Amidst a backdrop of global economic uncertainties and shifting market dynamics, Asian small-cap stocks are drawing increased attention from investors seeking opportunities beyond the traditional heavyweights. In this environment, identifying promising small-cap companies requires a keen focus on innovation, resilience to external pressures such as tariffs and inflation, and potential for growth in niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gem-Year IndustrialLtd | 1.70% | -3.85% | -33.56% | ★★★★★★ |

| Guangdong Lingxiao Pump IndustryLtd | NA | 2.07% | 6.46% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Advanced International Multitech | 36.42% | 6.79% | 4.08% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market cap of HK$3.17 billion.

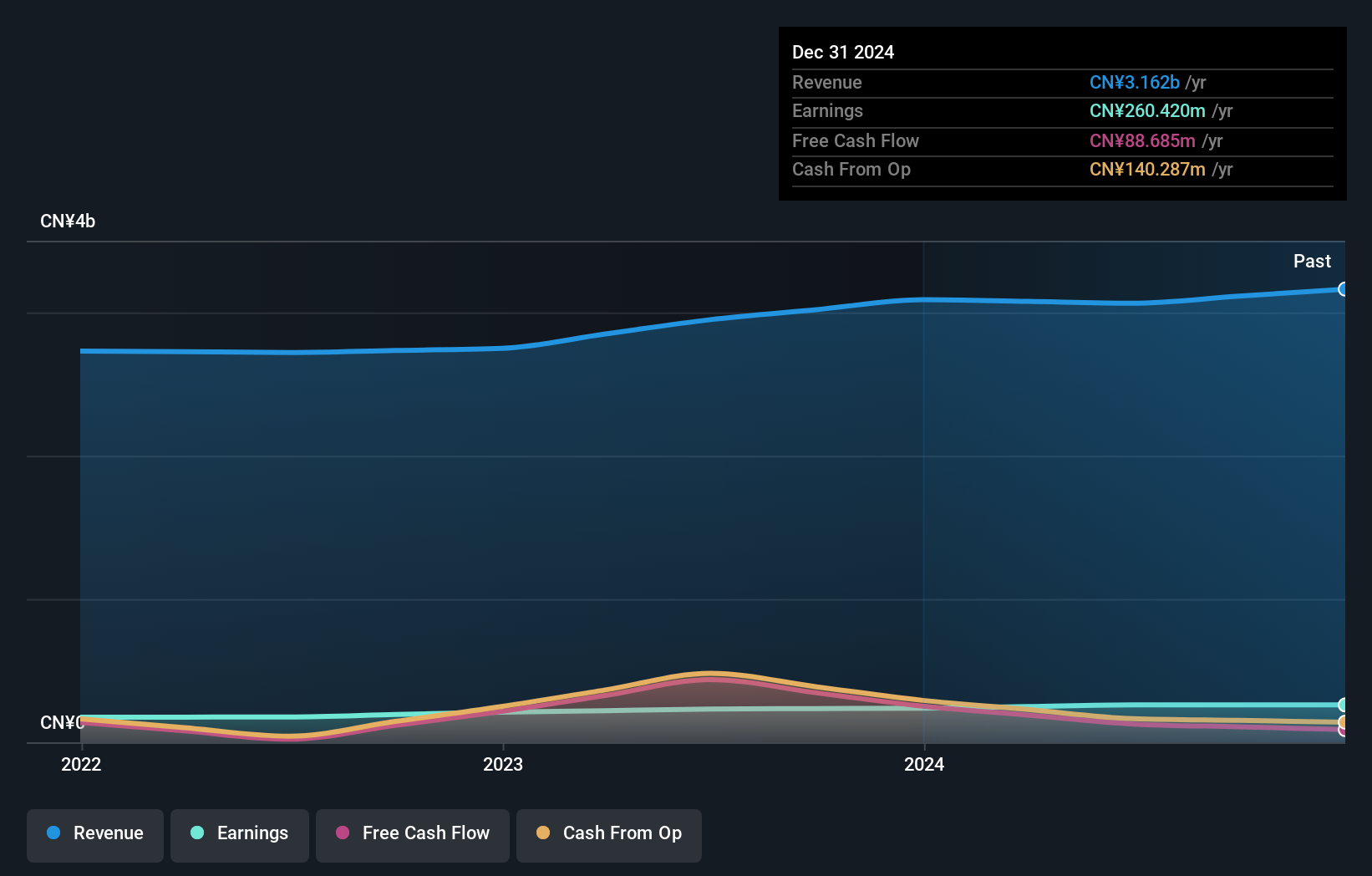

Operations: IVD Medical Holding generates revenue primarily from its Distribution Business, which contributes CN¥2.86 billion, followed by After-sales services at CN¥196.47 million and Self-Branded Products Business at CN¥9.05 million. The company shows a focus on distribution as the dominant revenue stream within its business model.

IVD Medical Holding, a small cap player in the healthcare sector, has shown robust earnings growth of 12.3% over the past year, outpacing the industry average of -14.1%. The company's debt to equity ratio climbed from 5.4% to 23.3% over five years, yet interest payments are comfortably covered by EBIT at a multiple of 20.8x. Despite recent shareholder dilution and an auditor change due to delays in financial information provision, IVD maintains a favorable price-to-earnings ratio of 11.4x compared to the industry’s 12.6x, suggesting potential value for investors seeking opportunities in Asia's dynamic markets.

- Click to explore a detailed breakdown of our findings in IVD Medical Holding's health report.

Assess IVD Medical Holding's past performance with our detailed historical performance reports.

Yongjin Technology Group (SHSE:603995)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yongjin Technology Group Co., Ltd. focuses on the research, development, production, and sale of cold-rolled stainless steel sheets and strips with a market capitalization of CN¥7.36 billion.

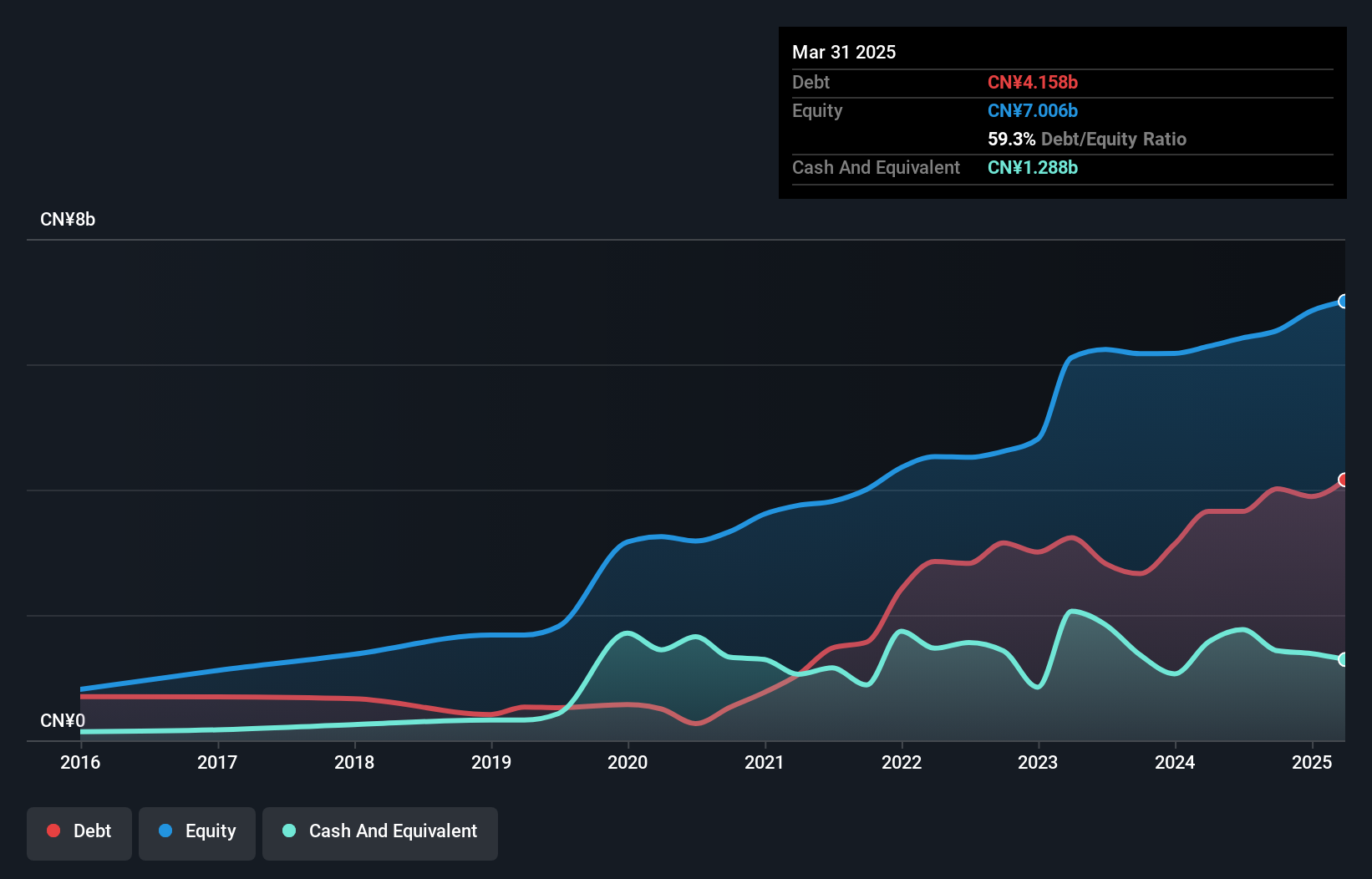

Operations: Yongjin Technology Group generates revenue primarily from the sale of cold-rolled stainless steel sheets and strips. The company's net profit margin shows variability, reflecting fluctuations in production costs and market conditions.

Yongjin Technology Group, a relatively small player in the market, has demonstrated impressive earnings growth of 59.6% over the past year, outpacing the Metals and Mining industry average of -0.2%. This performance is supported by a favorable price-to-earnings ratio of 10.2x, significantly lower than China's market average of 37.3x, indicating good value for investors. Despite an increase in its debt to equity ratio from 21.9% to 61.4% over five years, interest payments remain well covered with EBIT covering them 10 times over, suggesting financial stability amidst growth prospects forecasted at an annual rate of 9.16%.

- Navigate through the intricacies of Yongjin Technology Group with our comprehensive health report here.

Evaluate Yongjin Technology Group's historical performance by accessing our past performance report.

Arcadyan Technology (TWSE:3596)

Simply Wall St Value Rating: ★★★★★★

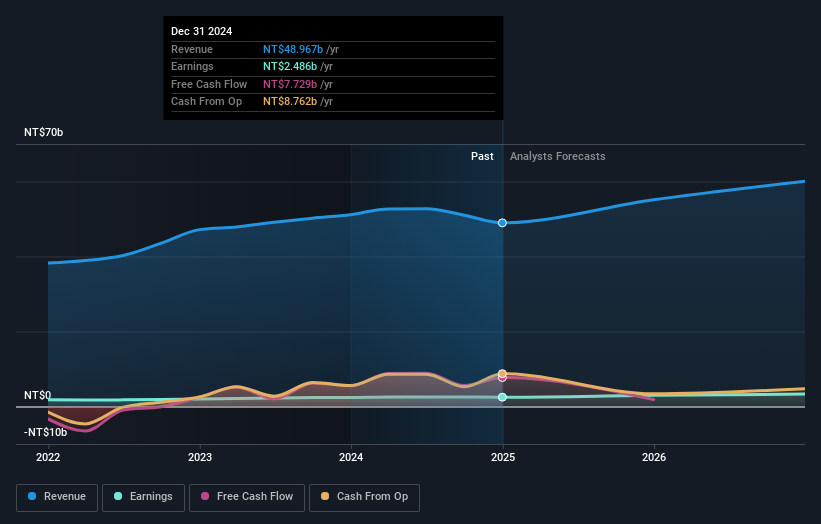

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$45.39 billion.

Operations: Arcadyan Technology generates revenue primarily through the sale of broadband access, multimedia, and wireless infrastructure solutions. The company has a market capitalization of NT$45.39 billion.

Arcadyan Technology, a notable player in the communications sector, has shown resilience with earnings growth of 2.7% over the past year, outpacing an industry downturn of -7%. Its price-to-earnings ratio stands at 18.3x, which is favorable compared to Taiwan's market average of 21.4x. The company boasts a solid financial position with its debt-to-equity ratio reduced from 13.1% to 7.4% over five years and maintains more cash than total debt, ensuring interest payments are well-covered. Despite sales dipping to TWD 48,967 million from TWD 51,158 million last year, net income rose slightly to TWD 2,486 million.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2576 more companies for you to explore.Click here to unveil our expertly curated list of 2579 Asian Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com