InnoCare Pharma Limited (HKG:9969) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

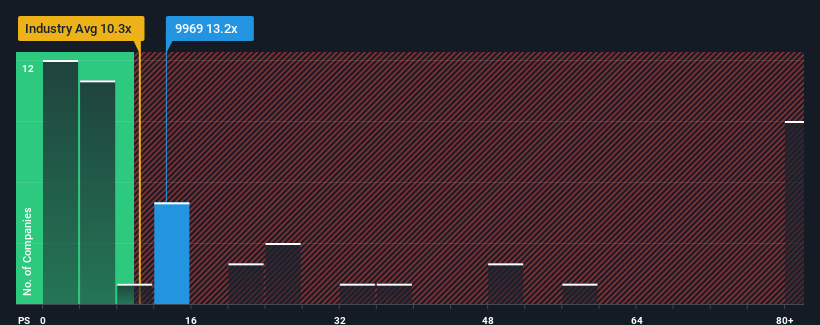

After such a large jump in price, InnoCare Pharma may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 13.2x, since almost half of all companies in the Biotechs in Hong Kong have P/S ratios under 10.3x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for InnoCare Pharma

What Does InnoCare Pharma's Recent Performance Look Like?

InnoCare Pharma could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on InnoCare Pharma.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as InnoCare Pharma's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 25% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 8.4% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 36% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 55% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that InnoCare Pharma's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On InnoCare Pharma's P/S

InnoCare Pharma's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see InnoCare Pharma trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - InnoCare Pharma has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.