Cathay Group Holdings Inc. (HKG:1981) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 156% in the last year.

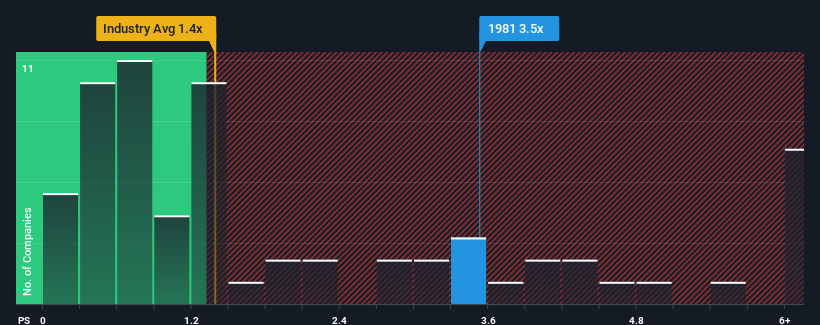

Since its price has surged higher, you could be forgiven for thinking Cathay Group Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in Hong Kong's Entertainment industry have P/S ratios below 1.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cathay Group Holdings

What Does Cathay Group Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Cathay Group Holdings has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Cathay Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Cathay Group Holdings?

In order to justify its P/S ratio, Cathay Group Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Revenue has also lifted 24% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the one analyst following the company. That's shaping up to be similar to the 12% growth forecast for the broader industry.

With this information, we find it interesting that Cathay Group Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Cathay Group Holdings' P/S?

Shares in Cathay Group Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Cathay Group Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Cathay Group Holdings with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.