Impro Precision Industries Limited (HKG:1286) shares have continued their recent momentum with a 33% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 27%.

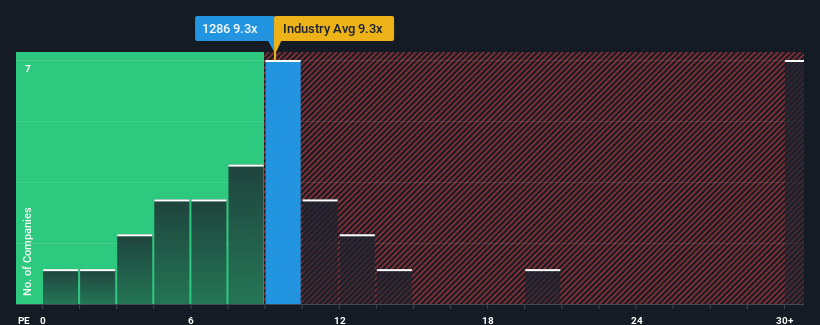

Although its price has surged higher, you could still be forgiven for feeling indifferent about Impro Precision Industries' P/E ratio of 9.3x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

The earnings growth achieved at Impro Precision Industries over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Impro Precision Industries

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Impro Precision Industries' is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. Pleasingly, EPS has also lifted 68% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 18% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Impro Precision Industries' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Impro Precision Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Impro Precision Industries maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - Impro Precision Industries has 2 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, you might also be able to find a better stock than Impro Precision Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.