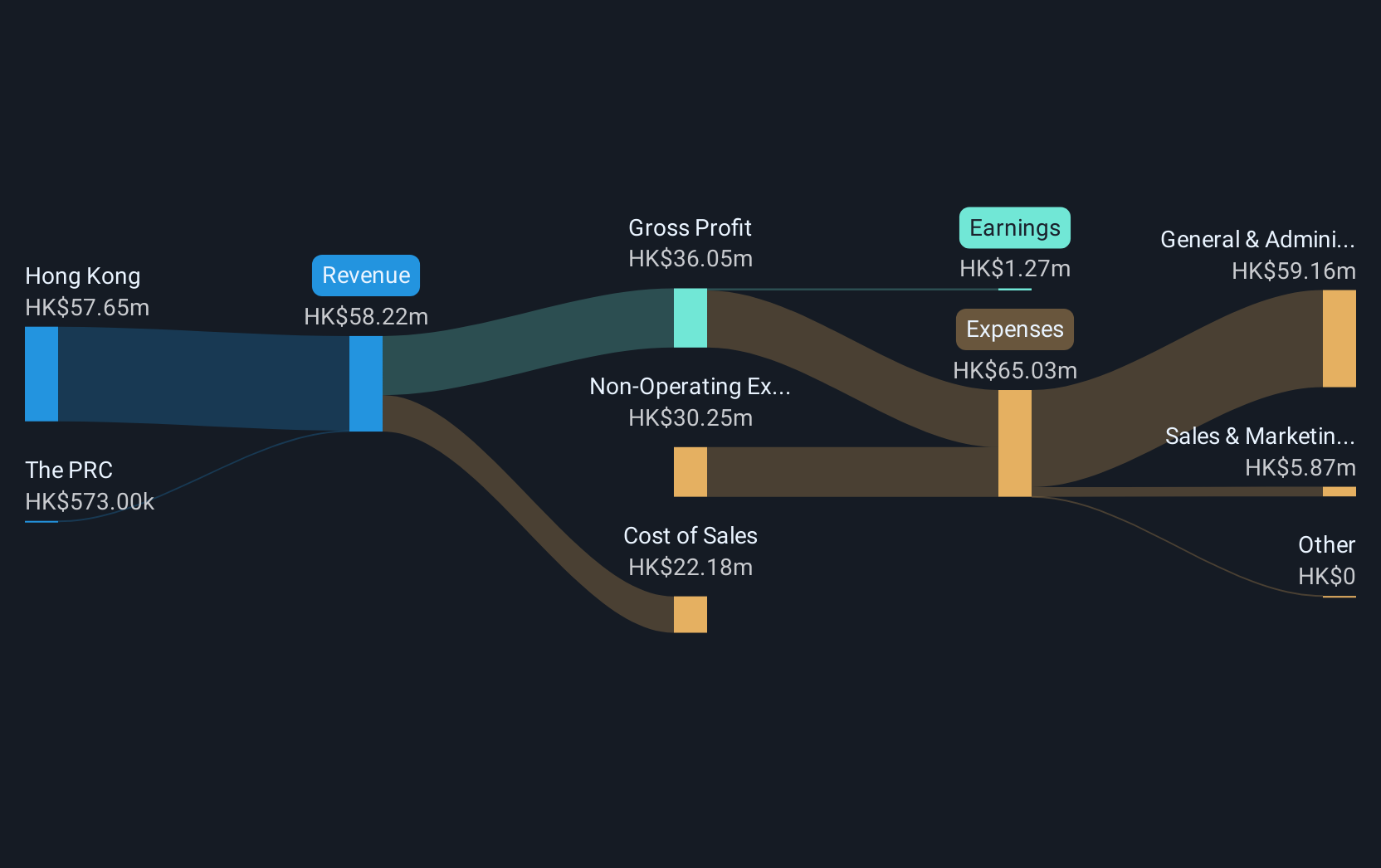

Operations: The company generates revenue from two primary segments: Medical Services, which contributed HK$5.26 million, and Aesthetic Medical and Beauty Services, which brought in HK$85.35 million.

Market Cap: HK$135.39M

China Regenerative Medicine International Limited, with a market cap of HK$135.39 million, has shown financial improvement, reporting sales of HK$90.62 million and a net income of HK$17.75 million for 2024 after overcoming past losses. The company's debt to equity ratio has significantly reduced over five years, indicating better financial management, although its operating cash flow still inadequately covers debt obligations at 12.4%. Despite this, the firm maintains more cash than total debt and high-quality earnings have contributed to its profitability turnaround. Additionally, experienced leadership supports strategic growth in its medical services and aesthetic segments.

- Unlock comprehensive insights into our analysis of China Regenerative Medicine International stock in this financial health report.

- Assess China Regenerative Medicine International's previous results with our detailed historical performance reports.

Make It Happen

- Reveal the 1,187 hidden gems among our Asian Penny Stocks screener with a single click here.

- Curious About Other Options? We've found 22 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com