Paradise Entertainment Limited (HKG:1180) shareholders have had their patience rewarded with a 142% share price jump in the last month. The annual gain comes to 150% following the latest surge, making investors sit up and take notice.

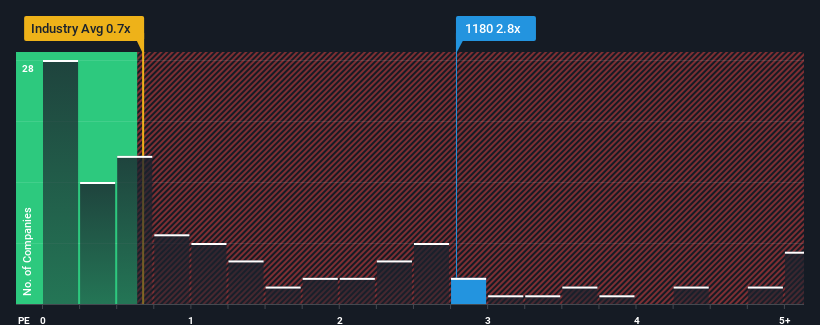

Following the firm bounce in price, given around half the companies in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Paradise Entertainment as a stock to avoid entirely with its 2.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Paradise Entertainment

How Paradise Entertainment Has Been Performing

Recent times have been advantageous for Paradise Entertainment as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Paradise Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Paradise Entertainment's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 124% gain to the company's top line. Pleasingly, revenue has also lifted 88% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is noticeably more attractive.

In light of this, it's alarming that Paradise Entertainment's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Paradise Entertainment's P/S?

The strong share price surge has lead to Paradise Entertainment's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Paradise Entertainment trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Paradise Entertainment is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Paradise Entertainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.