China CBM Group Company Limited (HKG:8270) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

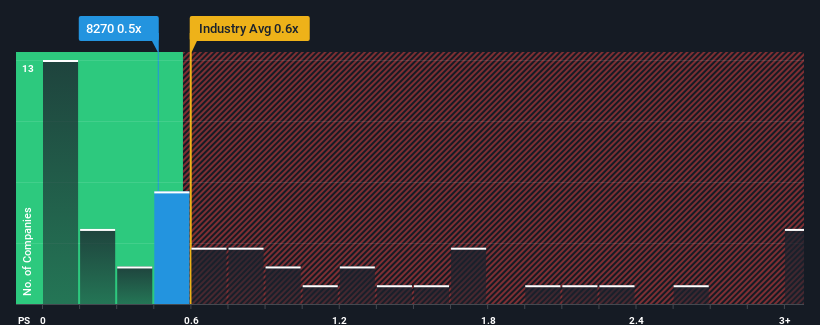

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about China CBM Group's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Oil and Gas industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for China CBM Group

How Has China CBM Group Performed Recently?

It looks like revenue growth has deserted China CBM Group recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on China CBM Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China CBM Group will help you shine a light on its historical performance.How Is China CBM Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like China CBM Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 13% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

In contrast to the company, the rest of the industry is expected to decline by 0.9% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that China CBM Group's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

With its share price dropping off a cliff, the P/S for China CBM Group looks to be in line with the rest of the Oil and Gas industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As mentioned previously, China CBM Group currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for China CBM Group (of which 1 shouldn't be ignored!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.