Mao Geping Cosmetics Co., Ltd. (HKG:1318) shares have continued their recent momentum with a 41% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

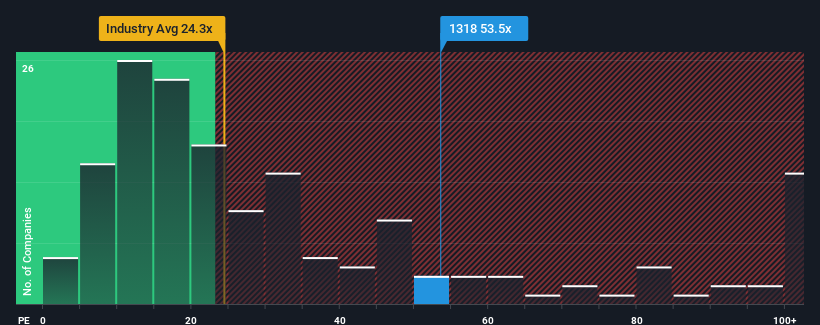

Following the firm bounce in price, Mao Geping Cosmetics may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 53.5x, since almost half of all companies in Hong Kong have P/E ratios under 10x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Mao Geping Cosmetics could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Mao Geping Cosmetics

Does Growth Match The High P/E?

In order to justify its P/E ratio, Mao Geping Cosmetics would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 8.5% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 21% per annum over the next three years. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Mao Geping Cosmetics' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Mao Geping Cosmetics have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Mao Geping Cosmetics maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Mao Geping Cosmetics with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.