Goodbaby International Holdings Limited (HKG:1086) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 99%.

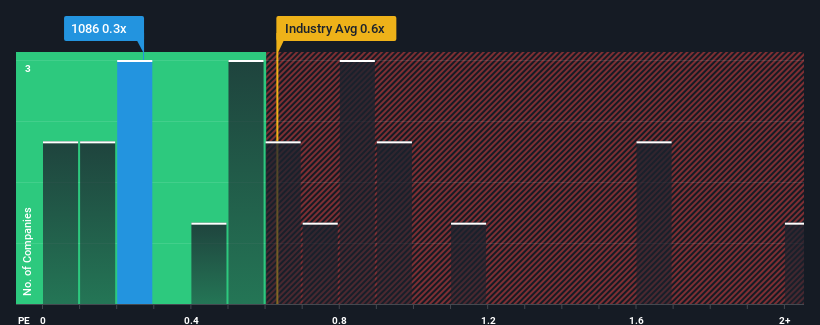

Although its price has surged higher, there still wouldn't be many who think Goodbaby International Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Leisure industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Goodbaby International Holdings

How Goodbaby International Holdings Has Been Performing

Goodbaby International Holdings' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Goodbaby International Holdings.How Is Goodbaby International Holdings' Revenue Growth Trending?

Goodbaby International Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.3%. However, this wasn't enough as the latest three year period has seen an unpleasant 11% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 9.0%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Goodbaby International Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Its shares have lifted substantially and now Goodbaby International Holdings' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Goodbaby International Holdings' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Goodbaby International Holdings has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.