As global markets navigate a landscape marked by rising inflation and the potential for prolonged interest rate hikes, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares despite small-cap stocks lagging behind larger indices. In this environment, identifying high-growth tech stocks requires an understanding of their ability to leverage innovation and adaptability to thrive amid economic shifts and investor sentiment trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 30.43% | 54.08% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

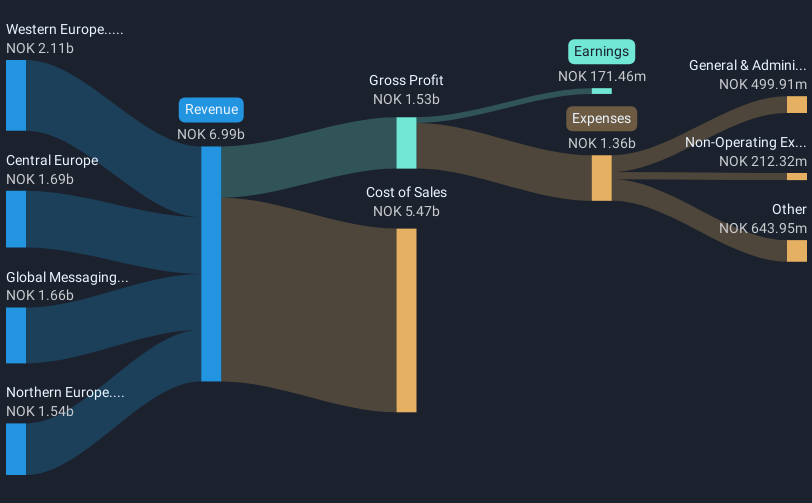

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions and has a market capitalization of NOK6.98 billion.

Operations: The company generates revenue primarily from four segments: Central Europe (NOK1.69 billion), Western Europe (NOK2.11 billion), Northern Europe (NOK1.54 billion), and Global Messaging (NOK1.66 billion).

LINK Mobility Group Holding ASA has demonstrated robust financial performance with a significant earnings growth of 347% over the past year, outpacing the software industry's average of 18%. This growth is underpinned by an impressive annualized earnings forecast of 31.4%, suggesting strong future potential. Despite a slower revenue growth rate at 8.1% annually, it still surpasses the Norwegian market average of 3.4%. The company's recent full-year results reported a substantial increase in net income to NOK 255.48 million from NOK 67.28 million, reflecting both operational efficiency and strategic market positioning. With these dynamics, LINK Mobility continues to enhance its competitive edge in the tech sector, although it faces challenges like lower forecasted return on equity and significant one-off losses impacting financials.

- Delve into the full analysis health report here for a deeper understanding of LINK Mobility Group Holding.

Understand LINK Mobility Group Holding's track record by examining our Past report.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

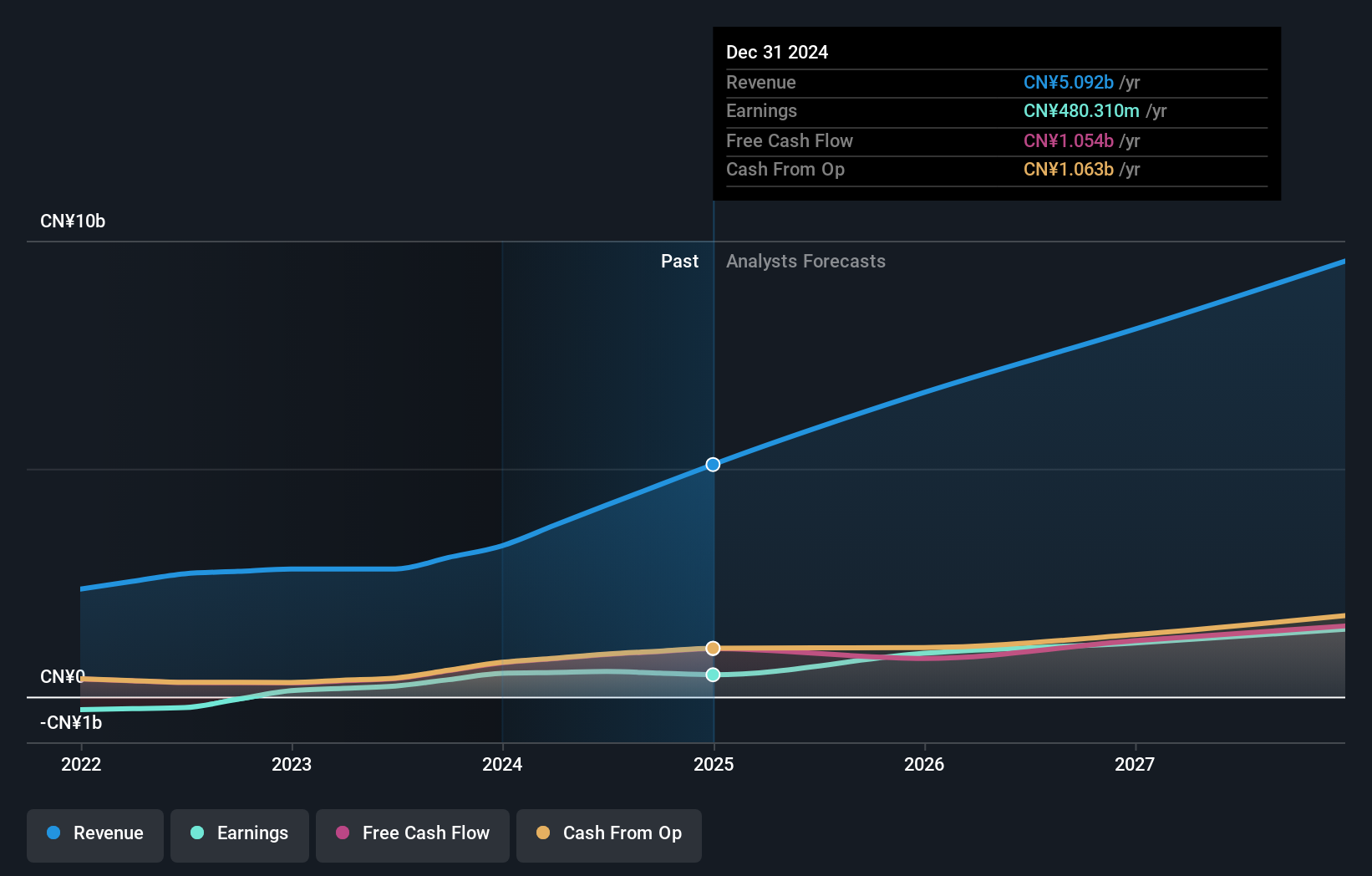

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market capitalization of approximately HK$7.17 billion.

Operations: The company generates revenue primarily from its social networking business, contributing CN¥3.80 billion, alongside an innovative business segment adding CN¥406.28 million.

Newborn Town Inc. is riding a wave of growth, with its social networking segment projected to generate revenue between RMB 4,520 million and RMB 4,720 million in 2024, marking an increase of about 54.3% to 61.1% year-on-year. This surge is largely driven by the integration of AI technologies into its social apps and the financial consolidation post-BlueCity acquisition. The company's innovative business segment also shows promise with expected revenue growth between 16.1% and 26.6%, supported by advancements in quality gaming and social e-commerce platforms. Despite recent executive changes, Newborn Town's strategic direction remains robust under new leadership, aiming to capitalize on technological innovations and market expansions.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

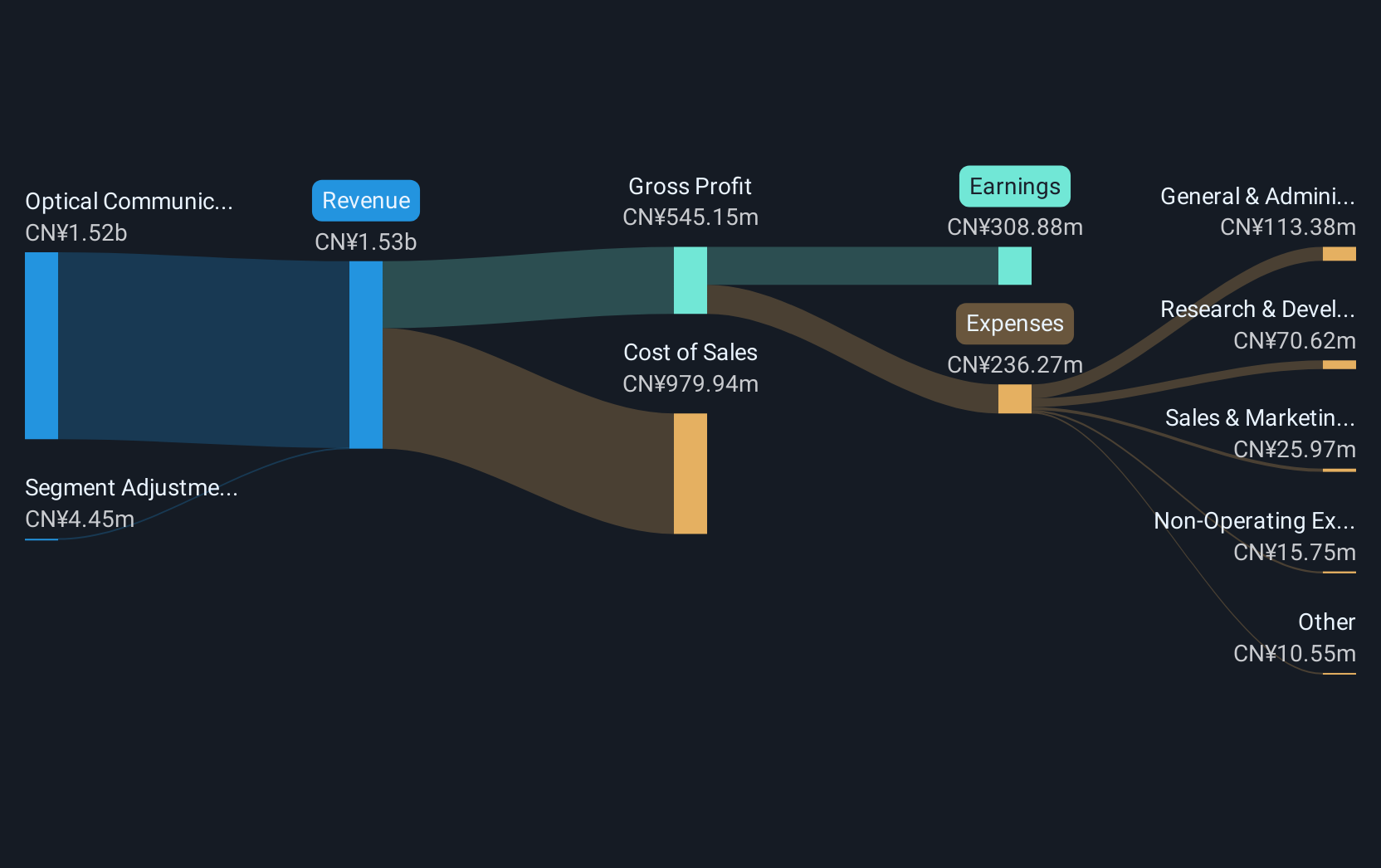

Overview: T&S Communications Co., Ltd. is engaged in the development, manufacturing, and sale of fiber optics communication products in China with a market capitalization of approximately CN¥23.47 billion.

Operations: T&S Communications generates revenue primarily from the sale of optical communication components, totaling approximately CN¥1.17 billion.

T&S CommunicationsLtd has demonstrated robust growth, with its revenue and earnings expanding by 39.1% and 46.5% annually, outpacing the CN market's average of 13.3% and 25.1%, respectively. This growth is underpinned by significant R&D investment, which totals $320 million this year alone, accounting for approximately 15% of its total revenue—a clear indicator of its commitment to innovation in communications technology. With a highly volatile share price in recent months, the company's aggressive expansion strategy and high Return on Equity forecast at 25.7% suggest potential for future performance amidst industry shifts towards advanced communication solutions.

- Unlock comprehensive insights into our analysis of T&S CommunicationsLtd stock in this health report.

Evaluate T&S CommunicationsLtd's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 1213 High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com