Shenzhen Pagoda Industrial (Group) Corporation Limited (HKG:2411) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

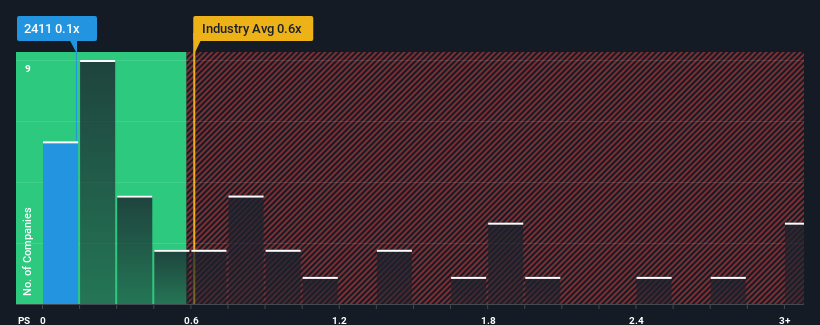

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Shenzhen Pagoda Industrial (Group)'s P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in Hong Kong is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shenzhen Pagoda Industrial (Group)

How Has Shenzhen Pagoda Industrial (Group) Performed Recently?

While the industry has experienced revenue growth lately, Shenzhen Pagoda Industrial (Group)'s revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Pagoda Industrial (Group) will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shenzhen Pagoda Industrial (Group)?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Pagoda Industrial (Group)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.8% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 2.5% during the coming year according to the dual analysts following the company. That's shaping up to be materially lower than the 9.9% growth forecast for the broader industry.

In light of this, it's curious that Shenzhen Pagoda Industrial (Group)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Shenzhen Pagoda Industrial (Group)'s P/S

Shenzhen Pagoda Industrial (Group)'s plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Shenzhen Pagoda Industrial (Group)'s revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Shenzhen Pagoda Industrial (Group) that you should be aware of.

If you're unsure about the strength of Shenzhen Pagoda Industrial (Group)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.