EVA Precision Industrial Holdings Limited (HKG:838) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

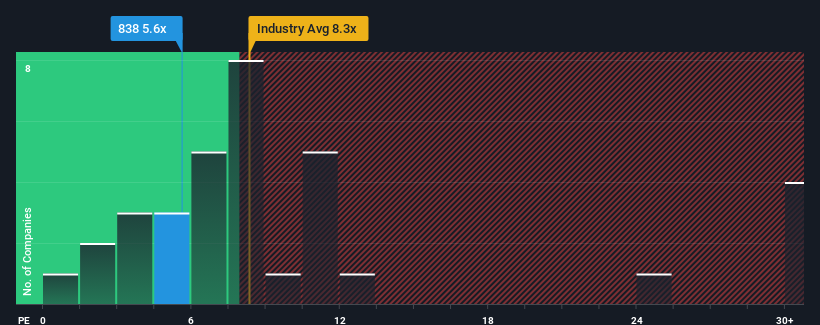

Although its price has surged higher, EVA Precision Industrial Holdings' price-to-earnings (or "P/E") ratio of 5.6x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 21x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for EVA Precision Industrial Holdings as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for EVA Precision Industrial Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like EVA Precision Industrial Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.2% last year. Pleasingly, EPS has also lifted 102% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 12% per annum, which is not materially different.

In light of this, it's peculiar that EVA Precision Industrial Holdings' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From EVA Precision Industrial Holdings' P/E?

Despite EVA Precision Industrial Holdings' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of EVA Precision Industrial Holdings' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with EVA Precision Industrial Holdings, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on EVA Precision Industrial Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.