For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. For example, Zhi Sheng Group Holdings Limited (HKG:8370) has generated a beautiful 854% return in just a single year. It's also good to see the share price up 59% over the last quarter. Looking back further, the stock price is 106% higher than it was three years ago. It really delights us to see such great share price performance for investors.

Since the stock has added HK$126m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Zhi Sheng Group Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Zhi Sheng Group Holdings saw its revenue shrink by 13%. So it's very confusing to see that the share price gained a whopping 854%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

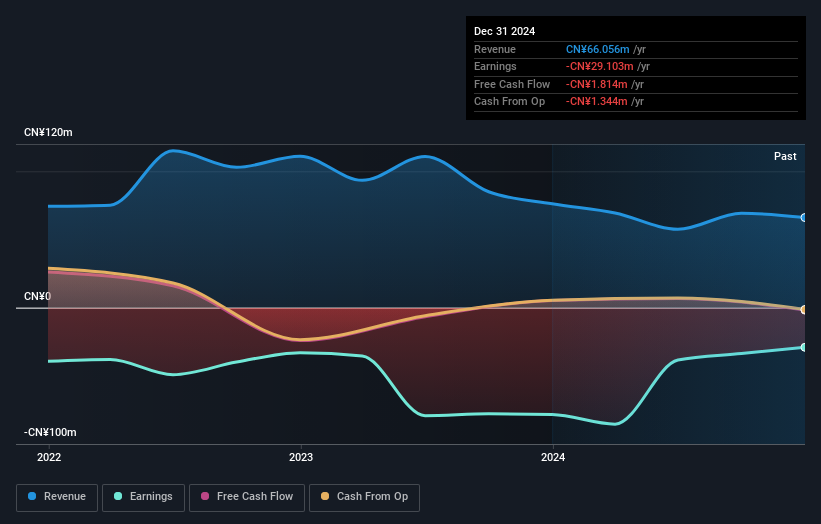

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Zhi Sheng Group Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Zhi Sheng Group Holdings has rewarded shareholders with a total shareholder return of 854% in the last twelve months. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Zhi Sheng Group Holdings better, we need to consider many other factors. Even so, be aware that Zhi Sheng Group Holdings is showing 3 warning signs in our investment analysis , and 2 of those make us uncomfortable...

Zhi Sheng Group Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.