As global markets navigate through tariff uncertainties and mixed economic signals, investors are keenly observing the impact on stock indices, with the S&P 500 experiencing a slight dip amid these challenges. Despite a cooling labor market and fluctuating manufacturing activity in the U.S., opportunities may arise for discerning investors looking to identify stocks trading below their fair value. In such an environment, a good stock is often characterized by strong fundamentals and resilience against market volatility, making it potentially undervalued amidst broader economic concerns.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| KG Mobilians (KOSDAQ:A046440) | ₩4445.00 | ₩8851.15 | 49.8% |

| Gilead Sciences (NasdaqGS:GILD) | US$96.14 | US$191.74 | 49.9% |

| On the Beach Group (LSE:OTB) | £2.495 | £4.94 | 49.5% |

| Aoshikang Technology (SZSE:002913) | CN¥29.12 | CN¥57.85 | 49.7% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR575.00 | IDR1141.10 | 49.6% |

| Smurfit Westrock (NYSE:SW) | US$53.64 | US$107.04 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | US$6.87 | US$13.66 | 49.7% |

| RENK Group (DB:R3NK) | €24.84 | €49.52 | 49.8% |

| 29Metals (ASX:29M) | A$0.195 | A$0.39 | 49.9% |

| Barbeque-Nation Hospitality (NSEI:BARBEQUE) | ₹276.65 | ₹550.90 | 49.8% |

Let's review some notable picks from our screened stocks.

JNTC (KOSDAQ:A204270)

Overview: JNTC Co., Ltd. operates in South Korea, offering connector, hinge, and tempered glass products with a market cap of ₩1.30 trillion.

Operations: The company's revenue primarily comes from the manufacturing and sales of mobile parts, amounting to ₩337.88 billion.

Estimated Discount To Fair Value: 40%

JNTC Co., Ltd. is trading at ₩27,700, significantly below its estimated fair value of ₩46,205.06, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow annually by 104.37%, with revenue expected to increase by 29.5% per year—surpassing the KR market growth rate of 9%. Despite high share price volatility recently, JNTC's return on equity is projected to be strong at 20.2% within three years.

- Our comprehensive growth report raises the possibility that JNTC is poised for substantial financial growth.

- Dive into the specifics of JNTC here with our thorough financial health report.

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd. is an investment banking firm offering services in Mainland China and internationally, with a market cap of HK$183.09 billion.

Operations: CSC Financial Co., Ltd. generates revenue from its investment banking services both domestically in Mainland China and on an international scale.

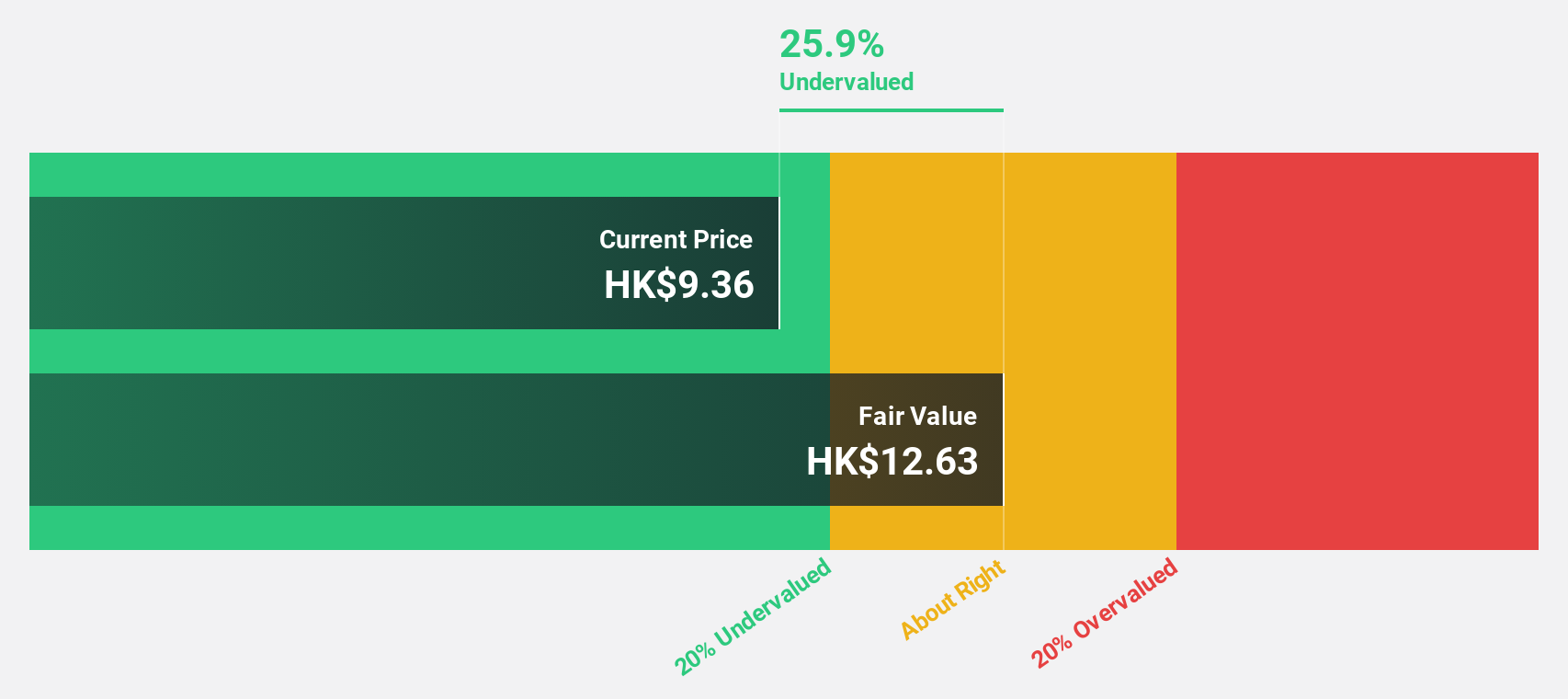

Estimated Discount To Fair Value: 21.3%

CSC Financial is trading at HK$10.18, over 20% below its estimated fair value of HK$12.93, highlighting potential undervaluation based on cash flows. Revenue growth is forecasted at 15.4% annually, outpacing the Hong Kong market's 7.8%, while earnings are expected to grow significantly by 36.87% per year, surpassing market averages. Recent board changes include new appointments and resignations but are not expected to impact operational stability significantly.

- In light of our recent growth report, it seems possible that CSC Financial's financial performance will exceed current levels.

- Navigate through the intricacies of CSC Financial with our comprehensive financial health report here.

Satellite ChemicalLtd (SZSE:002648)

Overview: Satellite Chemical Co., Ltd. is a low-carbon chemical company that produces and distributes functional chemicals, new polymer materials, and new energy materials both in China and internationally, with a market cap of CN¥70.74 billion.

Operations: Satellite Chemical Co., Ltd. generates revenue through the production and sale of functional chemicals, new polymer materials, and new energy materials in both domestic and international markets.

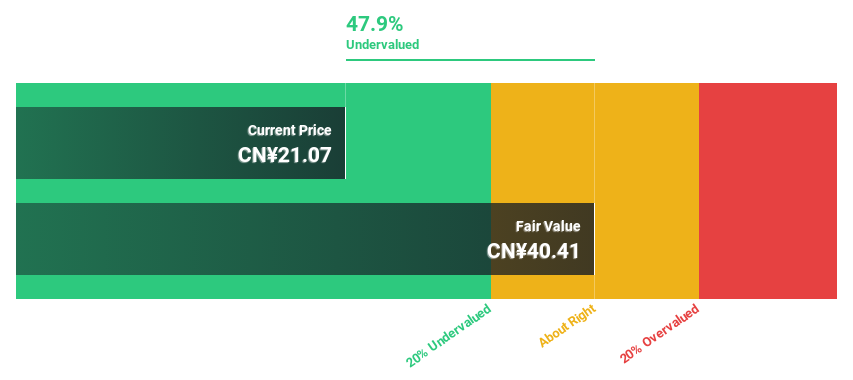

Estimated Discount To Fair Value: 47.9%

Satellite Chemical Ltd. is trading at CN¥21.07, significantly below its estimated fair value of CN¥40.41, suggesting it may be undervalued based on discounted cash flow analysis. The company's revenue is projected to grow at 17% annually, surpassing the Chinese market's average growth rate of 13.5%. Although earnings growth of 22.7% per year lags behind market expectations, the firm remains competitively valued against peers and demonstrates a strong return on equity forecast at 20.3%.

- Upon reviewing our latest growth report, Satellite ChemicalLtd's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Satellite ChemicalLtd's balance sheet health report.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 906 more companies for you to explore.Click here to unveil our expertly curated list of 909 Undervalued Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com