China Oriental Group Company Limited (HKG:581) shareholders are doubtless heartened to see the share price bounce 31% in just one week. But if you look at the last five years the returns have not been good. In fact, the share price is down 48%, which falls well short of the return you could get by buying an index fund.

While the stock has risen 31% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for China Oriental Group

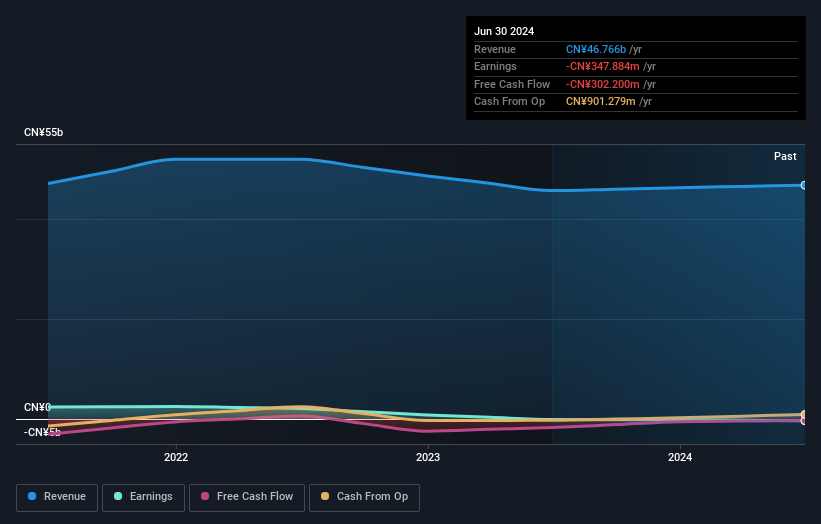

Because China Oriental Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, China Oriental Group saw its revenue increase by 3.7% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 8% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on China Oriental Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of China Oriental Group, it has a TSR of -29% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

China Oriental Group provided a TSR of 20% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with China Oriental Group (including 2 which are potentially serious) .

We will like China Oriental Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.