Xinda Investment Holdings Limited (HKG:1281) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 152%.

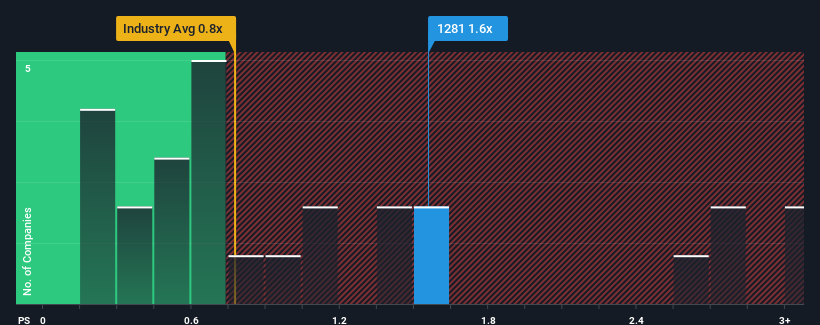

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Renewable Energy industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Xinda Investment Holdings as a stock probably not worth researching with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xinda Investment Holdings

What Does Xinda Investment Holdings' Recent Performance Look Like?

As an illustration, revenue has deteriorated at Xinda Investment Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinda Investment Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Xinda Investment Holdings would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 44%. This means it has also seen a slide in revenue over the longer-term as revenue is down 82% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.3% shows it's an unpleasant look.

With this in mind, we find it worrying that Xinda Investment Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Xinda Investment Holdings' P/S Mean For Investors?

Xinda Investment Holdings' P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xinda Investment Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you take the next step, you should know about the 2 warning signs for Xinda Investment Holdings that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.