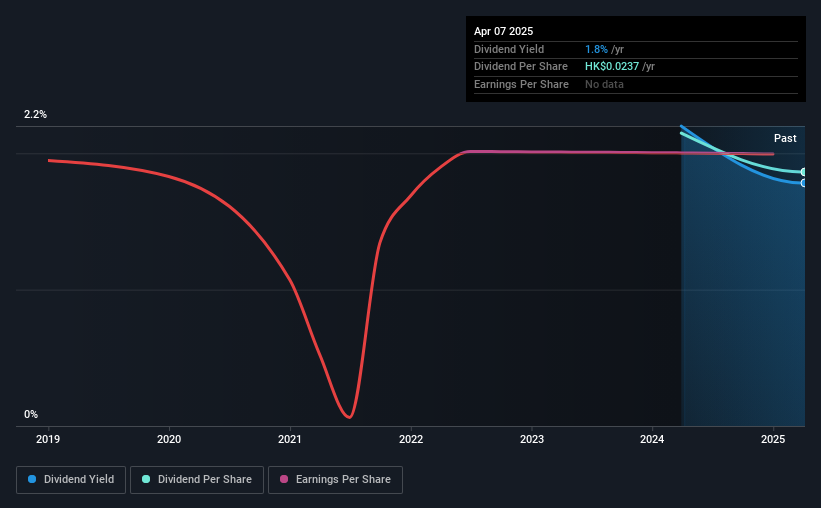

Kindstar Globalgene Technology, Inc. (HKG:9960) is reducing its dividend from last year's comparable payment to CN¥0.0238 on the 27th of August. This payment takes the dividend yield to 1.8%, which only provides a modest boost to overall returns.

Kindstar Globalgene Technology Might Find It Hard To Continue The Dividend

Even a low dividend yield can be attractive if it is sustained for years on end. Kindstar Globalgene Technology is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Over the next year, EPS could expand by 76.2% if recent trends continue. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

Check out our latest analysis for Kindstar Globalgene Technology

Kindstar Globalgene Technology Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Kindstar Globalgene Technology has seen EPS rising for the last five years, at 76% per annum. Even though the company is not profitable, it is growing at a solid clip. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

Our Thoughts On Kindstar Globalgene Technology's Dividend

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Kindstar Globalgene Technology stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.