As global markets grapple with economic uncertainty and inflation concerns, Asian stocks have been navigating a complex landscape shaped by trade tensions and evolving consumer sentiment. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to balance risk and reward.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 4.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.94% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.29% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.92% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.23% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.78% | ★★★★★★ |

Click here to see the full list of 1173 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

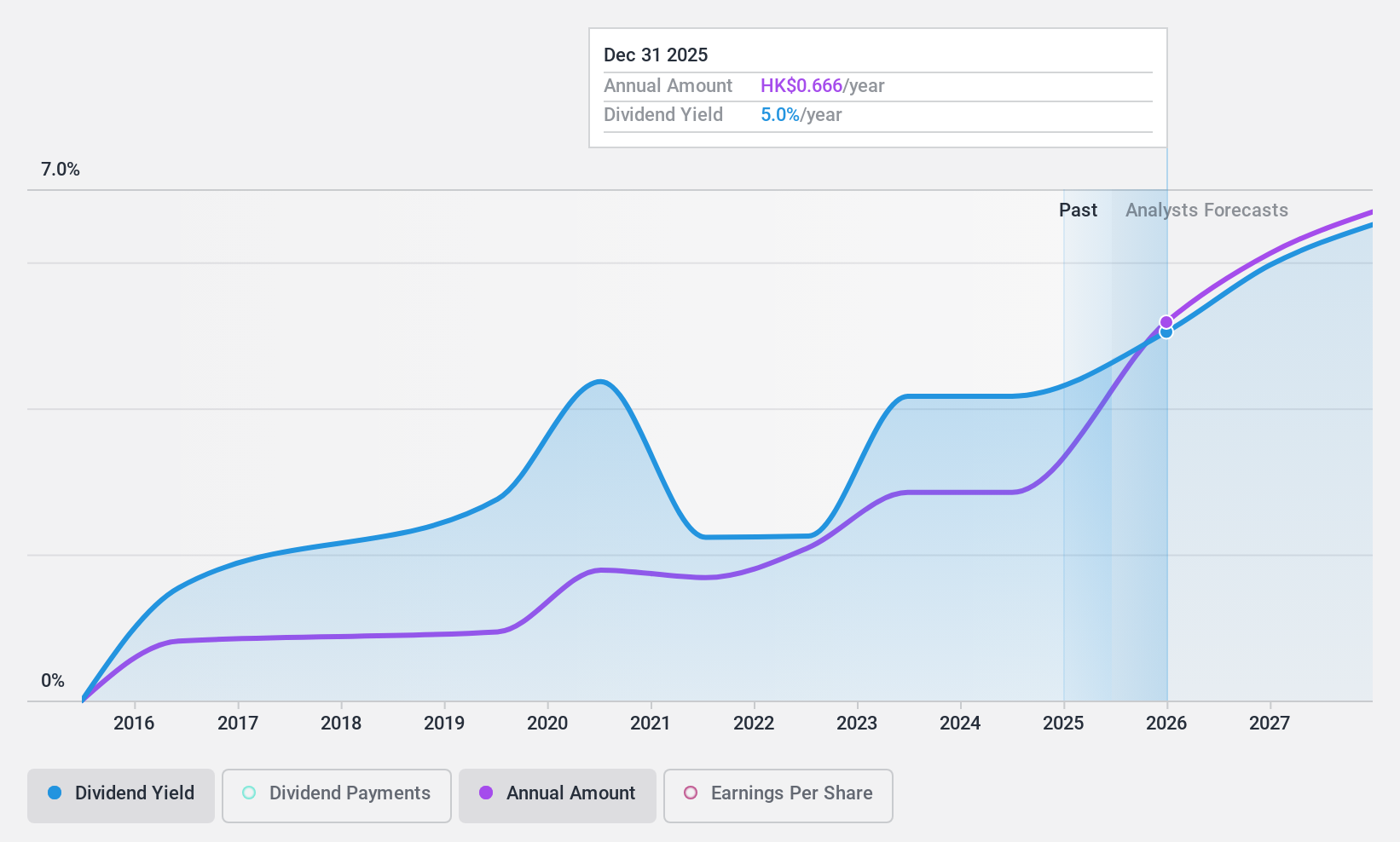

Dongfang Electric (SEHK:1072)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongfang Electric Corporation Limited designs, develops, manufactures, and sells power generation equipment both in China and internationally, with a market cap of HK$49.98 billion.

Operations: Dongfang Electric Corporation Limited's revenue is derived from several segments, including Clean and Efficient Energy Equipment (CN¥2.84 billion), Renewable Energy Equipment (CN¥1.66 billion), Emerging Growth Industry (CN¥1.12 billion), Engineering and Trade (CN¥601.91 million), and Modern Manufacturing Service Industry (CN¥756.44 million).

Dividend Yield: 4.4%

Dongfang Electric's dividend history is marked by volatility, with past payments experiencing significant fluctuations. Despite this, the company's dividends are well-covered by earnings and cash flows, with payout ratios of 46.7% and 31.3%, respectively. Recent financial results show increased sales and revenue but a decline in net income to CNY 2.92 billion for 2024, impacting dividend sustainability. The proposed final dividend is RMB 4.38 per ten shares, reflecting a decrease from previous distributions amidst leadership changes in the boardroom.

- Delve into the full analysis dividend report here for a deeper understanding of Dongfang Electric.

- Our valuation report unveils the possibility Dongfang Electric's shares may be trading at a discount.

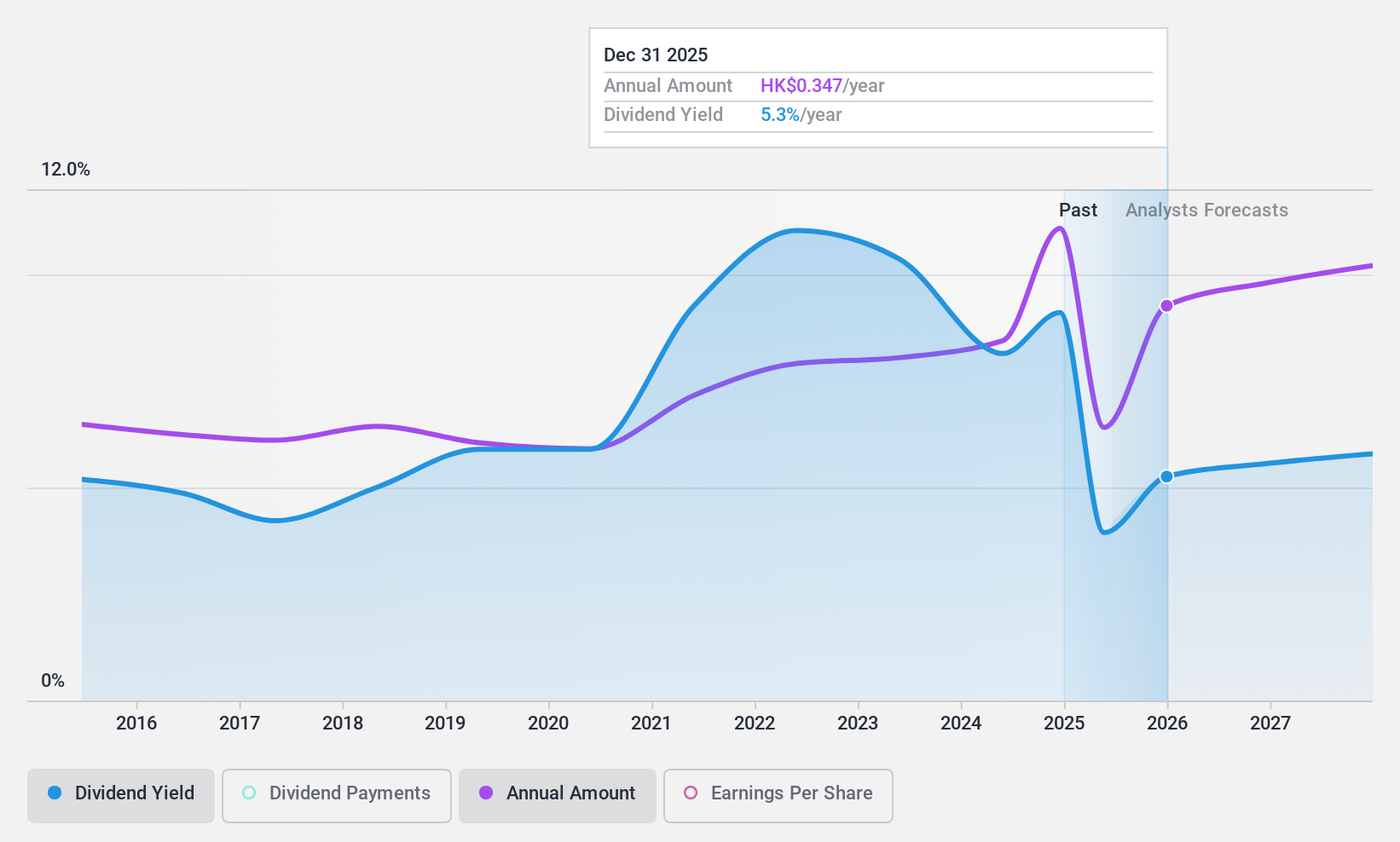

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chongqing Rural Commercial Bank Co., Ltd., along with its subsidiaries, offers banking services in the People’s Republic of China and has a market capitalization of HK$72.10 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates revenue from three main segments: Personal Banking (CN¥10.14 billion), Corporate Banking (CN¥4.93 billion), and Financial Market Operations (CN¥7.14 billion).

Dividend Yield: 4.3%

Chongqing Rural Commercial Bank's dividend track record is unstable, with past payments showing volatility. Despite this, current dividends are well-covered by earnings at a 30.7% payout ratio, and future coverage is forecasted to remain strong. Recent financial results indicate net income growth to CNY 11.51 billion for 2024, although net interest income declined slightly. The proposed final cash dividend of RMB 1.102 per ten shares reflects a decrease amidst recent executive changes in the boardroom.

- Unlock comprehensive insights into our analysis of Chongqing Rural Commercial Bank stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chongqing Rural Commercial Bank shares in the market.

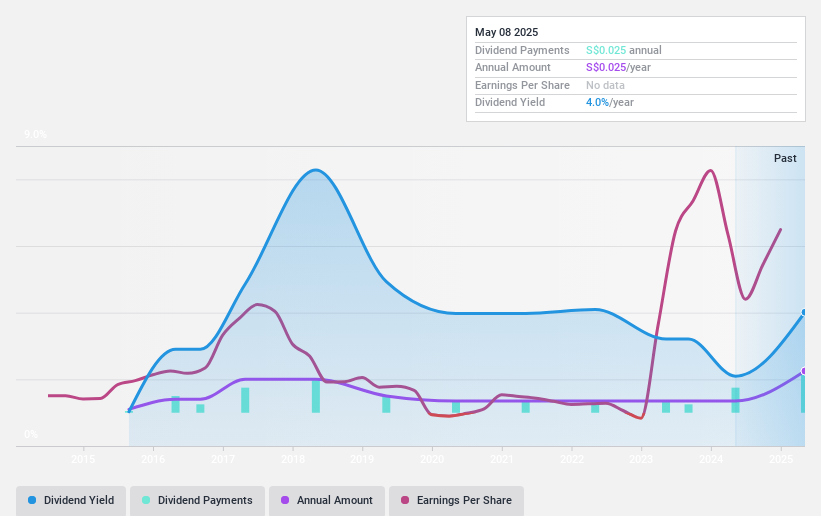

OKP Holdings (SGX:5CF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OKP Holdings Limited is a transport infrastructure and civil engineering company operating in Singapore and Australia, with a market cap of SGD208.73 million.

Operations: The company's revenue segments include construction at SGD91.89 million and maintenance at SGD28.32 million.

Dividend Yield: 3.7%

OKP Holdings' dividend payments have been volatile over the past decade, yet are well-covered by earnings with a 9.1% payout ratio and cash flows at 14.1%. Despite a recent decline in net income to S$33.7 million for 2024, the company proposed a special final dividend of S$0.015 per share alongside an annual dividend of S$0.01 per share, payable on May 27, 2025, subject to shareholder approval.

- Take a closer look at OKP Holdings' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that OKP Holdings is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Investigate our full lineup of 1173 Top Asian Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com