It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Travel Expert (Asia) Enterprises (HKG:1235). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Travel Expert (Asia) Enterprises

Travel Expert (Asia) Enterprises' Improving Profits

Over the last three years, Travel Expert (Asia) Enterprises has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Travel Expert (Asia) Enterprises' EPS shot from HK$0.0072 to HK$0.02, over the last year. Year on year growth of 173% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

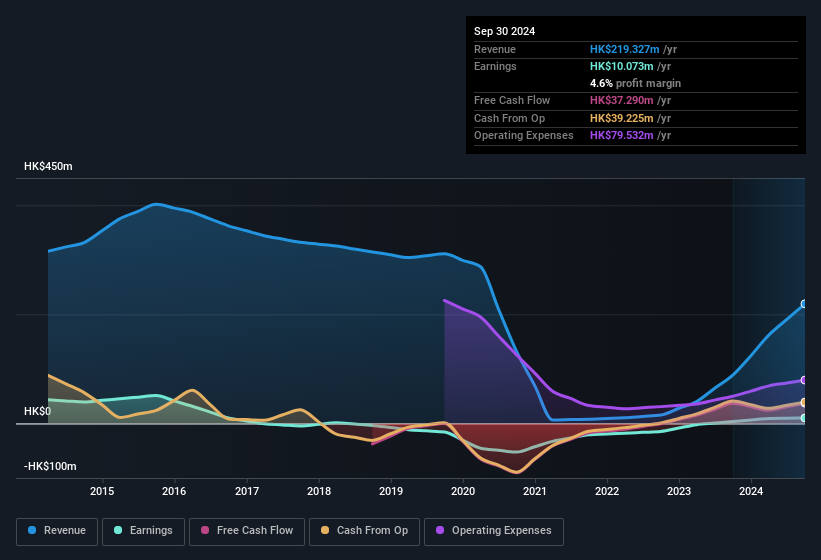

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Travel Expert (Asia) Enterprises shareholders can take confidence from the fact that EBIT margins are up from -2.9% to 1.3%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Travel Expert (Asia) Enterprises is no giant, with a market capitalisation of HK$83m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Travel Expert (Asia) Enterprises Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations under HK$1.6b, like Travel Expert (Asia) Enterprises, the median CEO pay is around HK$1.8m.

Travel Expert (Asia) Enterprises' CEO took home a total compensation package of HK$550k in the year prior to March 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Travel Expert (Asia) Enterprises Worth Keeping An Eye On?

Travel Expert (Asia) Enterprises' earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So Travel Expert (Asia) Enterprises looks like it could be a good quality growth stock, at first glance. That's worth watching. Before you take the next step you should know about the 4 warning signs for Travel Expert (Asia) Enterprises that we have uncovered.

Although Travel Expert (Asia) Enterprises certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.