As global markets grapple with inflation concerns and policy uncertainties, Asian stocks present intriguing opportunities for investors seeking value amidst the volatility. In this environment, identifying undervalued stocks that are trading below their estimated worth can be a prudent strategy, offering potential upside as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Meorient Commerce Exhibition (SZSE:300795) | CN¥23.57 | CN¥46.81 | 49.7% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥178.08 | CN¥352.75 | 49.5% |

| Akatsuki (TSE:3932) | ¥3125.00 | ¥6229.64 | 49.8% |

| Bide Pharmatech (SHSE:688073) | CN¥53.95 | CN¥106.91 | 49.5% |

| Gushengtang Holdings (SEHK:2273) | HK$41.00 | HK$81.81 | 49.9% |

| BalnibarbiLtd (TSE:3418) | ¥1097.00 | ¥2132.81 | 48.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.32 | 49.4% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.55 | CN¥16.82 | 49.2% |

| Intellian Technologies (KOSDAQ:A189300) | ₩38950.00 | ₩76204.85 | 48.9% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16340.00 | ₩31731.60 | 48.5% |

Let's uncover some gems from our specialized screener.

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally, with a market cap of HK$5.85 billion.

Operations: The company generates revenue from its orthopedic implants segment, with CN¥989.17 million coming from China and CN¥159.06 million from the United Kingdom.

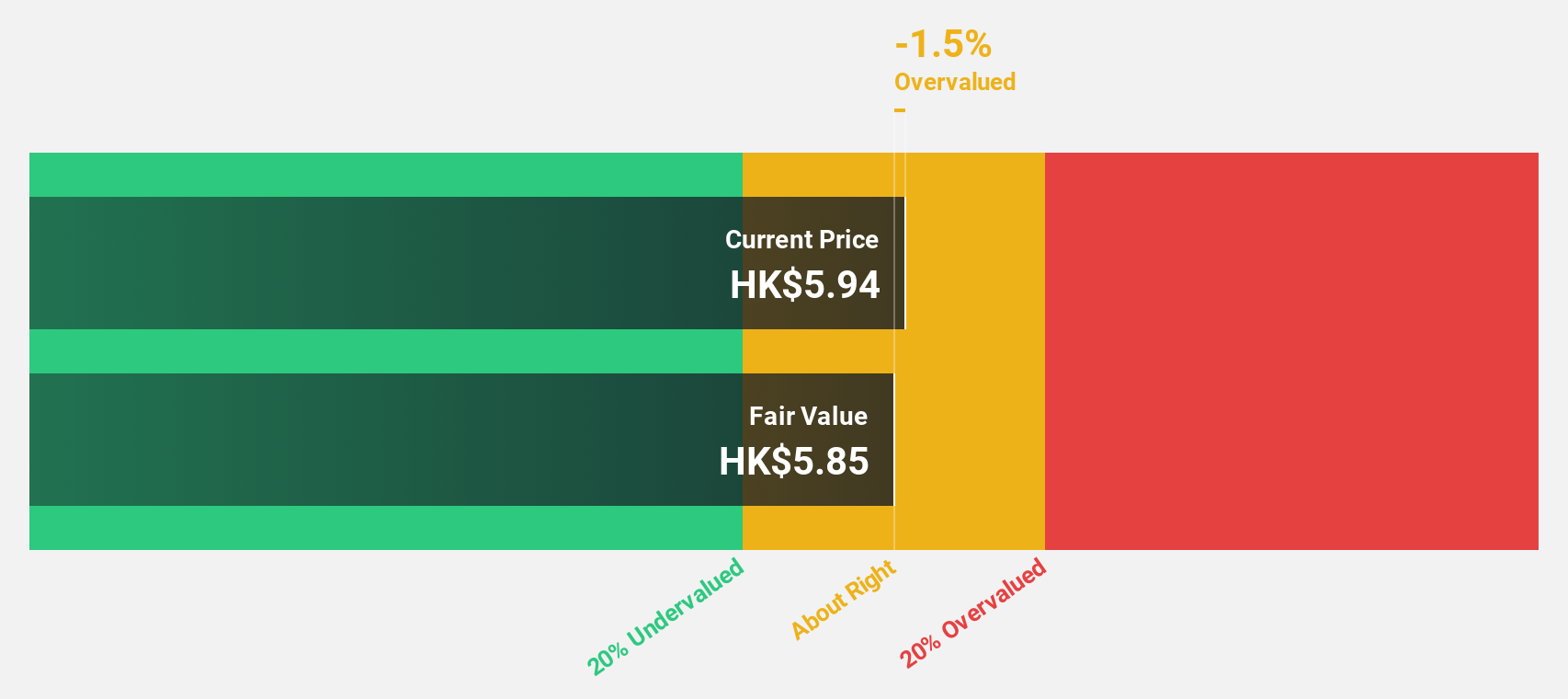

Estimated Discount To Fair Value: 35.3%

AK Medical Holdings is trading at a significant discount to its estimated fair value, with shares priced at HK$5.21 compared to a fair value estimate of HK$8.05. The company forecasts robust earnings growth of 29.5% annually, outpacing the Hong Kong market's average growth rate. Recent corporate guidance indicates over 50% net profit increase for 2024, driven by strong demand and effective cost control measures amidst stable operational expenses.

- According our earnings growth report, there's an indication that AK Medical Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of AK Medical Holdings stock in this financial health report.

Gushengtang Holdings (SEHK:2273)

Overview: Gushengtang Holdings Limited is an investment holding company that provides healthcare services in the People’s Republic of China, with a market cap of HK$9.81 billion.

Operations: Gushengtang Holdings Limited generates its revenue by offering healthcare services in China.

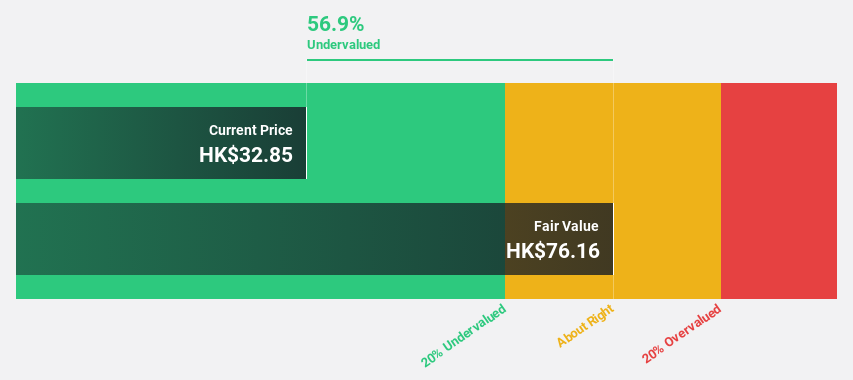

Estimated Discount To Fair Value: 49.9%

Gushengtang Holdings is trading at HK$41, significantly below its estimated fair value of HK$81.81, suggesting it may be undervalued based on cash flows. The company's earnings are projected to grow 31.7% annually, surpassing the Hong Kong market's average growth rate. Despite a lower forecasted return on equity of 16.9% in three years, Gushengtang's revenue is expected to increase by 24.5% per year, highlighting strong potential for future growth.

- Insights from our recent growth report point to a promising forecast for Gushengtang Holdings' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Gushengtang Holdings.

APT Electronics (SEHK:2551)

Overview: APT Electronics Co., Ltd. offers intelligent vision products and system solutions, with a market capitalization of approximately HK$2.49 billion.

Operations: The company's revenue primarily comes from its Electric Lighting & Other Fixtures segment, amounting to CN¥1.86 billion.

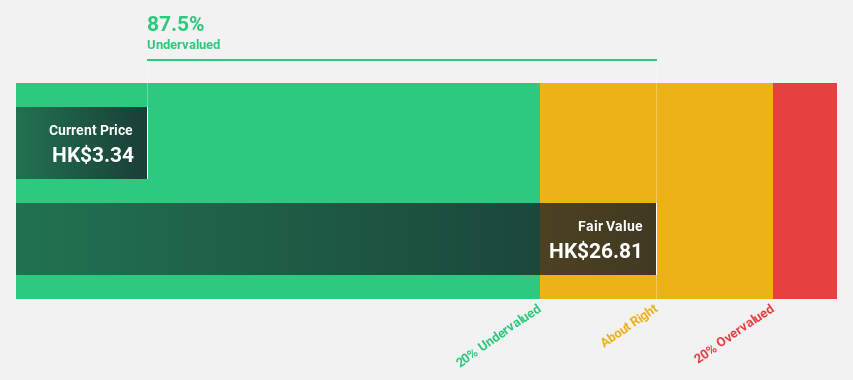

Estimated Discount To Fair Value: 25.3%

APT Electronics, trading at HK$4.64, is priced below its estimated fair value of HK$6.21, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 37.4% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.7%. Despite a volatile share price recently and a modest future return on equity of 15.9%, APT's revenue growth remains robust at 15.4% per year.

- The analysis detailed in our APT Electronics growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of APT Electronics.

Summing It All Up

- Reveal the 282 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com