Top 3 Materials Stocks Which Could Rescue Your Portfolio This Month

Benzinga · 03/18 12:32

Share

Listen to the news

The most oversold stocks in the materials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

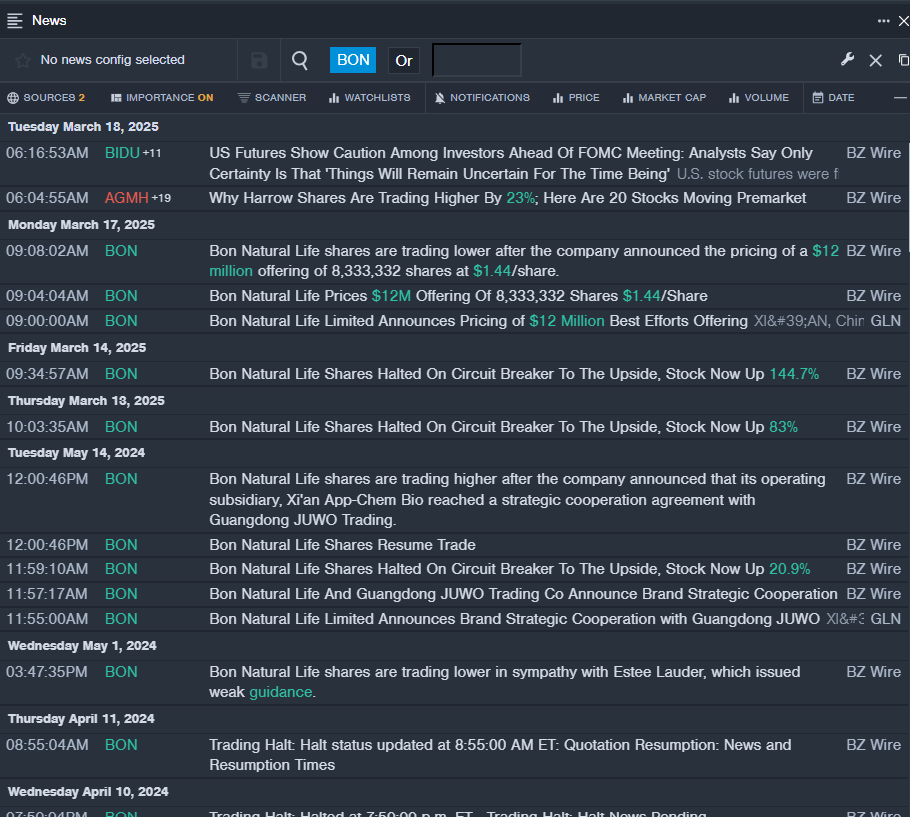

Bon Natural Life Ltd (NASDAQ:BON)

- On March 17, Bon Natural Life announced the pricing of a $12 million offering of 8,333,332 shares at $1.44/share. The company's stock fell around 53% over the past month and has a 52-week low of $0.55.

- RSI Value: 29.5

- BON Price Action: Shares of Bon Natural Life dipped 57.5% to close at $0.61 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest BON news.

ZK International Group Co Ltd (NASDAQ:ZKIN)

- On Feb. 24, ZK International Group resolved Nasdaq bid price deficiency and remained in compliance with Nasdaq. The company's stock fell around 27% over the past month and has a 52-week low of $1.24.

- RSI Value: 28

- ZKIN Price Action: Shares of ZK International Group closed at $1.30 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in ZKIN stock.

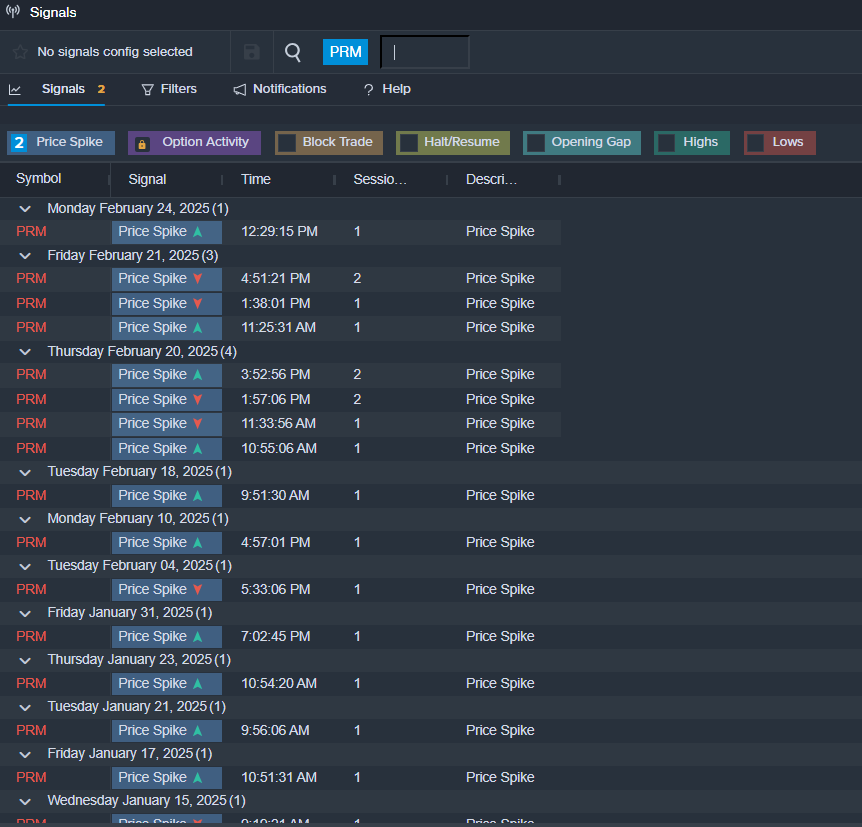

Perimeter Solutions Inc (NYSE:PRM)

- On Feb. 20, Perimeter Solutions posted upbeat quarterly results. The company's stock fell around 24% over the past month and has a 52-week low of $6.01.

- RSI Value: 29.8

- PRM Price Action: Shares of Perimeter Solutions fell 1.4% to close at $9.09 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in PRM shares.

Read This Next:

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved