Haitian International Holdings Limited (HKG:1882) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

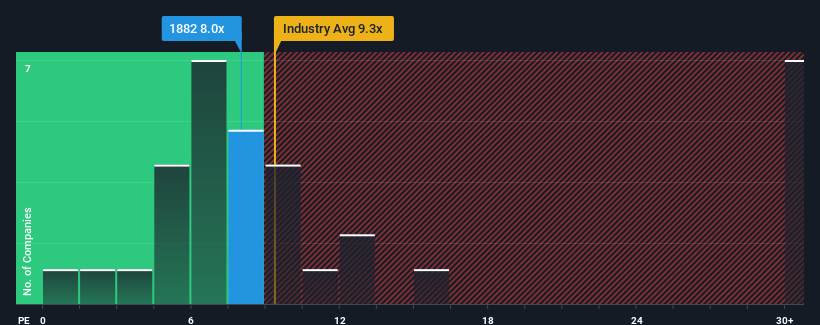

Even after such a large drop in price, Haitian International Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8x, since almost half of all companies in Hong Kong have P/E ratios greater than 11x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Haitian International Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Haitian International Holdings

Does Growth Match The Low P/E?

Haitian International Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 24% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 8.3% per annum during the coming three years according to the eleven analysts following the company. That's shaping up to be materially lower than the 14% per year growth forecast for the broader market.

In light of this, it's understandable that Haitian International Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Haitian International Holdings' P/E

The softening of Haitian International Holdings' shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Haitian International Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Haitian International Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.