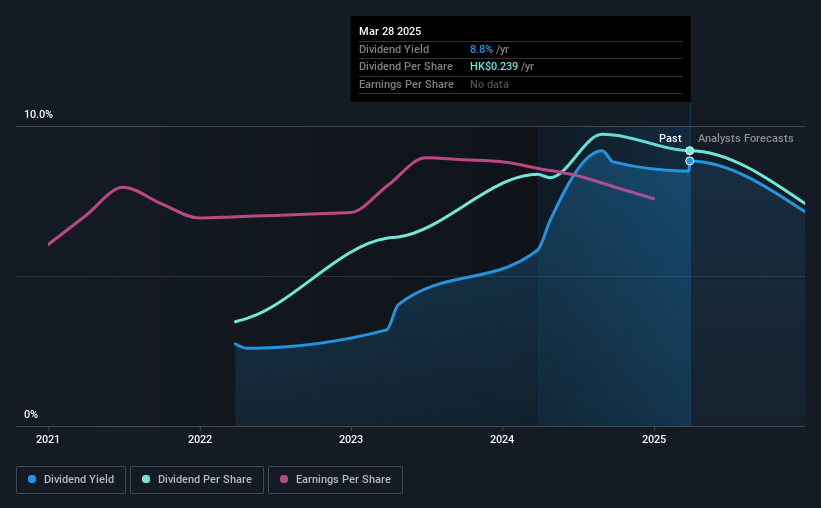

Chaoju Eye Care Holdings Limited (HKG:2219) has announced that on 27th of June, it will be paying a dividend ofCN¥0.1193, which a reduction from last year's comparable dividend. The yield is still above the industry average at 8.8%.

Chaoju Eye Care Holdings' Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last payment made up 83% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS is forecast to expand by 26.2%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 70% which would be quite comfortable going to take the dividend forward.

Check out our latest analysis for Chaoju Eye Care Holdings

Chaoju Eye Care Holdings Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2022, the dividend has gone from CN¥0.0844 total annually to CN¥0.223. This means that it has been growing its distributions at 38% per annum over that time. Chaoju Eye Care Holdings has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Chaoju Eye Care Holdings has only grown its earnings per share at 2.9% per annum over the past three years. Slow growth and a high payout ratio could mean that Chaoju Eye Care Holdings has maxed out the amount that it has been able to pay to shareholders. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 3 Chaoju Eye Care Holdings analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Is Chaoju Eye Care Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.