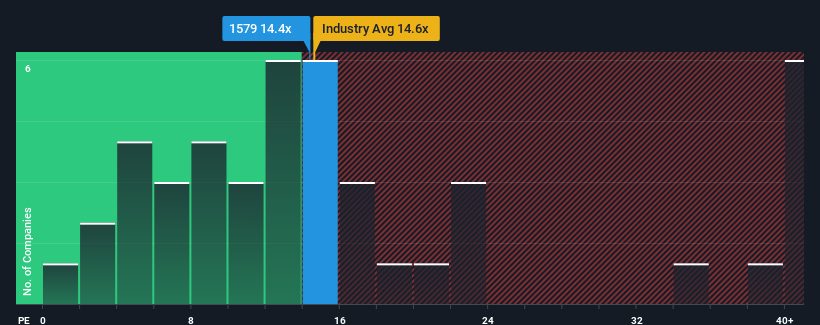

Yihai International Holding Ltd.'s (HKG:1579) price-to-earnings (or "P/E") ratio of 14.4x might make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Yihai International Holding's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Yihai International Holding

How Is Yihai International Holding's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Yihai International Holding's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.1%. The last three years don't look nice either as the company has shrunk EPS by 2.7% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.9% per year as estimated by the analysts watching the company. With the market predicted to deliver 13% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Yihai International Holding is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Yihai International Holding currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Yihai International Holding you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.