Despite an already strong run, MS Group Holdings Limited (HKG:1451) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

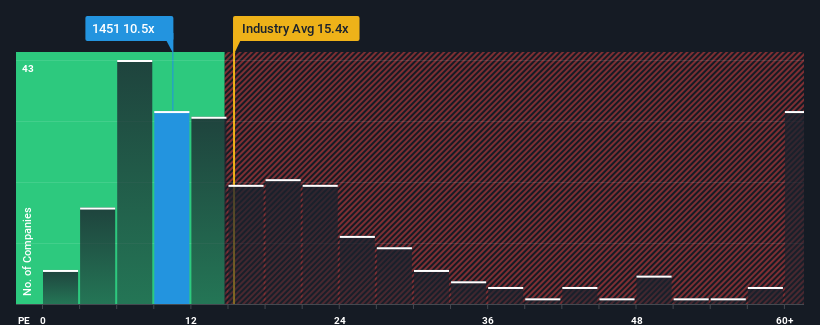

In spite of the firm bounce in price, there still wouldn't be many who think MS Group Holdings' price-to-earnings (or "P/E") ratio of 10.5x is worth a mention when the median P/E in Hong Kong is similar at about 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, MS Group Holdings has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for MS Group Holdings

Is There Some Growth For MS Group Holdings?

There's an inherent assumption that a company should be matching the market for P/E ratios like MS Group Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 164%. The latest three year period has also seen an excellent 72% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's about the same on an annualised basis.

With this information, we can see why MS Group Holdings is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On MS Group Holdings' P/E

Its shares have lifted substantially and now MS Group Holdings' P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that MS Group Holdings maintains its moderate P/E off the back of its recent three-year growth being in line with the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware MS Group Holdings is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

Of course, you might also be able to find a better stock than MS Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.