Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Red Star Macalline Group Corporation Ltd. (HKG:1528) share price is a whole 67% lower. That's an unpleasant experience for long term holders. The falls have accelerated recently, with the share price down 20% in the last three months.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

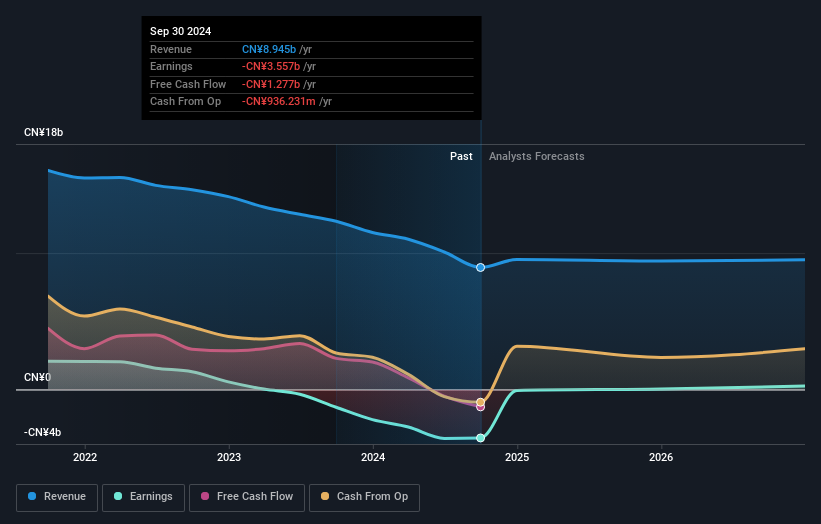

Given that Red Star Macalline Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Red Star Macalline Group reduced its trailing twelve month revenue by 8.2% for each year. While far from catastrophic that is not good. The share price decline of 11% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Red Star Macalline Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Red Star Macalline Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Red Star Macalline Group shareholders, and that cash payout explains why its total shareholder loss of 63%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Red Star Macalline Group had a tough year, with a total loss of 12%, against a market gain of about 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Red Star Macalline Group better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Red Star Macalline Group you should be aware of.

But note: Red Star Macalline Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.