When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Ximei Resources Holding share price has climbed 76% in five years, easily topping the market return of 30% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 11%.

Since it's been a strong week for Ximei Resources Holding shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Ximei Resources Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Ximei Resources Holding actually saw its EPS drop 1.3% per year.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The revenue reduction of per year is not a positive. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

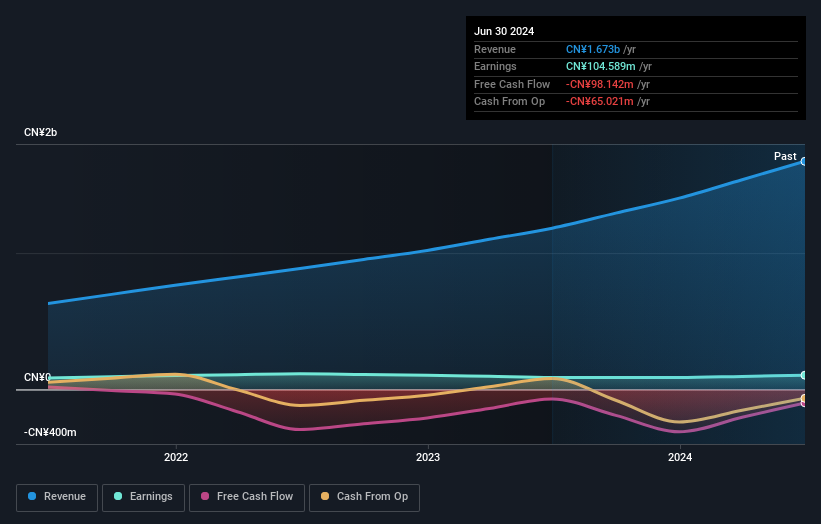

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Ximei Resources Holding's earnings, revenue and cash flow.

A Different Perspective

Ximei Resources Holding shareholders are up 11% for the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 12% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Is Ximei Resources Holding cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.