Qingci Games Inc. (HKG:6633) shareholders have had their patience rewarded with a 29% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

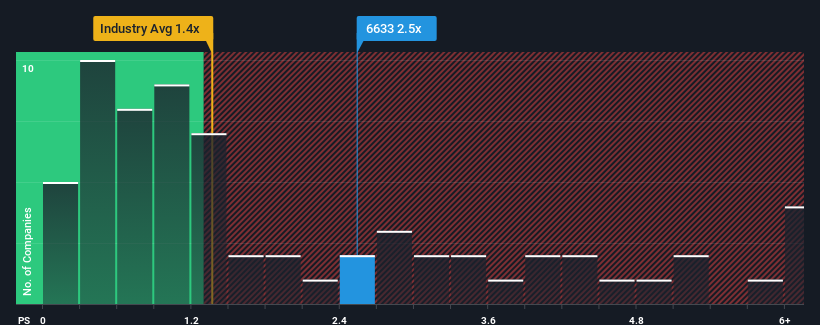

Following the firm bounce in price, you could be forgiven for thinking Qingci Games is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios below 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Qingci Games

How Qingci Games Has Been Performing

With revenue growth that's superior to most other companies of late, Qingci Games has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Qingci Games.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Qingci Games would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Still, revenue has fallen 52% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 9.0% during the coming year according to the one analyst following the company. That's not great when the rest of the industry is expected to grow by 9.6%.

With this in mind, we find it intriguing that Qingci Games' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Qingci Games' P/S?

The large bounce in Qingci Games' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

For a company with revenues that are set to decline in the context of a growing industry, Qingci Games' P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

It is also worth noting that we have found 1 warning sign for Qingci Games that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.