Hong Kong Technology Venture Company Limited (HKG:1137) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 3.7% isn't as impressive.

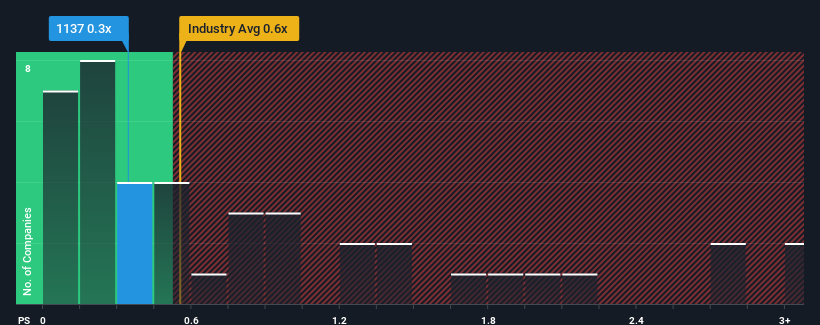

In spite of the firm bounce in price, there still wouldn't be many who think Hong Kong Technology Venture's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Consumer Retailing industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Hong Kong Technology Venture

How Hong Kong Technology Venture Has Been Performing

It looks like revenue growth has deserted Hong Kong Technology Venture recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hong Kong Technology Venture will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hong Kong Technology Venture's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 23% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 9.8% shows it's noticeably less attractive.

In light of this, it's curious that Hong Kong Technology Venture's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Hong Kong Technology Venture's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hong Kong Technology Venture's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hong Kong Technology Venture with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.