As global markets continue to navigate a landscape of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In this environment, identifying undervalued stocks that trade below their estimated fair value can present potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.99 | 49.6% |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥16.23 | CN¥32.07 | 49.4% |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49085.96 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.297 | ₪6.55 | 49.7% |

| Insyde Software (TPEX:6231) | NT$422.00 | NT$843.52 | 50% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17580.00 | ₩34896.79 | 49.6% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.13 | 49.8% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

We'll examine a selection from our screener results.

Wasion Holdings (SEHK:3393)

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries across various regions including China, Africa, the United States, Europe, and Asia; it has a market cap of approximately HK$8.07 billion.

Operations: The company's revenue segments include CN¥2.51 billion from Advanced Distribution Operations, CN¥2.99 billion from Power Advanced Metering Infrastructure, and CN¥2.42 billion from Communication and Fluid Advanced Metering Infrastructure.

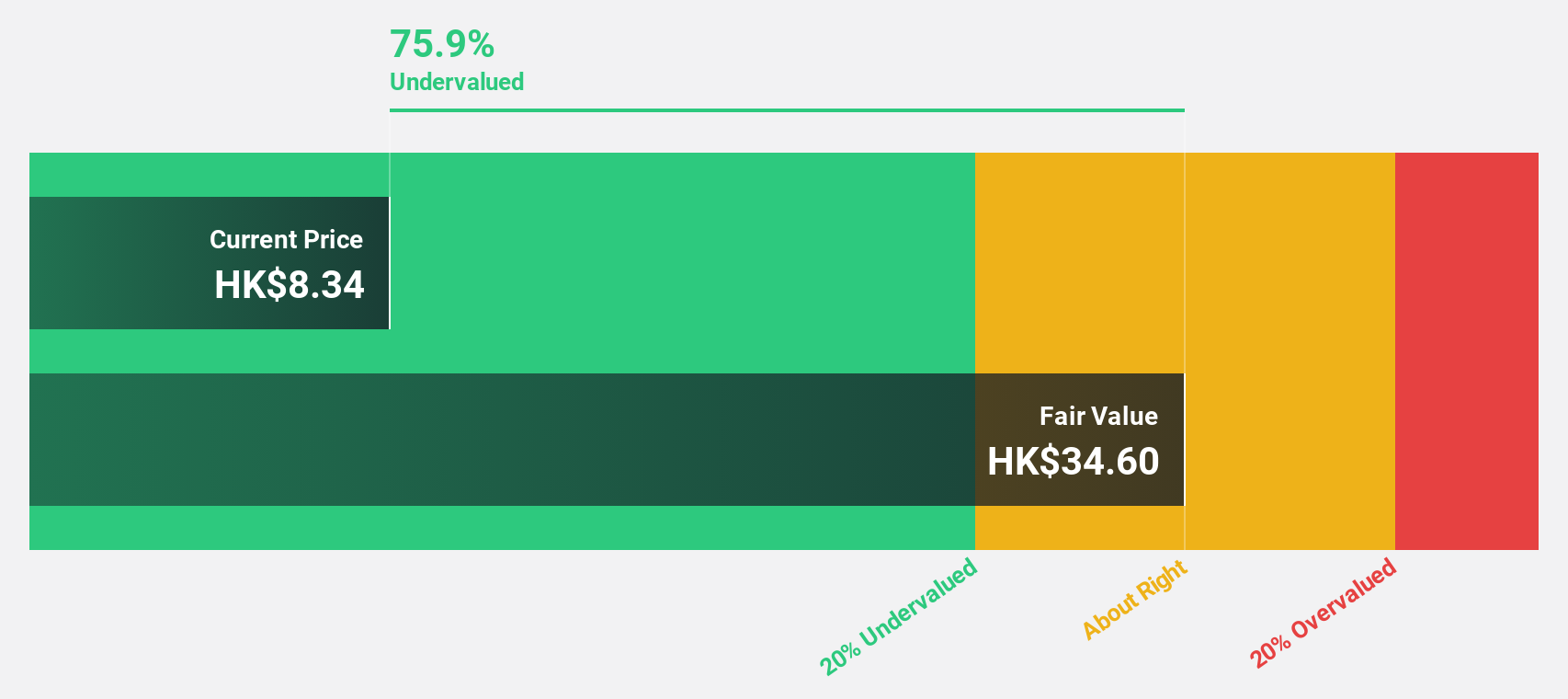

Estimated Discount To Fair Value: 40%

Wasion Holdings is trading at HK$8.15, significantly below its estimated fair value of HK$13.58, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow at 22.6% annually, outpacing the Hong Kong market's average growth rate of 11.7%. Despite a low forecasted return on equity of 15.4%, Wasion's recent earnings growth of 61.9% and future revenue projections support its position as an undervalued stock with promising cash flow prospects.

- Upon reviewing our latest growth report, Wasion Holdings' projected financial performance appears quite optimistic.

- Take a closer look at Wasion Holdings' balance sheet health here in our report.

Yeahka (SEHK:9923)

Overview: Yeahka Limited, with a market cap of HK$4.16 billion, is an investment holding company that offers payment and business services to merchants and consumers in the People’s Republic of China.

Operations: The company generates revenue from its business services segment, amounting to CN¥3.47 billion.

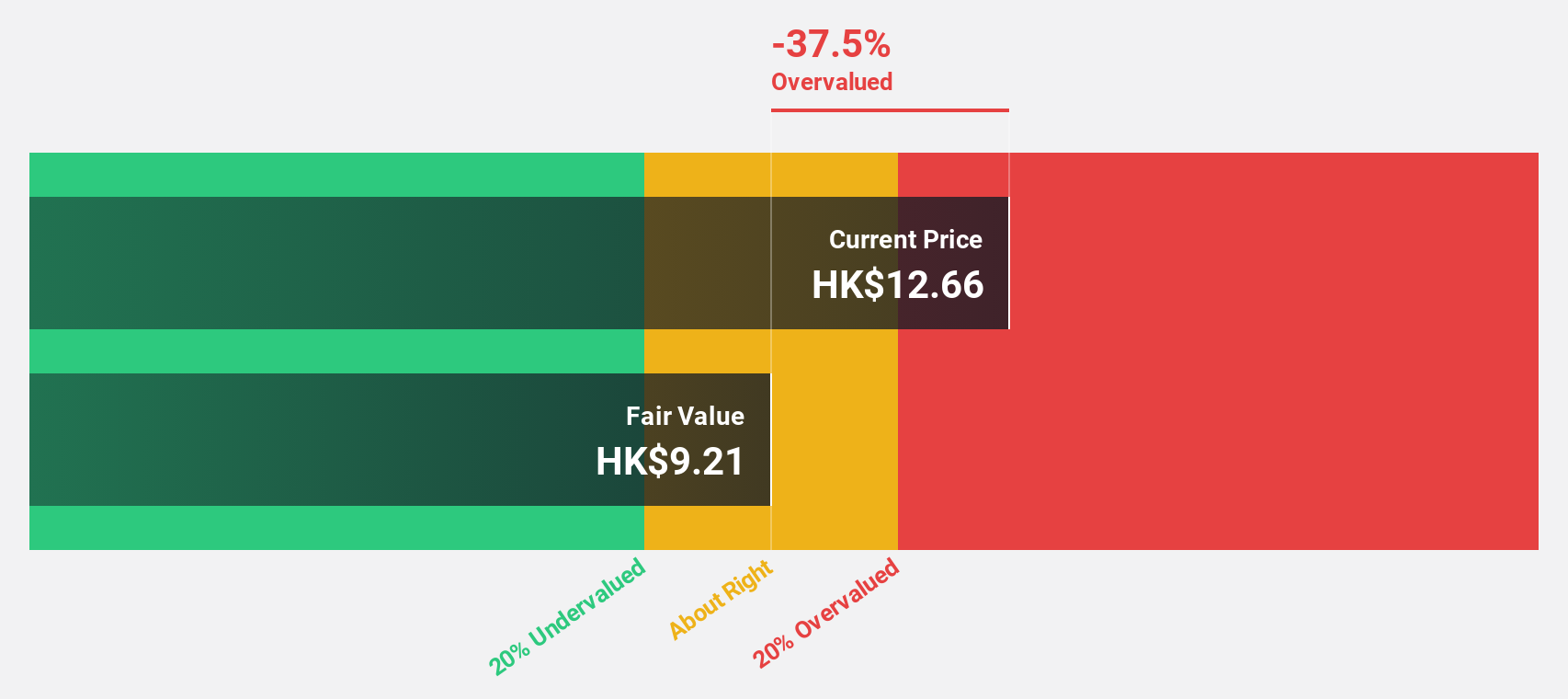

Estimated Discount To Fair Value: 31.7%

Yeahka is trading at HK$9.49, below its fair value estimate of HK$13.89, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly at 38.5% annually, surpassing the Hong Kong market average of 11.7%. Despite recent volatility and a low return on equity forecast of 15.8%, strategic share repurchases could enhance earnings per share, while new leadership aims to advance digital finance initiatives and fintech services expansion.

- The growth report we've compiled suggests that Yeahka's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Yeahka's balance sheet health report.

Kyushu Financial Group (TSE:7180)

Overview: Kyushu Financial Group, Inc., with a market cap of ¥323.14 billion, operates through its subsidiaries to offer a range of financial products and services to customers in Japan.

Operations: Kyushu Financial Group generates revenue through its subsidiaries by offering a variety of financial products and services within Japan.

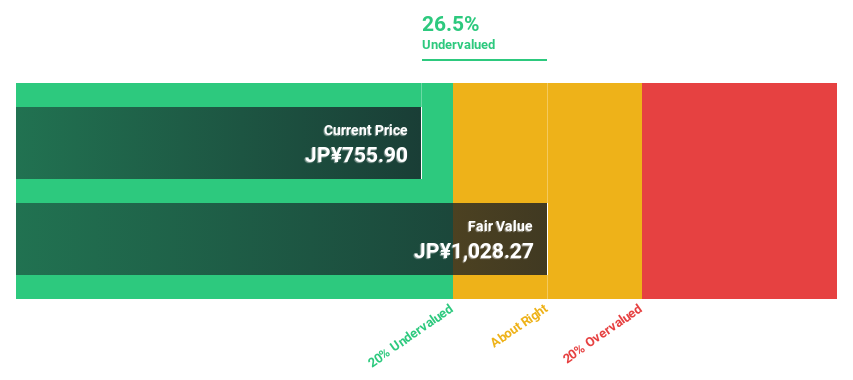

Estimated Discount To Fair Value: 24.8%

Kyushu Financial Group is trading at ¥771.1, below its fair value estimate of ¥1025.89, reflecting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 23.6% annually, outpacing the Japanese market average of 8%. Despite a low return on equity forecast of 5.2%, the company has announced an increased dividend guidance and expects profit attributable to owners to be ¥28.5 billion for the full year ending March 2025.

- Our growth report here indicates Kyushu Financial Group may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Kyushu Financial Group.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 914 more companies for you to explore.Click here to unveil our expertly curated list of 917 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com