Amid the backdrop of geopolitical tensions and consumer spending concerns impacting global markets, Asian tech stocks have shown resilience, particularly with Chinese technology shares gaining momentum due to stronger-than-expected earnings. In this environment, identifying high growth opportunities often involves looking at companies that demonstrate robust financial performance and adaptability to market shifts, especially in sectors like technology where innovation drives potential for future expansion.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 32.35% | 33.30% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

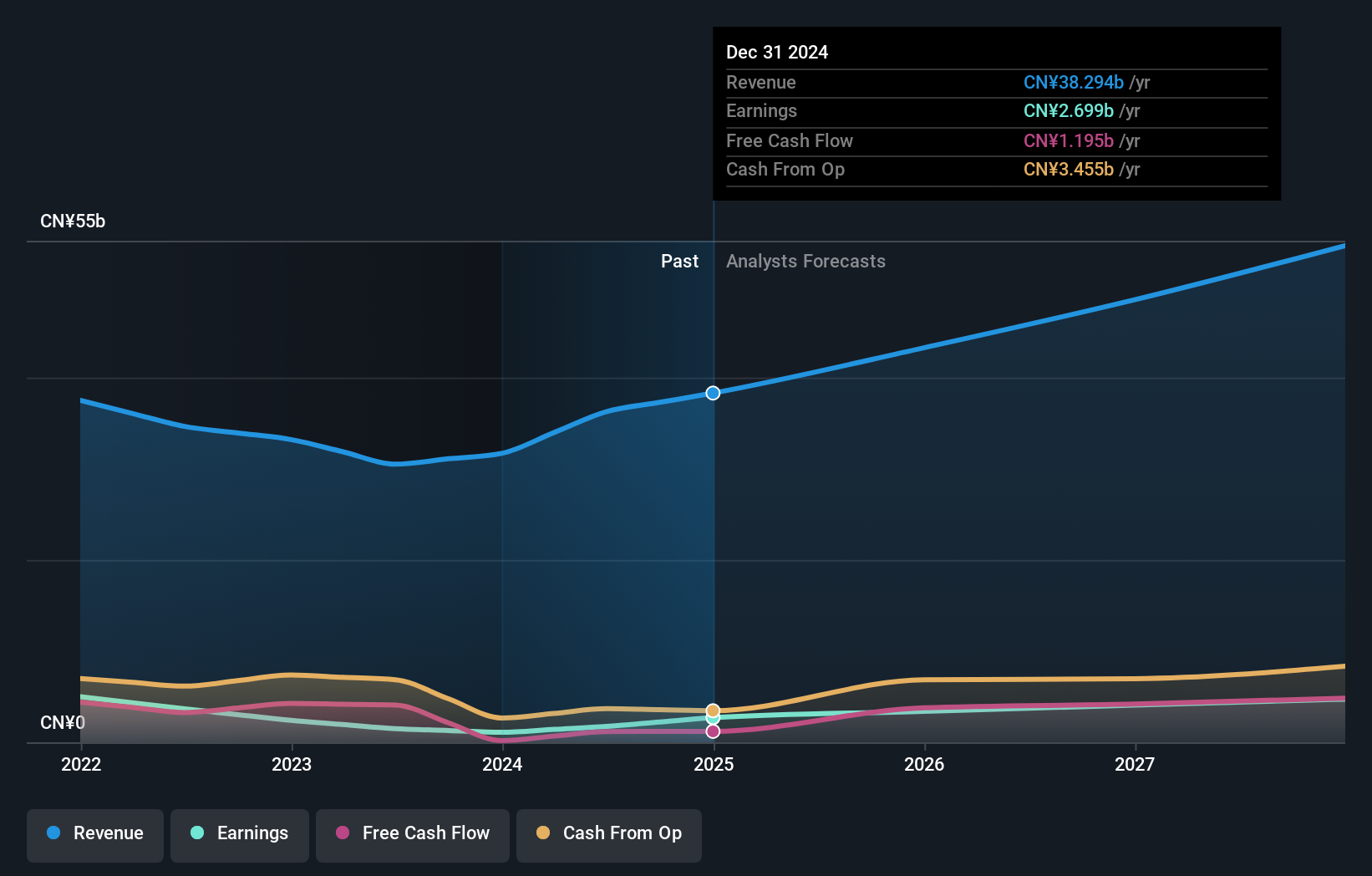

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company that focuses on designing, researching, developing, manufacturing, and selling optical and related products as well as scientific instruments, with a market capitalization of approximately HK$102.79 billion.

Operations: Sunny Optical engages in the design, research, development, manufacturing, and sale of optical components, optoelectronic products, and optical instruments. The company's primary revenue stream is from optoelectronic products (CN¥25.10 billion), followed by optical components (CN¥12.32 billion), with a smaller contribution from optical instruments (CN¥587.78 million).

Sunny Optical Technology has demonstrated robust growth, with its earnings expected to surge by 20.1% annually, outpacing the Hong Kong market's average of 11.7%. This growth trajectory is bolstered by a significant profit increase projected for the year ended December 2024, with profits potentially rising by up to 150% compared to the previous year. The company's commitment to innovation and expansion in high-demand sectors is evident from its active participation in major industry conferences across China, signaling a strategic push to enhance its market presence and foster industry relationships.

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

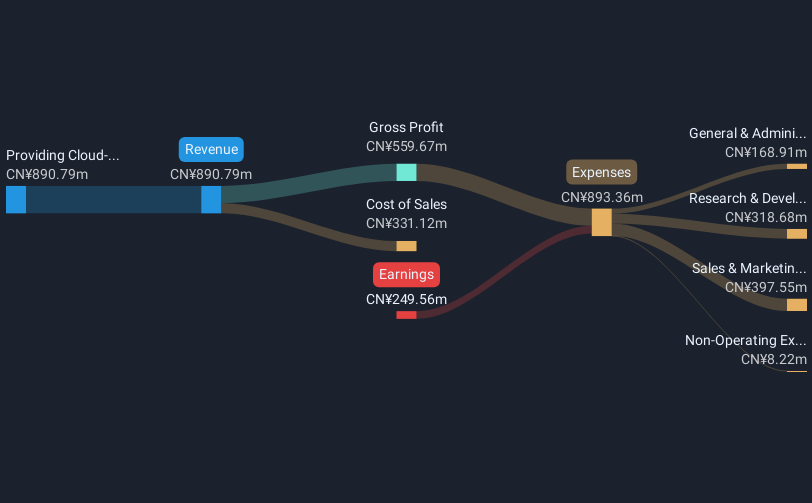

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions to help enterprises in the People’s Republic of China with talent recruitment, evaluation, management, development, and retention, with a market cap of approximately HK$3.87 billion.

Operations: The company generates revenue primarily from providing cloud-based human capital management solutions and related professional services, amounting to approximately CN¥890.79 million.

Beisen Holding, navigating through a competitive tech landscape in Asia, has shown promising signs with a revenue growth of 15.3% per year. Despite not yet being profitable, the company's earnings are expected to rise by an impressive 89% annually. This growth is supported by strategic share repurchases, with 20,075,200 shares bought back for HKD 89.59 million between April and September 2024. Beisen's commitment to innovation is reflected in its R&D spending trends which align closely with its revenue growth, ensuring sustained development and potential future profitability within the high-growth sectors it operates in.

- Delve into the full analysis health report here for a deeper understanding of Beisen Holding.

Understand Beisen Holding's track record by examining our Past report.

Dawning Information Industry (SHSE:603019)

Simply Wall St Growth Rating: ★★★★☆☆

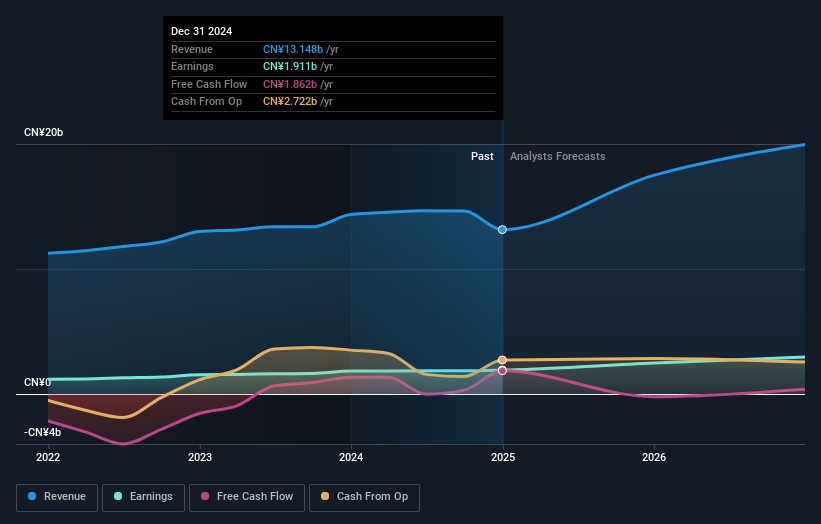

Overview: Dawning Information Industry Co., Ltd. offers high-performance computing, server, storage, cloud computing, and big data products both in China and internationally, with a market cap of CN¥111.77 billion.

Operations: The company generates revenue through its offerings in high-performance computing, servers, storage solutions, cloud computing, and big data products across domestic and international markets.

Dawning Information Industry, amidst a challenging fiscal year, reported a slight dip in sales to CNY 13.17 billion from CNY 14.35 billion but saw an increase in net income to CNY 1.91 billion, up from CNY 1.84 billion the previous year, reflecting resilient profitability with basic earnings per share rising to CNY 1.31 from CNY 1.26. This performance is underpinned by robust annual revenue and earnings growth rates of 21.8% and 21.9%, respectively, outpacing the broader Chinese tech market's growth rates of 13.3% for revenue and lagging slightly behind the market’s earnings growth projection of 25%. The company’s focus on innovation is evident in its R&D expenditures which are strategically aligned with its revenue streams, suggesting a commitment to maintaining competitive edge through technological advancements.

Next Steps

- Discover the full array of 524 Asian High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com