As global markets navigate through tariff uncertainties and mixed economic signals, small-cap stocks have experienced a nuanced impact with indices like the Russell 2000 showing modest declines. Amidst these fluctuations, investors often seek opportunities in lesser-known stocks that may offer potential growth despite broader market challenges. In such an environment, identifying promising stocks requires a keen eye for companies with strong fundamentals and resilience to economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

We'll examine a selection from our screener results.

ZONQING Environmental (SEHK:1855)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zonbong Landscape Environmental Limited, with a market cap of HK$5.51 billion, operates in the People’s Republic of China focusing on landscaping, ecological restoration, and related activities through its subsidiaries.

Operations: Zonbong Landscape Environmental Limited generates revenue primarily from city renewal construction services (CN¥1.85 billion), followed by city operation and maintenance services (CN¥280.90 million), and design and consultancy services (CN¥86.75 million).

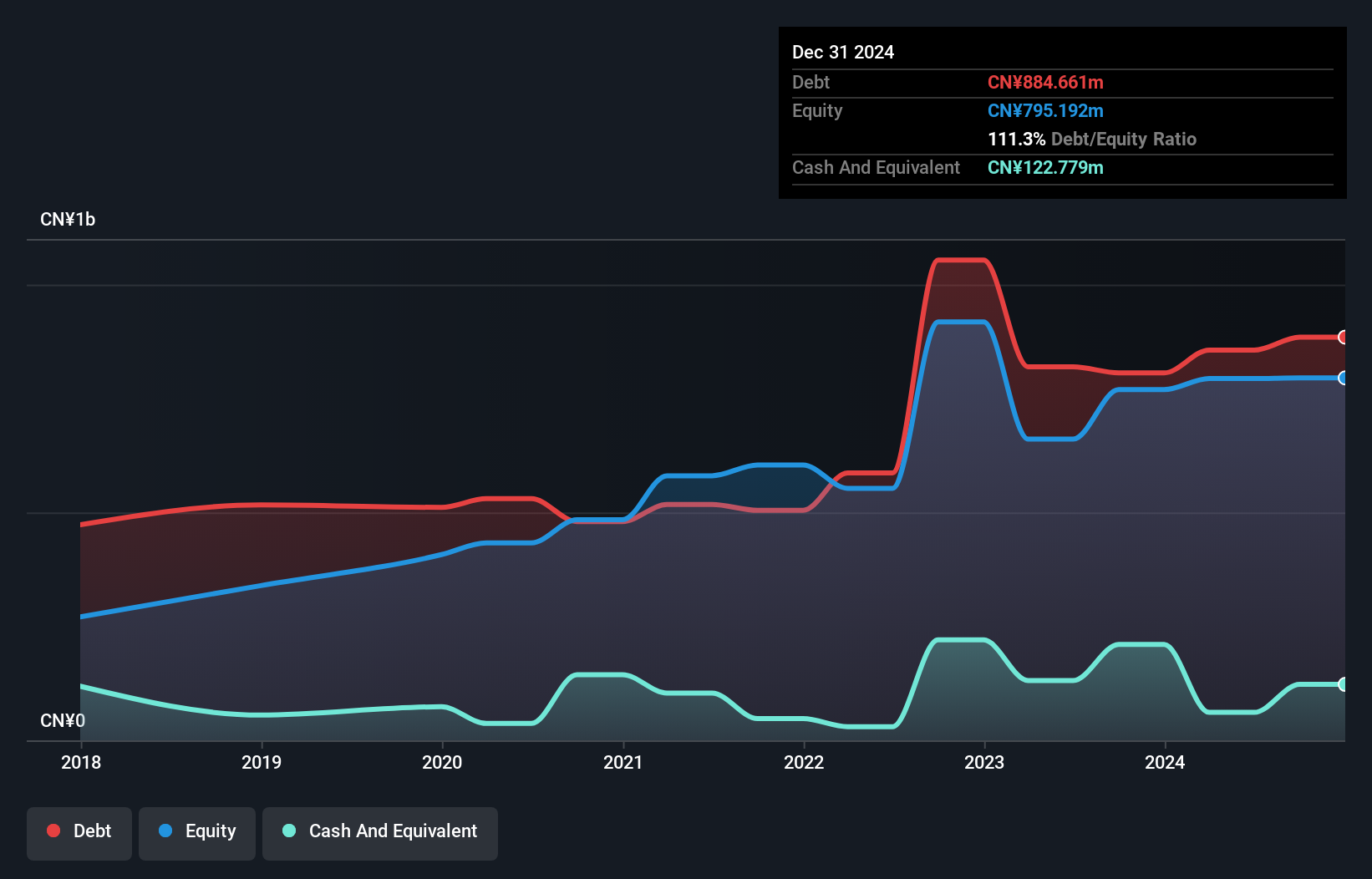

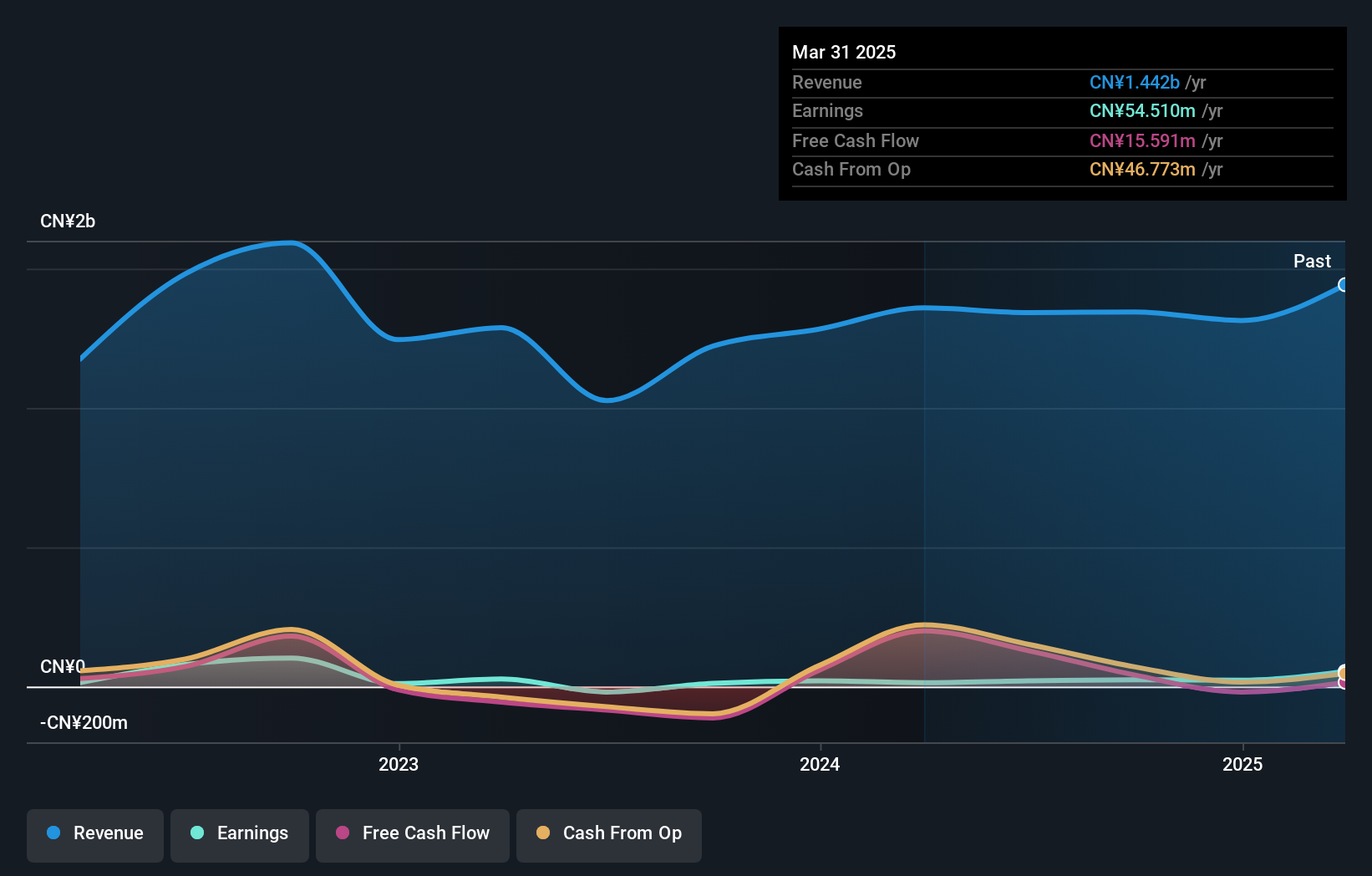

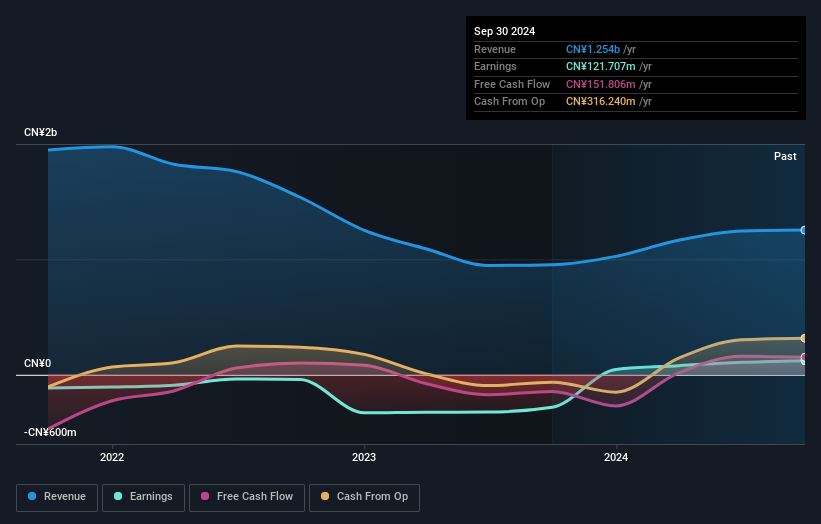

ZONQING Environmental, a small cap player in the environmental sector, has shown impressive financial dynamics recently. The company's earnings skyrocketed by 2106% over the past year, significantly outpacing the -4.9% industry average growth rate. Despite a high net debt to equity ratio of 100%, ZONQING's interest payments are well covered with an EBIT coverage of 4.8x. Over five years, their debt to equity ratio decreased from 137.7% to 107.9%. These figures suggest robust operational performance and potential for future stability within its industry context, though high leverage remains a concern worth monitoring closely.

- Click here to discover the nuances of ZONQING Environmental with our detailed analytical health report.

Evaluate ZONQING Environmental's historical performance by accessing our past performance report.

Jinxi Axle (SHSE:600495)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinxi Axle Company Limited focuses on the research, development, and manufacturing of railway vehicles and related accessories, as well as precision forging and casting products in China, with a market cap of CN¥4.80 billion.

Operations: Jinxi Axle generates revenue primarily from the manufacturing of railway vehicles and related accessories, alongside precision forging and casting products. The company's market capitalization stands at approximately CN¥4.80 billion.

Jinxi Axle, a nimble player in the machinery sector, is debt-free and has shown impressive earnings growth of 113.4% over the past year, outpacing the industry average. Despite this surge, there's been a 7.9% annual decline in earnings over five years, hinting at some volatility. The recent boost was partly due to a significant one-off gain of CN¥23.8M impacting its financials as of September 2024. With positive free cash flow and no debt burden affecting interest payments, Jinxi seems poised for steady operations but must navigate its historical earnings challenges carefully.

- Unlock comprehensive insights into our analysis of Jinxi Axle stock in this health report.

Assess Jinxi Axle's past performance with our detailed historical performance reports.

Shenzhen Longli TechnologyLtd (SZSE:300752)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Longli Technology Co., Ltd focuses on the research, development, production, and sale of LED backlight display modules globally and has a market capitalization of approximately CN¥4.31 billion.

Operations: Shenzhen Longli Technology Co., Ltd generates revenue primarily from its Backlight Display Module segment, which accounts for CN¥1.22 billion. The company has a market capitalization of approximately CN¥4.31 billion.

Shenzhen Longli Technology, a player in the tech sector, has recently turned profitable, marking a significant milestone. The company is trading at 20.5% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and free cash flow positivity, it seems well-positioned financially. Over the past five years, its debt to equity ratio slightly increased from 3.3% to 3.7%, but it still holds more cash than total debt, indicating financial stability. A recent share repurchase plan of up to CNY 60 million aims to enhance shareholder value through an employee stock ownership plan or equity incentives.

Next Steps

- Access the full spectrum of 4702 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com