The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like COSCO SHIPPING International (Hong Kong) (HKG:517). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is COSCO SHIPPING International (Hong Kong) Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that COSCO SHIPPING International (Hong Kong) has grown EPS by 37% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

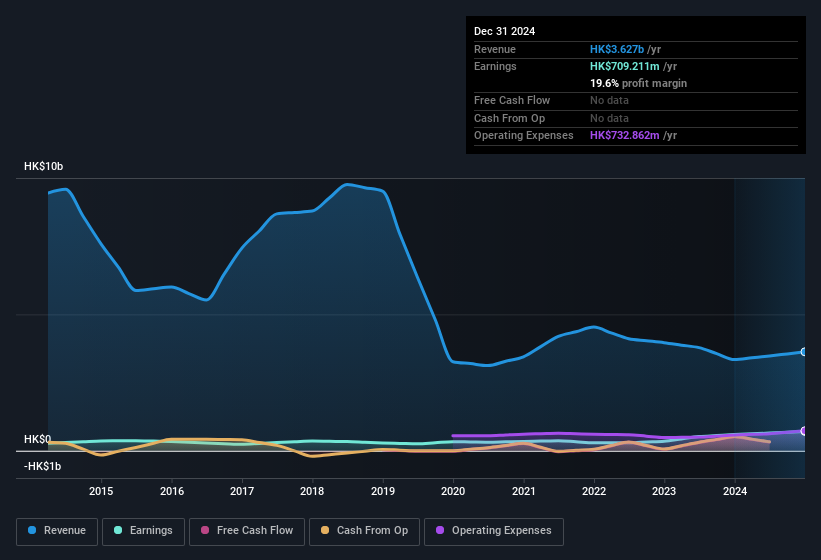

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note COSCO SHIPPING International (Hong Kong) achieved similar EBIT margins to last year, revenue grew by a solid 8.5% to HK$3.6b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

See our latest analysis for COSCO SHIPPING International (Hong Kong)

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are COSCO SHIPPING International (Hong Kong) Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between HK$3.1b and HK$12b, like COSCO SHIPPING International (Hong Kong), the median CEO pay is around HK$3.6m.

COSCO SHIPPING International (Hong Kong)'s CEO took home a total compensation package of HK$1.6m in the year prior to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is COSCO SHIPPING International (Hong Kong) Worth Keeping An Eye On?

COSCO SHIPPING International (Hong Kong)'s earnings per share growth have been climbing higher at an appreciable rate. Such fast EPS growth prompts the question: has the business reached an inflection point? What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. It will definitely require further research to be sure, but it does seem that COSCO SHIPPING International (Hong Kong) has the hallmarks of a quality business; and that would make it well worth watching. You still need to take note of risks, for example - COSCO SHIPPING International (Hong Kong) has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Hong Kong companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.