As global markets face challenges from U.S. trade policies and economic uncertainties, Asia's stock markets present intriguing opportunities, particularly with the recent modest gains in Japan and stimulus-driven optimism in China. In this environment, identifying promising stocks involves focusing on companies that can navigate economic fluctuations and leverage regional growth initiatives effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lumax International | NA | 4.43% | 5.77% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| BBK Test Systems | NA | 8.57% | 12.90% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Maezawa Kasei Industries | 0.80% | 2.65% | 19.59% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Eclatorq Technology | 20.08% | 26.60% | 31.78% | ★★★★★☆ |

| Yukiguni Maitake | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.04 billion.

Operations: YC Corporation generates revenue primarily from the sale of inspection equipment for semiconductor memories. The company's market capitalization stands at ₩1.04 billion.

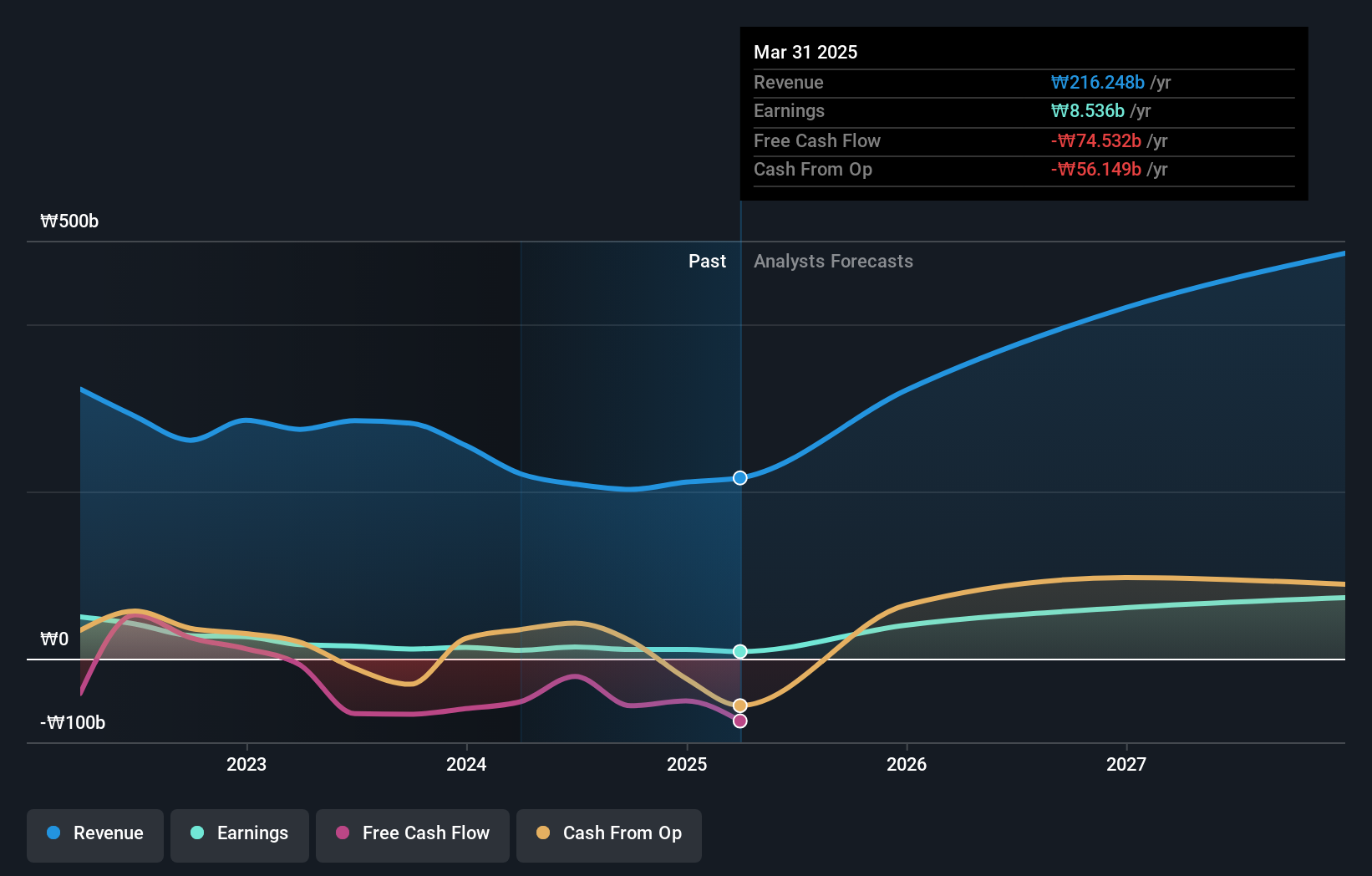

YC, a small-cap player in the semiconductor industry, presents an intriguing mix of strengths and challenges. Despite negative earnings growth of 4.2% last year, its debt-to-equity ratio has impressively decreased from 46.3% to 20.6% over five years, indicating prudent financial management. The company earns more interest than it pays out, ensuring that interest coverage is not a worry for investors. However, the highly volatile share price over the past three months and lack of free cash flow positivity suggest caution is warranted despite its high-quality past earnings and forecasted annual growth rate of 55%.

- Click here and access our complete health analysis report to understand the dynamics of YC.

Explore historical data to track YC's performance over time in our Past section.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research, development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market capitalization of HK$2.91 billion.

Operations: The company's primary revenue stream is derived from wireless communications equipment, amounting to CN¥3.27 billion. The focus on this segment highlights its significant role in the overall financial structure of the business.

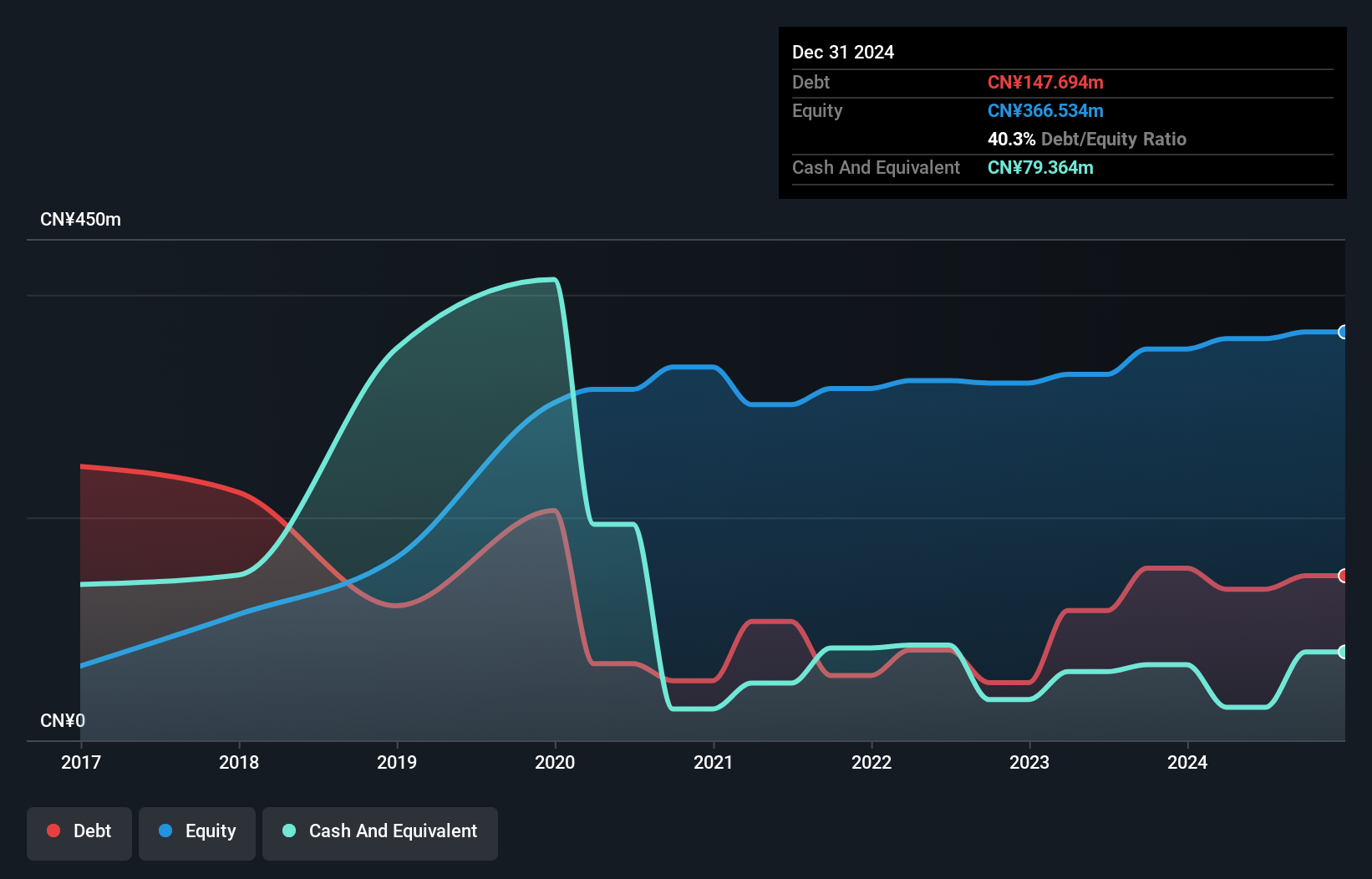

Sprocomm Intelligence, a tech player with a focus on innovation, has seen its earnings soar by 301% over the past year, outpacing the industry average of 48.9%. Despite this impressive growth, the company's net profit for 2024 is projected to fall between CN¥10M and CN¥18M due to a strategic move that reduced its gross profit margin from 10.6% in 2023 to approximately 8.8%. With debt levels more than halved over five years and a satisfactory net debt to equity ratio of 29.4%, Sprocomm's financial health appears robust despite challenges with interest coverage at only 1.8 times EBIT.

Nanhua Futures (SHSE:603093)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanhua Futures Co., Ltd. is a financial services company specializing in derivatives, with a market capitalization of approximately CN¥8.49 billion.

Operations: Nanhua Futures generates revenue primarily from its Risk Management Business at CN¥4.49 billion and Futures Brokerage Business at CN¥493.81 million, with additional contributions from Wealth Management and Overseas Financial Service segments. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

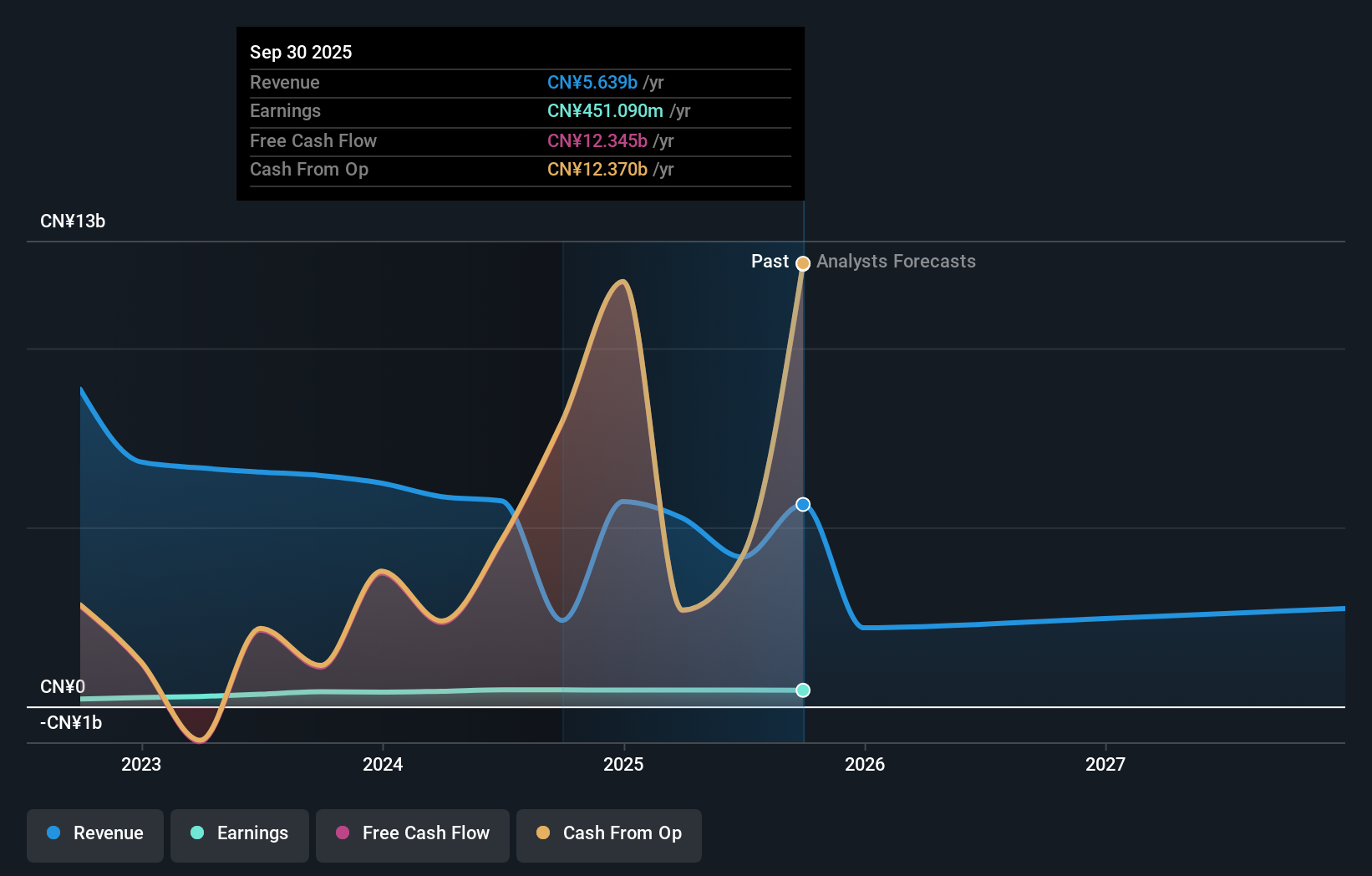

Nanhua Futures, a relatively small player in the financial sector, shows promising figures with a price-to-earnings ratio of 18.5x, notably below the broader Chinese market's 39.6x. The company reported earnings growth of 14% over the past year, outpacing the Capital Markets industry's 9.8%, and boasts high-quality earnings alongside positive free cash flow. Despite revenue dipping to CNY 5.71 billion from CNY 6.25 billion last year, net income rose to CNY 457.97 million from CNY 401.85 million previously, reflecting improved profitability and efficient debt management as its debt-to-equity ratio decreased to 38.7% over five years.

- Click to explore a detailed breakdown of our findings in Nanhua Futures' health report.

Gain insights into Nanhua Futures' past trends and performance with our Past report.

Make It Happen

- Dive into all 2619 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com