Amidst global economic uncertainties and inflation concerns, Asian markets have mirrored the cautious sentiment seen in other regions, with investors keeping a close watch on trade policies and consumer confidence. Despite these challenges, there remains an enduring appeal in exploring penny stocks—an area that continues to capture interest for its potential to uncover hidden value. While the term 'penny stocks' might seem outdated, these smaller or newer companies can offer a blend of affordability and growth potential when they are supported by robust financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.37 | THB1.9B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.76 | THB1.75B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.375 | SGD151.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.35 | SGD9.28B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.27 | HK$1.34B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.10 | HK$46.96B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.42 | HK$2.37B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.17 | CN¥3.67B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,112 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Modern Innovative Digital Technology (SEHK:2322)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Modern Innovative Digital Technology Company Limited operates in the trading, money lending and factoring, and finance leasing and financial services sectors within the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$2.23 billion.

Operations: The company's revenue is primarily derived from trading (HK$60.02 million), money lending and factoring (HK$16.18 million), finance leasing (HK$10.57 million), and financial services (HK$5.82 million).

Market Cap: HK$2.23B

Modern Innovative Digital Technology Company Limited, with a market capitalization of HK$2.23 billion, operates in trading and financial services sectors across China and Hong Kong. Despite its unprofitability and declining earnings over the past five years, the company maintains a solid balance sheet with short-term assets significantly exceeding liabilities. Recent management changes include the appointment of Mr. Lau Hoi Kit as an executive director following Mr. Chan Chi Yuen's resignation as CEO to focus on other engagements. The company's shares are set to be delisted from OTC Equity due to inactivity, reflecting potential challenges in maintaining investor interest amidst strategic transitions.

- Unlock comprehensive insights into our analysis of Modern Innovative Digital Technology stock in this financial health report.

- Evaluate Modern Innovative Digital Technology's historical performance by accessing our past performance report.

Modern Dental Group (SEHK:3600)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Dental Group Limited is an investment holding company involved in the production, distribution, and trading of dental prosthetic devices across Europe, Greater China, North America, Australia, and other international markets with a market cap of HK$3.87 billion.

Operations: The company's revenue is primarily derived from Fixed Prosthetic Devices at HK$2.05 billion and Removable Prosthetic Devices at HK$799.01 million.

Market Cap: HK$3.87B

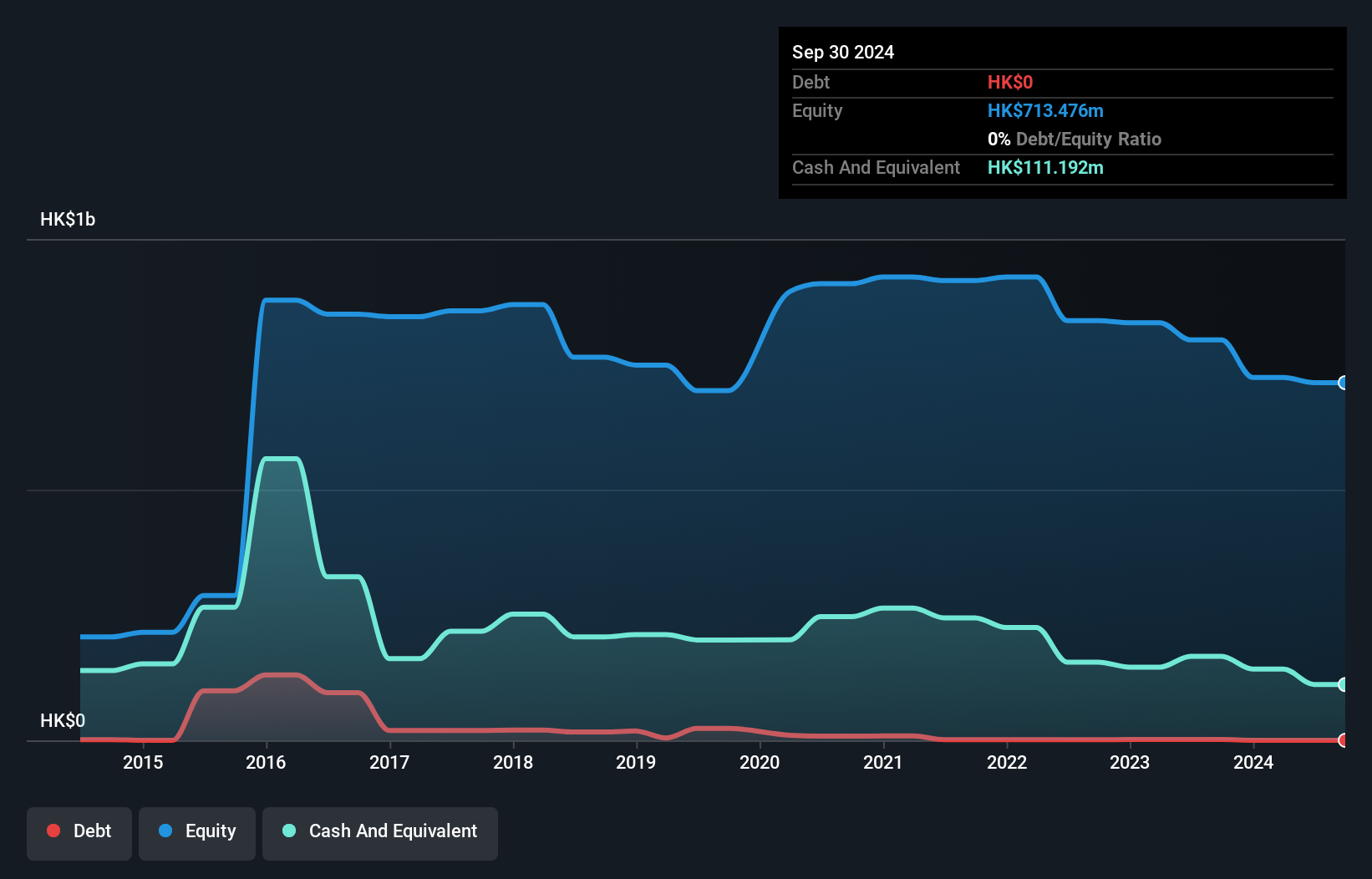

Modern Dental Group, with a market cap of HK$3.87 billion, demonstrates financial stability in the penny stock arena through strong asset coverage over liabilities and reduced debt levels. The company reported increased sales of HK$3.36 billion for 2024, reflecting steady revenue growth from its prosthetic devices segment. Despite a modest net income increase to HK$408 million and stable earnings per share, the company's dividend track record remains unstable. Management's extensive experience supports operational consistency, while cash flow adequately covers debt obligations. However, earnings growth has slowed recently compared to its historical performance and industry benchmarks.

- Take a closer look at Modern Dental Group's potential here in our financial health report.

- Assess Modern Dental Group's future earnings estimates with our detailed growth reports.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited is a transport infrastructure and civil engineering company operating in Singapore and Australia, with a market capitalization of SGD193.39 million.

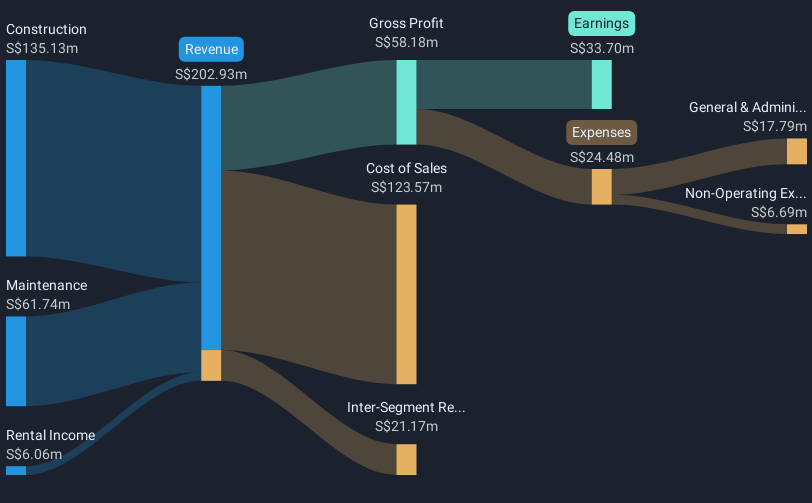

Operations: The company does not report specific revenue segments.

Market Cap: SGD193.39M

OKP Holdings, with a market cap of SGD193.39 million, exhibits financial resilience despite recent challenges in earnings growth. The company's revenue rose to SGD181.75 million for 2024, though net income declined to SGD33.7 million due to narrower profit margins compared to the previous year. Its strong cash position surpasses total debt, ensuring robust coverage of interest payments and operating cash flow obligations. The board and management team bring extensive experience, contributing to strategic stability amid volatile share prices. While trading significantly below estimated fair value, OKP's debt-to-equity ratio has improved over five years, enhancing its financial health profile in the penny stock sector.

- Click to explore a detailed breakdown of our findings in OKP Holdings' financial health report.

- Explore historical data to track OKP Holdings' performance over time in our past results report.

Turning Ideas Into Actions

- Reveal the 1,112 hidden gems among our Asian Penny Stocks screener with a single click here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com