OneConnect Financial Technology Co., Ltd. (HKG:6638) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

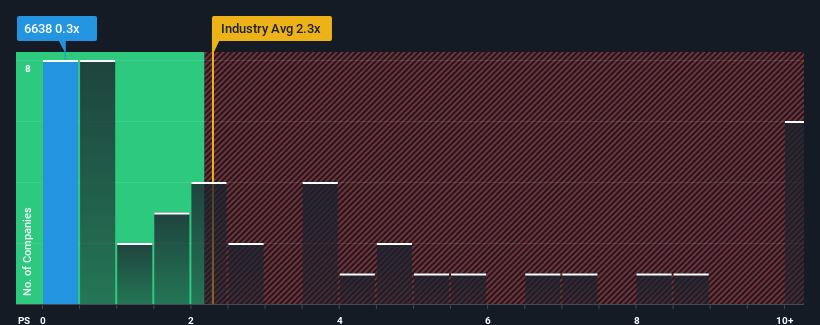

Although its price has surged higher, OneConnect Financial Technology's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Software industry in Hong Kong, where around half of the companies have P/S ratios above 2.3x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for OneConnect Financial Technology

What Does OneConnect Financial Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, OneConnect Financial Technology's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OneConnect Financial Technology.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, OneConnect Financial Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. As a result, revenue from three years ago have also fallen 27% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 36% during the coming year according to the sole analyst following the company. That's not great when the rest of the industry is expected to grow by 23%.

In light of this, it's understandable that OneConnect Financial Technology's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does OneConnect Financial Technology's P/S Mean For Investors?

Despite OneConnect Financial Technology's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of OneConnect Financial Technology's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for OneConnect Financial Technology with six simple checks on some of these key factors.

If you're unsure about the strength of OneConnect Financial Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.