As global markets continue to navigate the complexities of rising inflation and shifting monetary policies, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this context, penny stocks—though an outdated term—still represent a niche area for investors seeking growth opportunities in smaller or newer companies. By focusing on those with strong financials and clear growth trajectories, investors can uncover hidden gems that offer stability alongside potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £479.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.695 | MYR411.2M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.84 | MYR278.83M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

Click here to see the full list of 5,686 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Golden Solar New Energy Technology Holdings (SEHK:1121)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Solar New Energy Technology Holdings Limited is an investment holding company that manufactures and sells footwear products across various international markets including China, the United States, South America, Europe, and Southeast Asia with a market cap of HK$3.61 billion.

Operations: Golden Solar New Energy Technology Holdings generates revenue from several segments, including CN¥1.72 million from Boree Products, CN¥49.29 million from Photovoltaic Products, CN¥7.01 million from Graphene-Based Products, and CN¥209.30 million from Original Equipment Manufacturer (OEM) activities.

Market Cap: HK$3.61B

Golden Solar New Energy Technology Holdings, with a market cap of HK$3.61 billion, operates across multiple international markets and has diversified revenue streams from Boree Products (CN¥1.72 million), Photovoltaic Products (CN¥49.29 million), Graphene-Based Products (CN¥7.01 million), and OEM activities (CN¥209.30 million). The company is involved in constructing a 200,000 kW photovoltaic power station in China, positioning itself as a key supplier for this project without bearing financial liability from the EPC contract. Despite reducing its debt to equity ratio over five years and having experienced management, the company remains unprofitable with less than one year of cash runway based on current free cash flow trends.

- Navigate through the intricacies of Golden Solar New Energy Technology Holdings with our comprehensive balance sheet health report here.

- Evaluate Golden Solar New Energy Technology Holdings' historical performance by accessing our past performance report.

Flowing Cloud Technology (SEHK:6610)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flowing Cloud Technology Ltd, with a market cap of HK$568.94 million, operates through its subsidiaries to offer augmented reality and virtual reality marketing, content, and related services in the People’s Republic of China and Hong Kong.

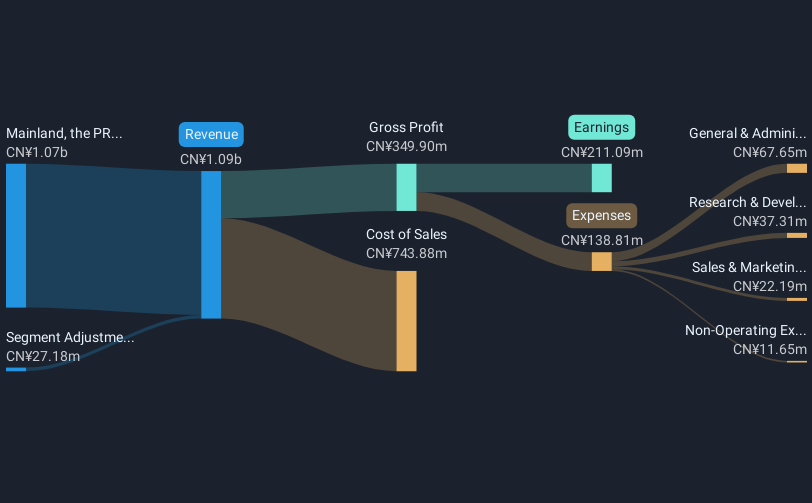

Operations: The company generates its revenue primarily from the Software & Programming segment, which amounted to CN¥1.09 billion.

Market Cap: HK$568.94M

Flowing Cloud Technology Ltd, with a market cap of HK$568.94 million, primarily generates revenue from its Software & Programming segment, amounting to CN¥1.09 billion. The company's price-to-earnings ratio of 2.5x is below the Hong Kong market average, suggesting potential undervaluation. Despite having more cash than total debt and short-term assets exceeding liabilities, Flowing Cloud's earnings growth has been negative over the past year compared to industry averages. Its board lacks extensive experience with an average tenure of 2.8 years, while high non-cash earnings indicate quality concerns in reported profits amidst volatile share prices and insider selling activities recently observed.

- Unlock comprehensive insights into our analysis of Flowing Cloud Technology stock in this financial health report.

- Learn about Flowing Cloud Technology's historical performance here.

Hotung Investment Holdings (SGX:BLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hotung Investment Holdings Limited is a venture capital investment company operating in Taiwan, China, Israel, the United States, the United Kingdom, and internationally with a market cap of SGD132.77 million.

Operations: Hotung Investment Holdings Limited does not report specific revenue segments.

Market Cap: SGD132.77M

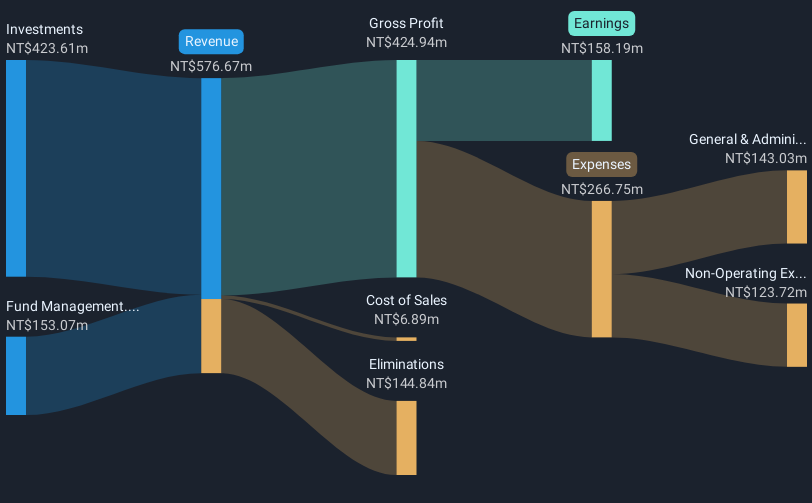

Hotung Investment Holdings Limited, with a market cap of SGD132.77 million, has demonstrated strong financial stability, as evidenced by its short-term assets of NT$1.9 billion exceeding both short and long-term liabilities. Despite experiencing a 30.7% annual decline in earnings over the past five years, the company reported significant earnings growth of 63.4% last year, surpassing industry averages. Recent results show improved profitability with net income rising to TWD158.19 million from TWD96.8 million a year ago and stable dividends at TWD2.55 per share for 2024, though dividend coverage remains weak due to low earnings relative to payouts.

- Take a closer look at Hotung Investment Holdings' potential here in our financial health report.

- Gain insights into Hotung Investment Holdings' past trends and performance with our report on the company's historical track record.

Key Takeaways

- Take a closer look at our Penny Stocks list of 5,686 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com